TMTB Weekly

This post was originally sent out on 6/22/2025

A COUPLE TMTB NOTICES BEFORE WE START:

1) Vacation: We will be on vacation from June 29th - July 11th. No weeklies the next two weeks. It’s been a fun 1H - looking forward to more in the 2H. Thanks for your continued readership and support.

2) AI Power Groups: I received a lot of feedback after I posted my exchange re: RDDT with ChatGPT-o3 earlier in the week that helped give us conviction in our long — a PM friend and AI power user proposed forming a small power-user circle. We liked the idea.

I’m looking for investors who already lean heavily on o3/ChatGPT/AI tools in their research/investment process and are eager to swap ideas, test workflows, experiment, and refine how AI fits into the investment process. You should be willing to share freely, openly and frequently - the vibe is collaborative, not competitive—open sharing, collective learning.

If interested, send me email — tmtbreakout@gmail.com — with a quick few lines on your background/coverage/trading style, why you’re interested and how you already use AI tools in your workflow. Groups will be small, limited to 5 or 6 members. The more info you give me about yourself, the better job I’ll be able to do in grouping. Must be a TMTB Paid sub.

I’ve already had a lot of interest — will get this started next month after I get back from vacation.

TMTB Weekly

Happy Sunday. Middle East continues to dominate news flow as U.S. decided to assist Israel by supplying some B2 bombers and hitting 3 key nuclear facilities.

We’ll have to wait and see what this means for oil and the markets - one could argue events could wind up being de-escalatory but the situation is very fluid so I won’t try to handicap too much at the moment.

Similar to last week, we continue to be in “let’s wait and see things clear up a bit” mode after a nice run post-increasing gross and net (we also like to tighten things up before heading on vacation). We’re also mindful that any increase in oil/energy trade is typically met with near-term QQQ selling.

We’re also moving closer to the 90 day deadline on July 9th and there are tea leaves certain deals will stay above 10% baseline. Price impact of tariffs remains subdued, but 2H guides for some tariff impacted companies might make set up into earnings tricky.

Yet, we still remain positively biased (choppy and upwards trending continues to be our base case medium term) and would be looking for the right time to re-increase net/gross, but will have to wait until we’re back to decide what to do. While we’ve learned the lesson throughout our career, this year has hammered it home: things are unpredictable, and it’s important to stay fluid.

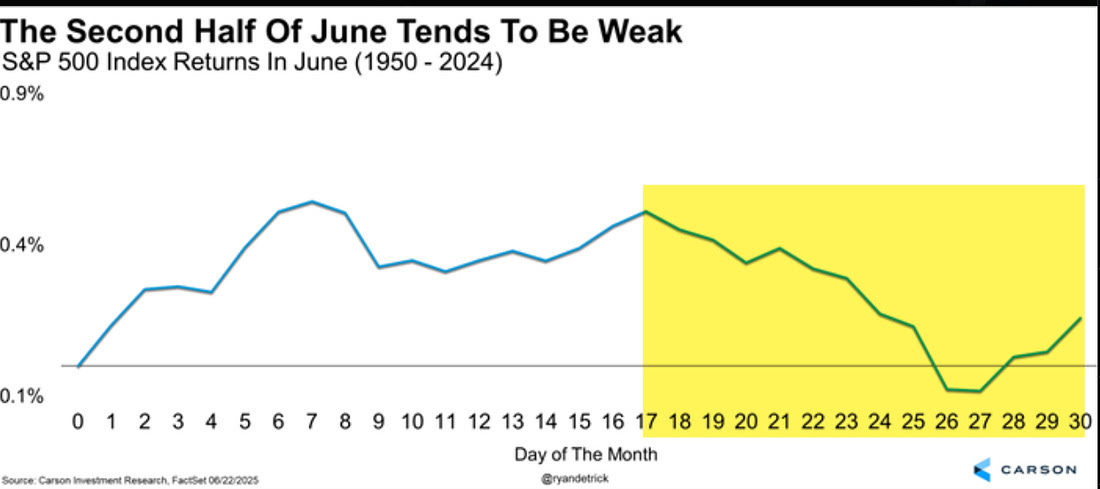

In terms of seasonality, June has played out largely as expected with a fair strong 1H but we’re now heading into 2H where things get a little trickier:

