TMTB: PLTR NXPI First Takes; EOD Wrap

PLTR +12% results look solid with a 4% beat to revs accelerating 3% on a 4 ppt tougher comp and big beat to Operating Profit. Rev guide for Q4 also better.

Looks like we sold our long too early as stock hitting new ATHs post-close.

PLTR F/Y GUIDANCE

- Guides ADJ operating profit $1.05B to $1.06B, saw $966M to $974M, EST $970.5M

- Guides ADJ free cash flow above $1B, saw $800M to $1B

- Guides US Commercial revenue above $687M

GUIDANCE: Q4

- Guides revenue $767M to $771M, EST $746.5M

- Guides ADJ operating profit $298M to $302M, EST $261.6M

RESULTS: Q3

- Revenue $725.5M, +30% y/y, EST $703.7M

- Operating profit $113.1M vs. $40.0M y/y, EST $87.3M

- EPS $6.00 vs. $3.00 y/y

- Cash and cash equivalents $768.7M, EST $831.4M

- ADJ operating profit $275.5M, +69% y/y, EST $236.1M

- ADJ EPS $0.10 vs. $7.00 y/y, EST $0.09

- ADJ EBITDA $283.6M, +65% y/y, EST $244M

- ADJ free cash flow $434.5M vs. $140.8M y/y

- ADJ operating margin 38% vs. 29% y/y, EST 34.5%

NXPI -5% as guide worse than buyside whispers. Inline revs and slight beat to GM. Industrial down seq but all other end mkts up seq

Call tomorrow morning

Q3 Revenue $3.25bn vs Street est $3.255bn

Q3 Non GAAP EPS $3.45 vs. in line with street (Guide $3.21to $3.63)

Q4 Revenue GUIDE $3.0.bn-$3.2bn St est. $3.371bn

Q4 Non GAAP GM GUIDE 56%-58% vs Street est. 58.6%

Q4 Non GAAP EPS GUIDE $2.93. to $3.33 vs. St est. $3.62

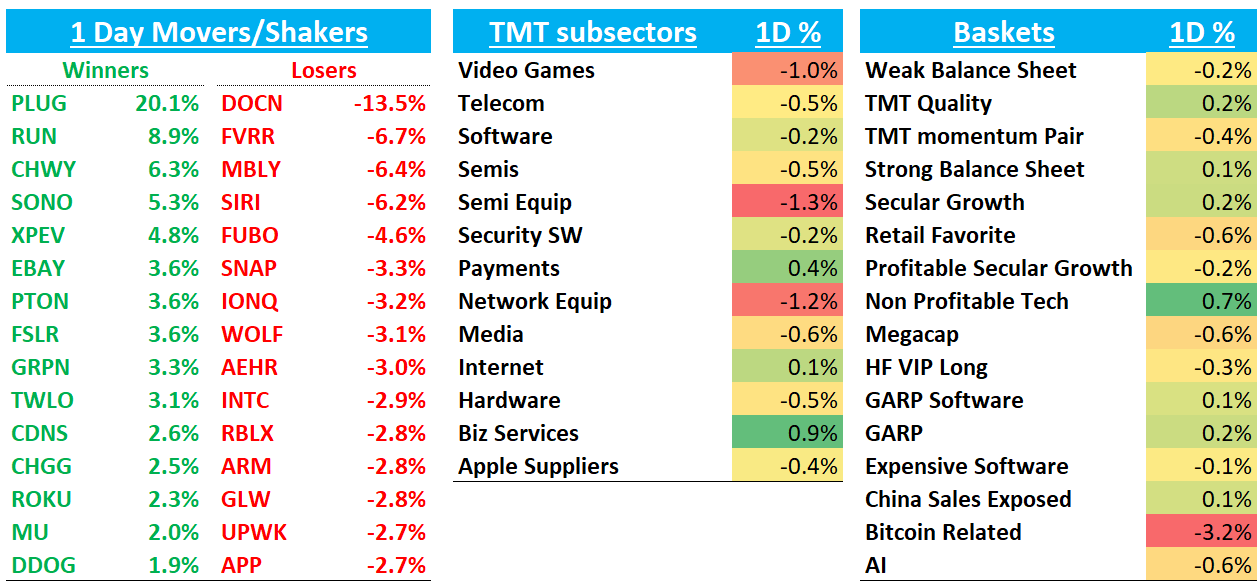

EOD Wrap

QQQs -22bps ahead of the election tomorrow as yields fell 5-10bps across the curve. Election odds close to 50/50 now as Harris gained ground over the weekend and reports some polls over-indexing towards Trump after under-indexing in ‘16 and ‘20.. BTC - 2% selling off as Trump seen as more positive for crypto. Oil +3% on heightened geopolitical tensions.

Let’s get to the recap…

Internet

CHWY +6% on SP400 add flows

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.