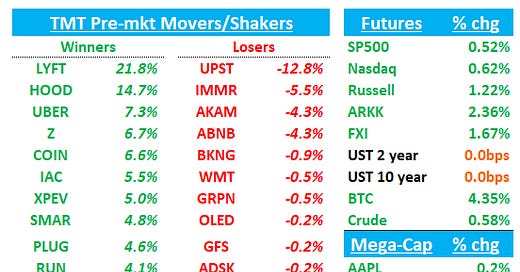

TMTB: UBER sets bullish tgts; PANW mixed checks at Keybanc; CRM +ve checks Jefferies; CDNS ug at MS; NFLX +ve 3p; Zuck goes after Vision Pro; AMZN Bezos sells more; S UG at BAML; LYFT ABNB Z AKAM HOOD

Good morning. QQQs are up 60bps following yesterday’s decline with yields flat. BTC is up 5% crossing the $50k mark. We’ll get to research/news on top, then move onto the EPS recaps below

UBER: Sets bullish targets in front of upcoming analyst day today

Announced $7B buyback (~5% of mkt cap)

Adj EBITDA growth in high 30s-40% over next 3 years

GB growth mid to high teens over 3 years.

FCF as % of EBTIDA to be 90% or higher annually (expects were for 70-80%)

TMTB: Targets imply $10B in FCF in ‘26 and generate $20-$25B of FCF next 3 years (so could say buyback is just the start…) As a reference point, street estimates for CY24-26 on GB sit at 18%, 15%, 13% and EBITDA sit at 51%, 34%, and 28%. Overall, numbers look solid with high end hitting buyside bogeys, and given UBER’s and new CFO’s history of guiding conservative, these numbers will be looked as beatable.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.