TMTB: PINS, TTD, MCHP, CART, XYZ, TEAM, TTWO, EXPE Earnings Takeaways

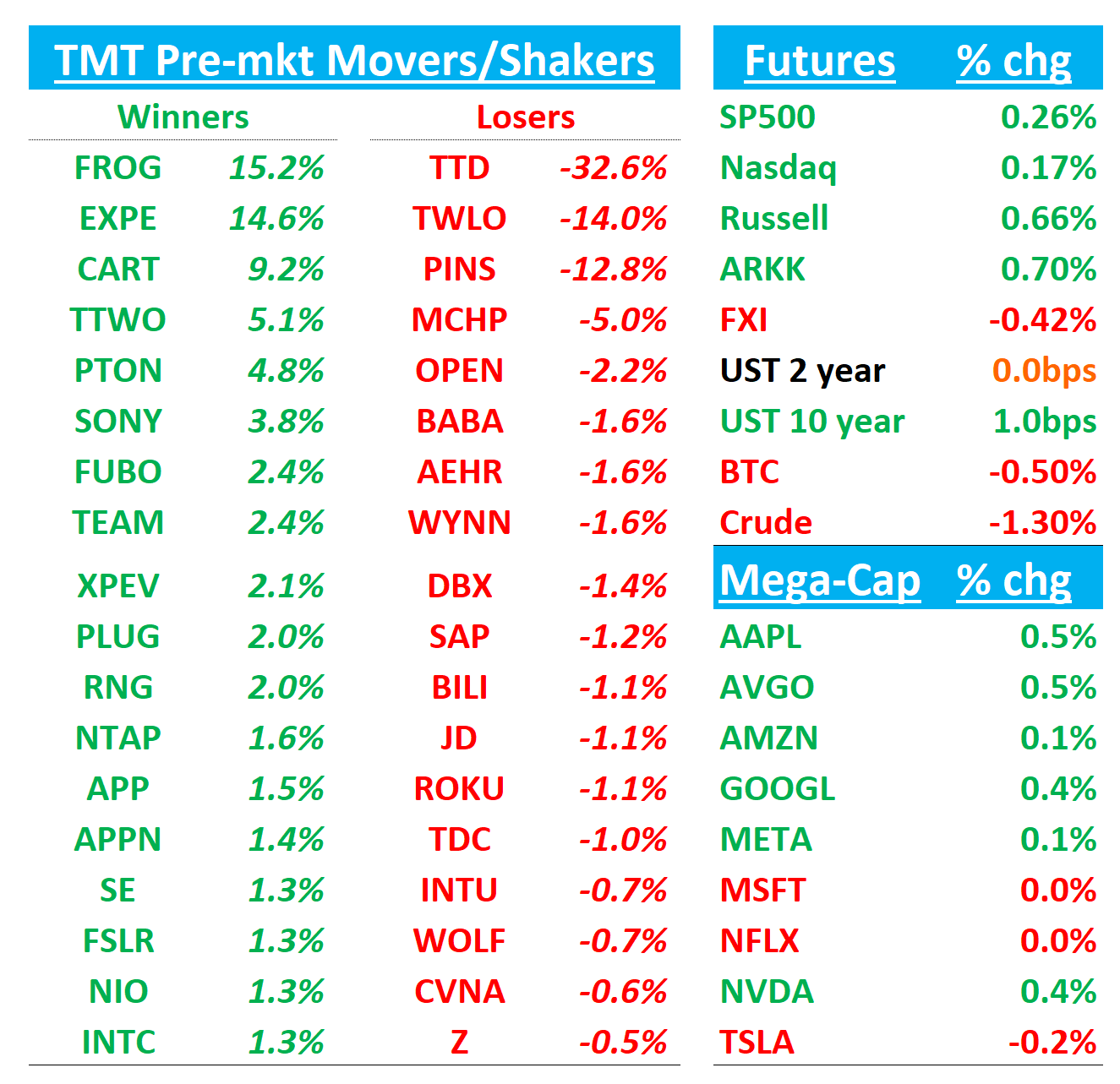

Futures bid slightly with QQQ +17bps.

Busy morning on earnings front so let’s get straight to it…we’ll send out a separate email with Tech Research/News in a bit.

But for now, below PINS, TTD, MCHP, CART, XYZ, TEAM, TTWO EXPE takeaways….

Here we go…

PINS -12%: Q2 beat; Q3 guide ok but lacks acceleration and AI ramp cools 2H margins

Q2 Revs of $998M grew 17% vs street at $976-$977M, but some on the buyside were hoping for something closer to 18% given the META and RDDT prints.

Q3 guide came in at 15-17% with fx tailwind of 1%, inline with the bogeys we heard coming in although some were expecting 18% at the high end. Management also signaled 2H margin expansion below 1H as AI/product and sales headcount step up.

Our view: Crowded long positioning was our main fear going into to the q which is playing out as stock down dd early. After the print, we initially thought this might still be a “B” idea, but after going through it we aren’t that excited about it: U.S. only grew 11%, 2H margin outlook is below expectations, and the Q3 guide was unimpressive. If we assume they beat their guide by an average of 1.5% (in line with historical beats), that puts PINS at 17.5% growth in Q3, barely an acceleration on a 3ppts easier comp, which makes the 19-20% exit rate a stretch for ‘25 as the comps don’t get easier in Q4/Q1. There’s not really a super exciting hook and we thought CEO Bill sounded decent, but more measured than previous calls.

