TMTB Weekly

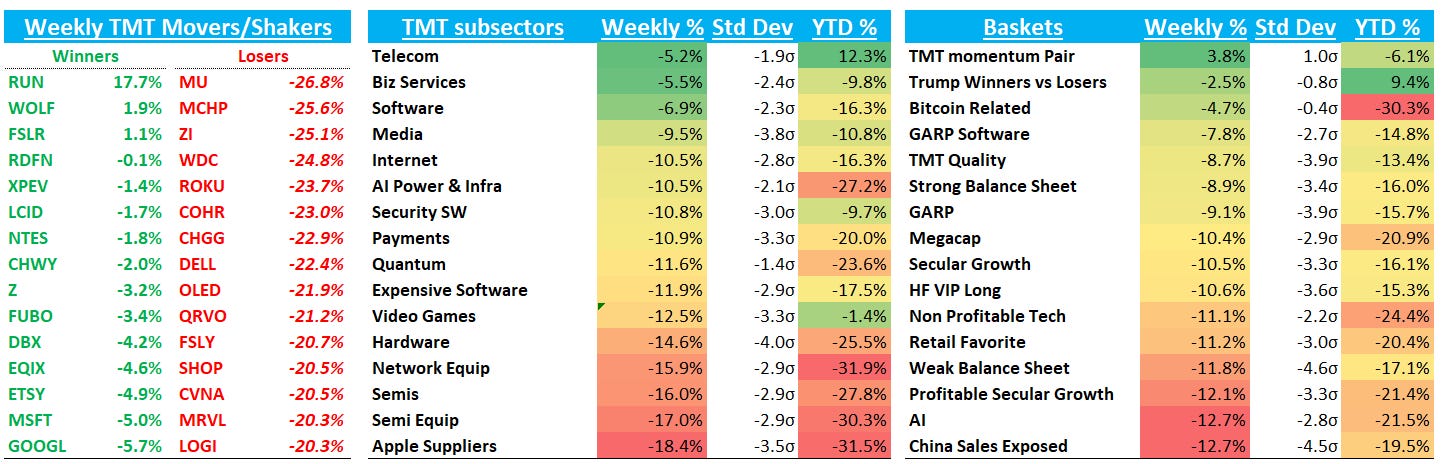

Quite a week. We’ve arguably just underwent a the biggest change in the investing environment many of us have seen — we went from free trade and a globalization system to a system which implies significant restrictions on trade in every direction. Everyone brought out their recession playbook on Thursday and Friday. We’ve been working on updating our recession screens this weekend - looking at what Rev/EPS have done in prior slowdowns, seeing where multiples have troughed, filtering out which companies are most immune to tariffs. We think the 2022 to 2023 pullback is a good gauge to take a look at what revs/earnings can do in a slowdown, but things are very muddied this time around with impact of tariffs. Yes 20% down on the QQQs in a short amount of time feels rough, but let’s not forget the QQQs went down close to 40% in 2022 over 9 months and we had 4 or so bear market rallies of 10%+ in that span. And GDP only went from 5.8% in 2021 to 1.9% in 2022 — it wasn’t a recession.

We’re not finished yet with our screens yet, but hopefully will be able to pass along something early in the week.

We’ve got no great takes on what we think the market will do this week. We’re in the same boat as everyone else trying to make sense of what happened in the past week, potential knock-on effects, and remaining open-minded and adjusting to potential news flow (much which might have changed by the time you read this). Nothing is static and our time-frames on trades will likely become more compressed than they already were. We’re focusing on singles here on any windows of opportunities we can find.

So far the one asset that’s open is BTC, which is down a quick 5% under $80k this weekend.

Many takes all across X and the media this weekend to feast on. We thought Howard Marks’ gave some thoughtful takes on the bigger picture in this 15 minute interview. Key points (h/t to @kintsugiinvesdt for summary):

For decades, investors benefited from one major tailwind: globalization. Trade was open. Supply chains were efficient. Goods were cheap. That tailwind is fading.

