TMTB Weekly

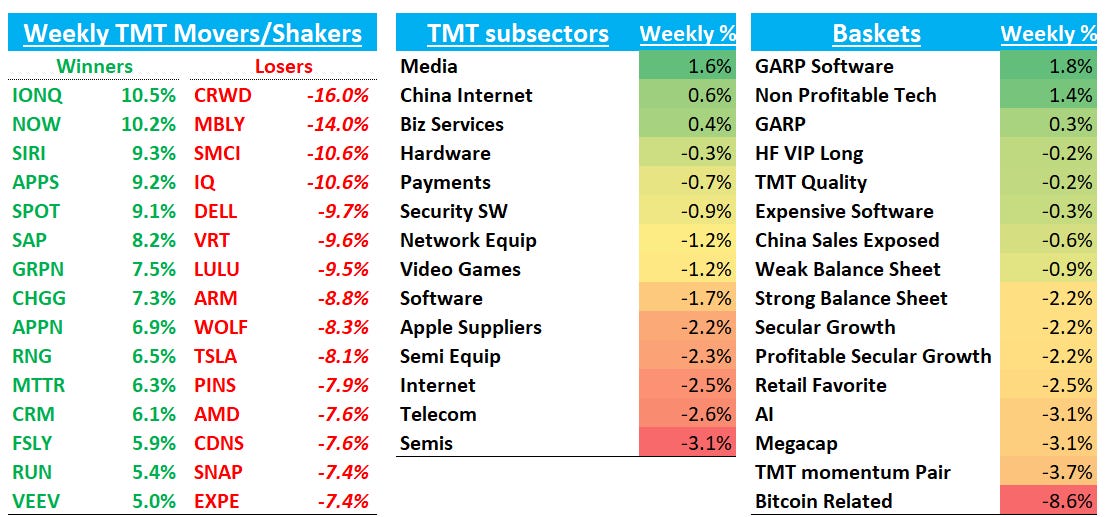

Good evening - hope everyone is having a good weekend. Quite a first week of earnings although that was overshadowed by continued volatility in the indexes. QQQs finished the week -3% while IWM +3.5%. Since the 12 trading days that have passed since the July 11th CPI print, the Russell has outperformed the Nasdaq by 20%, which is a 5.5 sigma move and the largest since 2000 and the Russell is nearly at parity with the Nasdaq on YTD performance, with both now up close to 12-13%. We wrote and showed some charts last weekend on why we think this IWM outperformance could have more legs. QQQs suffered their worst loss since Oct ‘22 on Thurs (-365bps) and after Friday sit 9%+ below the highs with the peak to trough drawdown 9.5%. Meanwhile, IWM sits right at 52wk closing highs.

Still, there are some questions about how much IWM can continue to outperform, how much is the positioning unwind done, and whether a big earnings week for Mega Cap tech can reverse some of this recent trend. The Fed…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.