Still at $34, stock is trading at 15x so doesn’t argue for much downside either and the r/r likely skews up.

The key question for us: Why own PINS when you can own more META, APP, RDDT, DASH, SPOT, SHOP, AMZN, or GOOGL? It’s not very high on the totem pole in internet land.

Key takeaways:

Demand/macro: CEO described digital ad demand as “more constructive” than feared earlier in the year; advertisers’ always‑on/performance budgets remained durable, a setup management thinks plays to Pinterest’s lower‑funnel progress.

Tariffs: Impact was smaller than anticipated overall, but Asia‑based e‑commerce advertisers pulled back spend in UCAN tied to the de‑minimis change, with some spend redirected to Europe/ROW. Mgmt still sees some uncertainty into 3Q.

Internal “IT”/AI investment cadence: Opex growth is concentrated in R&D headcount for AI and product and in enterprise sales, and mgmt reiterated 2H margin expansion will continue but at a slower pace vs. 1H. Analysts echo this—2H expansion 50–100 bps or “more moderate”—as PINS leans into AI/automation.

Volume up, price down: ad impressions +55% y/y and pricing –25% y/y on mix shift to under‑monetized international; auction density improving via partners/resellers. Bulls see more runway; bears worry about UCAN ad‑load headroom

Europe +34% y/y and ROW +65% y/y accelerated again; UCAN only +11% and impacted by tariff‑exposed APAC e‑comm advertisers

MAUs hit a record 578M (+11%); Gen Z now >50% of MAUs; 100% logged‑in, ~85% direct to mobile app—useful for targeting/measurement.

Bull vs Bear Narrative:

The bull case centers on durability and operating leverage. Bulls argue that Pinterest is methodically compounding: record users with Gen Z now over half the base; a 100% logged‑in, mostly in‑app audience; and a product roadmap that makes Pinterest look more like a visual search engine built on proprietary first‑party, curated “taste‑graph” signals. AI is now visibly driving outcomes (multimodal search, generative retrieval, LLM‑assisted query understanding), with +230 bps YTD search‑fulfillment gains and ~5% conversion‑rate lifts in A/B tests. Add rapid Performance+ adoption in the mid‑market and accelerating Europe/ROW monetization (plus reseller/partner channels that deepen auction density), and bulls see sustained mid‑teens topline with steady margin progress even as the company reinvests in AI and sales, with some bulls hoping for a high teens / 20% exit rate in 2025, although that seems like a bit of a stretch. Bulls will say buy the dip as $2.25 in ‘26 x 20x = $45, 30% upside as high teens growth should help keep the multiple near 20x

The bear case focuses on composition and cadence. Bears highlight that the growth algorithm is heavily volume‑led (impressions +55%) while pricing –25% on international mix and ad‑load increases; that dynamic raises questions about UCAN ad‑load headroom and near‑term ARPU trajectory. They also note 3Q guide is above Street but not the acceleration some hoped for after strong peer prints; UCAN growth decelerated modestly and remains exposed to tariff‑impacted APAC e‑comm spend; and management flagged slower margin expansion in 2H as AI/product and enterprise sales hiring ramps. This quarter, bears point specifically to price/mix, UCAN softness, and tempered 2H margin cadence as reasons to stay cautious on multiple expansion until the automation (Performance+) and AI gains translate into more visible pricing and UCAN monetization

TTD -30%: Oof! Mid teens Q3 guide and small beat fans fears of AMZN competition as TTD now more permanently enters structural loser bucket

Expectations had crept up going into the print given the big beat last quarter and easy comp set up, but TTD whiffed. The Q3 guide is what’s scary: TTD has grown 20%+ every quarter since they came public in 2017 (ex one q during Covid) the guide implies a decel to mid teens although bulls point to it being +18% ex-political. Management highlighted tariff uncertainty at large brands (not SMBs), with early‑Q2 volatility in autos/CPG but stabilization since; guide explicitly caveats tariff risk.

We think the stock will enter the structural/competitive loser bucket more permanently now as bears will be putting a 15x multiple on a $1.3B EBITDA number = $50 and we think any move into mid 60s where it was last night offers decent r/r. We think any attempt at a rally will be met with selling as this was still a big long-only favorite and this 2nd miss (after Q4) will have those longs wavering on their belief that TTD is the compounding darling it once was.

Gets downgrades at Moffet Nathanson to sell, Wedbush to neutral and double dg at BofA to sell

Bears obviously much louder today and focus on growth deceleration (2Q ~20% ex‑political vs. 1Q ~25%; 3Q guide ~18% ex‑political), the small revenue beat relative to high buyside expectations, and increasing competitive intensity—especially reports that Amazon DSP’s supply ramp is undercutting CPMs. They also flag macro/tariff sensitivity given TTD’s concentration in large global advertisers, and raise questions around management turnover (CFO) and the need to lap Kokai‑driven take‑rate benefits.

Bulls will try to push back and say TTD’s independence, identity leadership (UID2), and AI‑driven Kokai delivering measurable ROI (20‑point KPI uplifts) that wins share across CTV and retail media. The 2Q print confirms healthy margins (39%) and international outgrowth, while JBP momentum (record number live; ~100 in pipeline) should compound share gains into 2026. Management’s Amazon stance (objective buyer of the open internet vs. a walled garden conflicted by Prime Video) and flexible upfronts trend support the view that the biddable open internet keeps taking dollars.

Key quotes on AMZN competition:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.