Instead, we’re entering an era of fragmentation. Countries are rethinking trade. Tariffs are rising. Domestic production is being prioritized—even if it’s more expensive. That has real consequences for economies, inflation, and asset prices

This matters because trade isn’t just a political issue—it’s an economic engine. When nations specialize and trade efficiently, everyone benefits: • Lower prices • Greater productivity • Broader access to goods Undoing that comes at a cost.

But when trade contracts, cost pressures rise. Domestic manufacturing often means higher wages, higher input costs, and less efficiency. This isn’t inherently bad—but it is inflationary. It changes the assumptions we’ve relied on for decades.

So what do you do with this information? You rethink the context for every investing decision. For example: If inflation is structurally higher, then valuation multiples may need to adjust lower. The cost of capital rises. Discount rates matter again. SPX multiple remains elevated at 19x, we shouldn’t expect great returns from here.

Another key point: Forecasting doesn’t work in environments like this. We can’t reliably predict what policies, partnerships, or power dynamics will look like 6–12 months out. That’s not a flaw—it’s reality.

So if we can’t forecast precisely, what can we do? We anchor to probabilities, positioning, and price. Instead of trying to predict, focus on how assets are priced relative to this new backdrop. Then ask: is that reasonable?

Despite these shifts, the U.S. still remains a strong place to invest. It has deep capital markets, world-class innovation, and a rule of law that—while evolving—still outperforms most alternatives. But the “automatic best” label? That’s now a judgment, not a given.

The big left tail risk is other countries deciding not to buy U.S. Treasuries because of a weak dollar and because we’re not being nice with them.

It’s very likely some of the reciprocal tariffs move lower over the coming days/ weeks, but without any concrete “wins” yet, investors are continuing to question whether this is just more talk. At the very least, the 10% blanket tariff which went into effect yesterday will likely stay for the foreseeable future. The main issues investors are grappling with is how exactly a negotiation would even take place given the actual # the administration gave out of other countries’ tariff on the U.S. is not based in any reality. Plenty of uncertainty that is unlikely to go away immediately. What is clear: growth will continue to slow, prices will likely tick up in the very short-term, and confidence among businesses will likely remain subdued until we get further levels of clarity.

At this point, investors have lost all confidence in the administration and every statement will be taken with a huge grain of salt until we get actual action on deals. It does seem like news flow can’t get much worse than hear from a headline perspective after the China retaliation, but this week will cause reverberations that are hard to predict but will take place across a longer time frame.

