TMTB: WDAY/ZM/U EPS Recaps; NFLX UBS +ve/no more AAPL billing; ARM dg at New Street; 3p roundup (CHWY, CVNA); ROKU dg at Wells; ORCL MS cautious; PANW rips; GOOGL choice screen impact

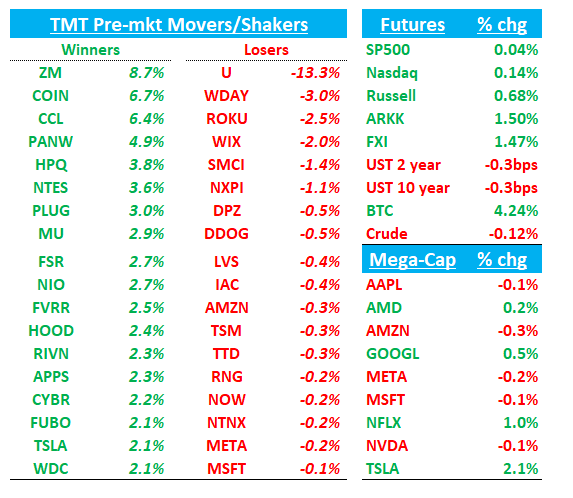

QQQs are up 12bps while early pre mkt trading suggest IWM/ARKK will continue to outperform today vs large caps. BTC back to its old ways up another 4% (helping drive up COIN, HOOD, etc…) . FXI +1.5% — we called out some tea leaves/charts in our weekly on China (TCOM, HTHT, now add LI to the list) - things adding up pointing to a possible bigger move.

Let’s get to it….

WDAY -4% misses buyside bogeys on subscription revs and cRPO

Given expectations and stock at highs, not surprising to see a bit of a pullback given slight miss to buyside bogeys but doesn’t feel like a thesis changer. Bears will say subscription revenue was smallest in a long time and backlog beats smallest in 2 years. Bears will also WDAY faces some tougher comps in FY25 as it laps strong FY24 renewal cycle and they are nitpicking the FY FCF target as it’s being guided to grow flat yy vs Street 20% as a result of a Q4 collections impact and the extra payroll payment for the leap year.

However, this is a tough one to pla…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.