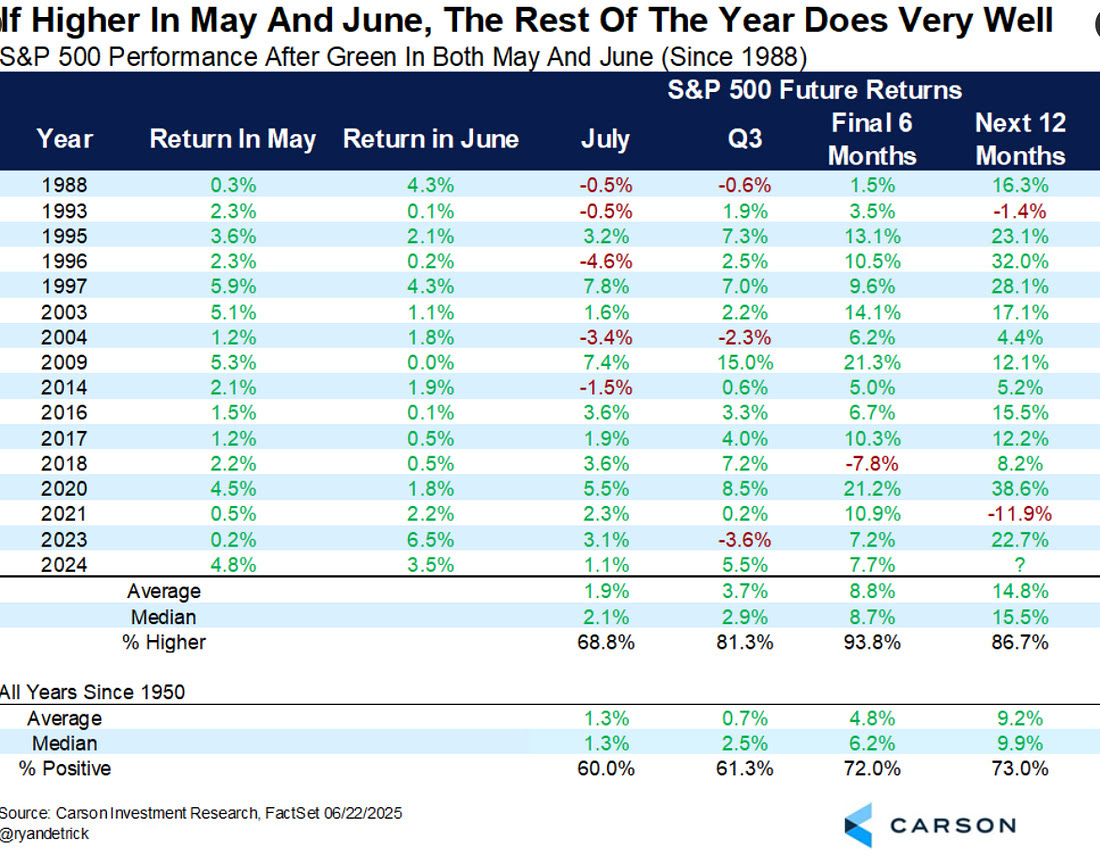

Still: a higher June typically portends a good July, Q3 and 2H of the year:

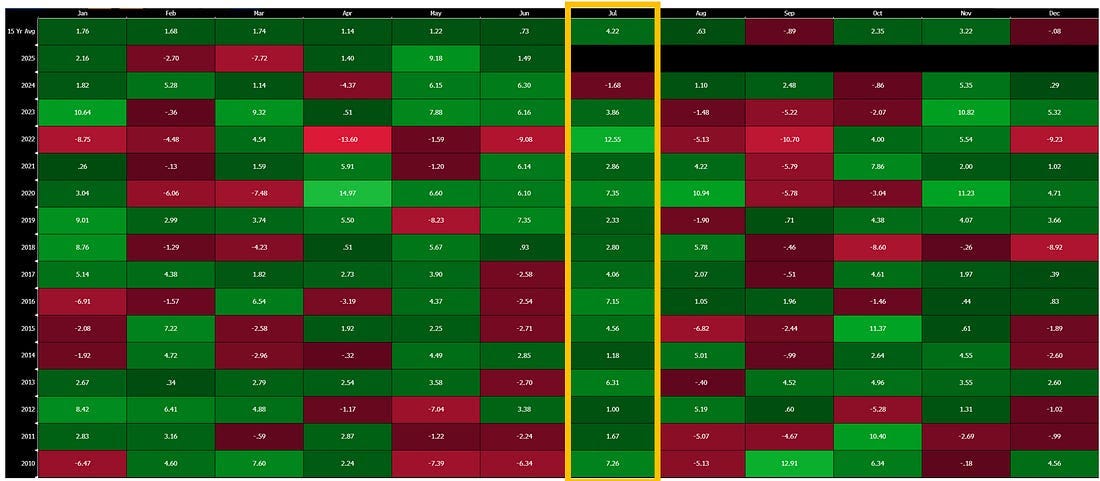

July is seasonally strongest month of the year and has been up 14 out of the last 15 years:

Breadth remains strong, which portends well:

Tech Round-up

In Tech, charts continue to look bi-furcated as the gap between winners and losers continues to grow. We like this environment as we think it makes for good stock picking alpha.

First, let’s take a look at some winners, starting with one of our favorites…

RBLX:

We’ve written plenty about how we love the medium-term monetization levers on the name.

Have things slowed down? Not yet.

As kids are getting off school, this weekend we saw a new record for concurrent users on Grow-a-Garden:

We wrote a few weeks ago why we think viral spikes end up converting into lasting bookings growth: Once someone buys Robux to upgrade a single garden, spending elsewhere becomes frictionless, while developers rush out themed clones and tie-ins that keep the cycle alive — think NFLX tent-poles, not fleeting mobile.

Are these type of viral hits replicable? It’s an important question. Let’s dig in…