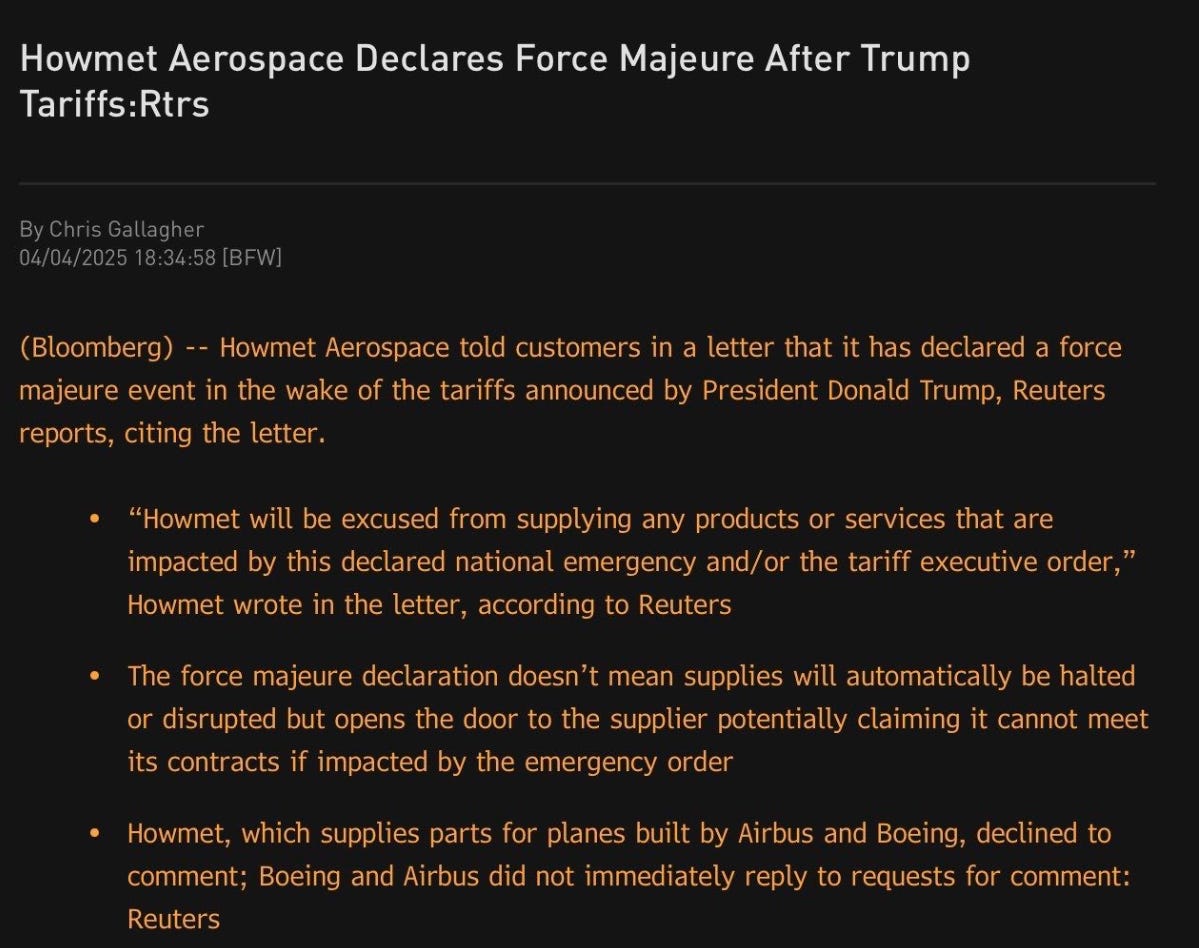

Then there’s the question for what Q2 guides will look like in Tech during the upcoming earnings season. Companies will only have a couple weeks of data to go on post the implementation of tariffs on 4/9 — can we expect many co’s to have any reasonable estimate of what the demand or supply chains will look like on a go forward basis? Will kitchen sink guides be viewed positively or as a sign of a company investors want to stay away from? It’s all very unclear. We already have companies outside of tech declaring Force Majeure:

