TMTB: SHOP DDOG ANET CDNS Recaps; MSFT WSJ mixed Copilot; UBER/LYFT strike; 3p roundup (MU, CVNA); AMD/NVDA Mizuho raises PTs; PYPL Daiwa dg

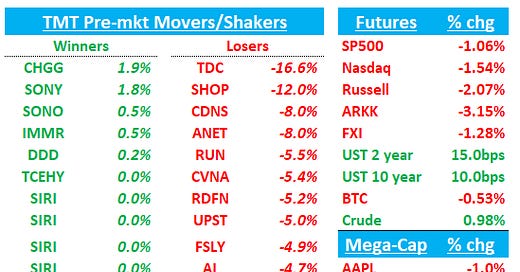

Good morning. QQQs are down 1.3% bps post a hotter CPI, which came in at 0.3% vs 0.2% m/m and 3.1% vs 2.9% y/y. Yields are spiking with 2 yr +15bps and 10 yr +10bps.

We wrote up some thoughts on Tech price action last night, which left us feeling less excited about the QQQs. The higher CPI throws another curveball at in theory should benefit Mega Cap vs shorted stocks. If yesterday’s market was being held up by IWM/shorted stocks while Mega Cap was weak, this pulls the rug from under that bid as well.

Last night and this morning we got misses vs. high expectations from several consensus longs: ANET, CDNS, DDOG, SHOP and WSJ out early throwing darts at MSFT’s co-pilot. Will be interesting to see how these stocks react as street out mainly defending the prints so far, although SHOP looks the most spotty to me given GM/OPM weakness dents the bull case a bit.

MSFT: WSJ throws some cold water on co-pilot with mixed feedback from users so far

Does this help pour some NT cold water on AI trade? Not an out of the blue article as we’ve heard mixed feedback from multiple checks early on co-pilot, but given it’s a big part of the MSFT bull case going forward, something to continue to keep close eye on.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.