TMTB Weekly

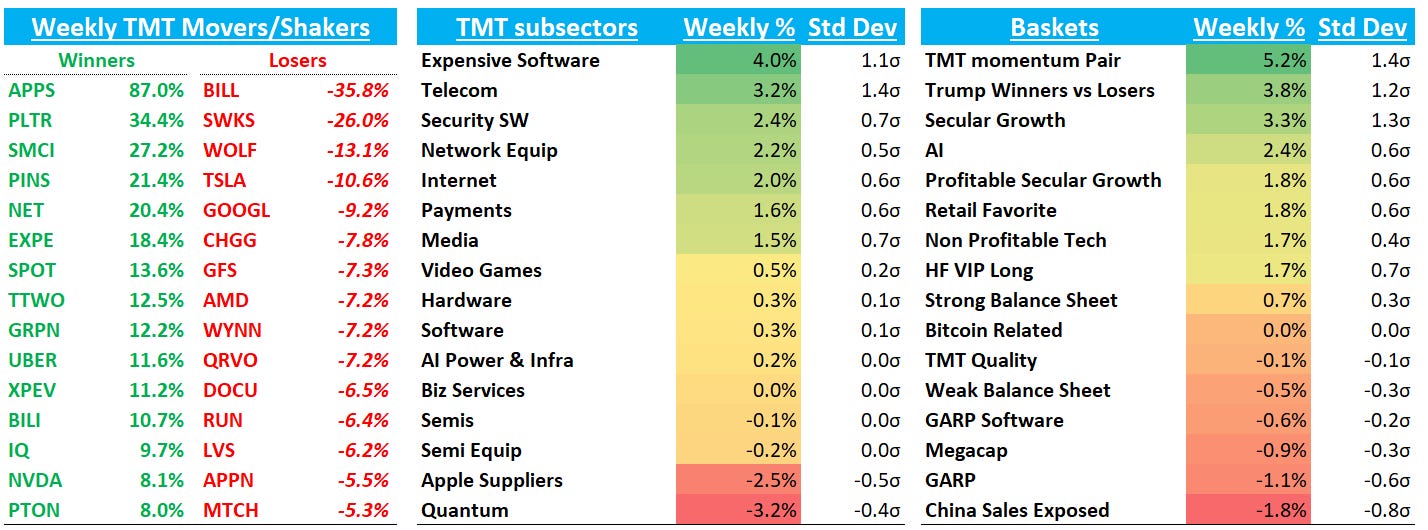

Happy Sunday. QQQs were roughly flat this week as the indexes continue to chop.

I won’t spend too much time on macro backdrop this week as not much changed. Overall, the environment continues to feel solid for stocks to us: subdued inflation, steady econ growth, fed easing cycle near the end but still intact, new biz friendly administration helping drive deregulation/increased biz confidence, oil close to $70, and an AI supercycle that is still intact. However, offsetting that we continue to have headline risks around tariffs/Trump proclamations, potential shutdown/debt ceiling, and uncertainty around DOGE and its impact,. We continue to think macro releases will have outsized impacts on the market — just look to Friday’s sell off following uptick in Michigan inflation expects. Next hurdle: CPI on Wednesday.

This all makes for a choppy but upward trending market. As we have been writing about over the past month, we continue to see evidence the market dynamic for Tech stocks has shifted in 2025: 2024 was an ideal backdrop for momentum—rates were in a sweet spot, sentiment was euphoric, and multiple expansion was rampant. Expensive stocks kept making higher highs, dips were consistently bought, and high-multiple seemed untouchable as valuations stretched further and all the focus was on high level thematic drivers.

So far, 2025 has presented a slightly different set up where the hurdle for multiple expansion is higher due to higher rates and the fed easing cycle closer to ending. That means a greater focus on risk/reward, estimate revisions, catalysts, stretched sentiment, rate of change along with being more tactical in our set ups. A couple of risk/reward set ups that worked this week: UBER pulling back to the mid 60s and NVDA, which was less than 10% from trough multiple on ‘25 #s rallying close to 10%. This environment also means alpha stock picking is back in with both shorts and longs working and bifurcating performance of stocks within sectors rising: as an example, look no further than the AI trade where this bifurcation has grown over the last year: early last year a week of better than expected hyperscale capex would have lifted all AI semis; now, investors are focused on the nuances of the timeline and market share dynamics and debate has gotten even more granular than just ASIC vs GPUs to who is winning within ASICs (re: AIChip vs MRVL debate).

A few observations after this week…

Speaking of Hyperscaler Capex, we had every large CSP come out higher than buyside expectations in their initial 2025 capex guidance.