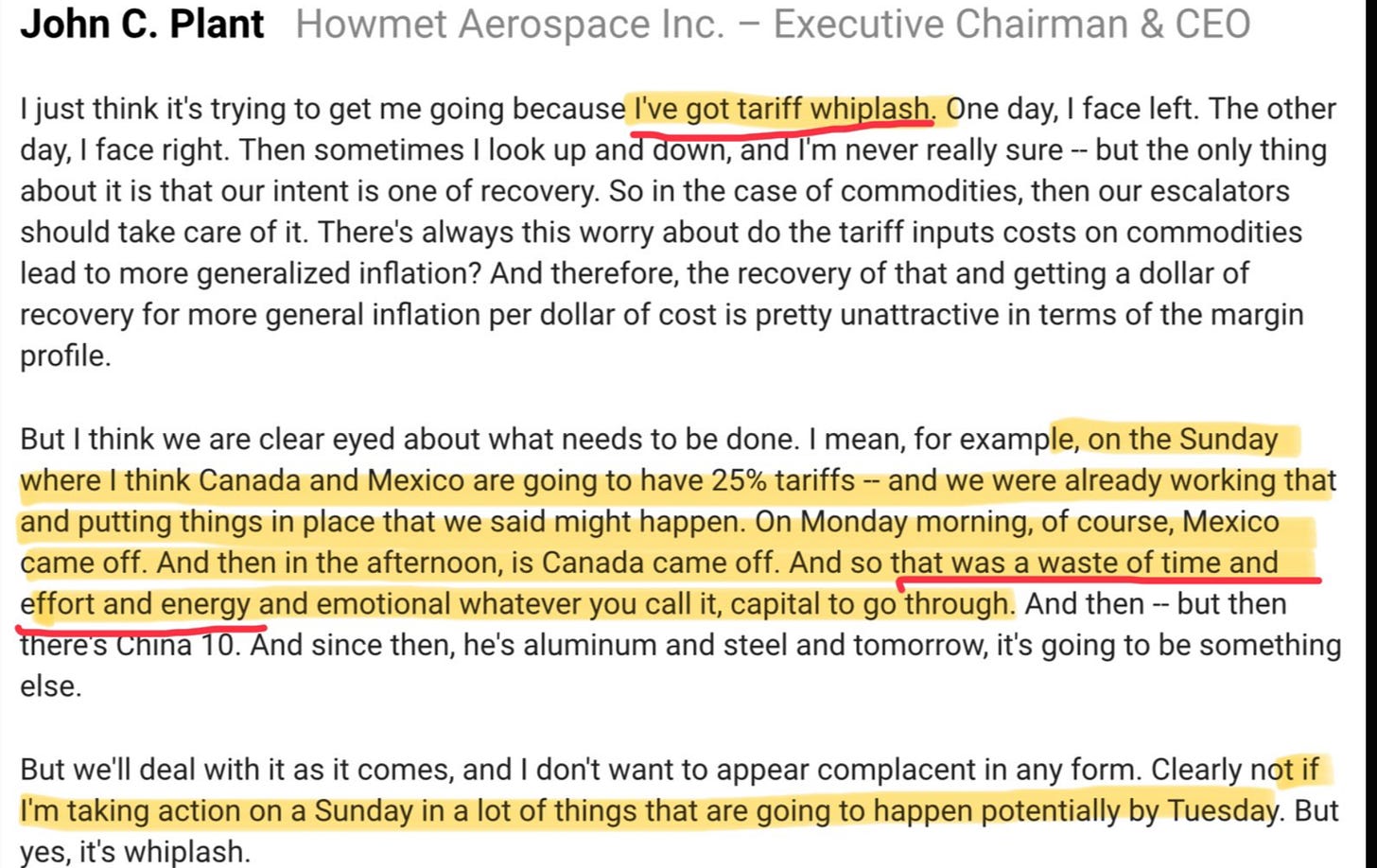

And just to give you a sense how exhausted mgmt teams must be by all this back and forth and why business sentiment likely to remain subdued, we thought these comments from Howmet’s CEO were very elucidating:

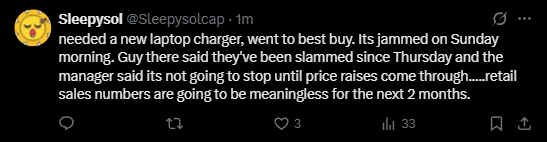

Third party data releases are likely to be skewed by front-running of tariffs for many consumer facing companies over the coming weeks. One example of things that are already happening:

So far this weekend, some positive tea leaves to grasp…Hassett said 50 countries reached out to the White House to begin trade negotiations. Bessent says negotiations will take time, not days or weeks. This is a different tone compared to "permanent tariffs" and "not negotiable". Taiwan/Vietnam saying no retaliation. India focusing effort on negotiating a bilateral trad deal with the US to bring down tariffs.

Even Elon turning on Navarro:

On the other hand, the EU is getting ready for its retaliatory tariffs:

Some other takes/charts we liked:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.