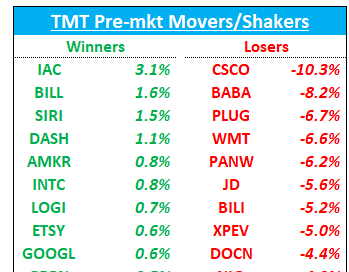

TMTB: PANW CSCO takes; MSFT RBLX recaps; 3p roundup (AMZN, CPNG, OKTA, MSFT, CRM, NFLX); MDB +ve initiation @ WFC; INTC ug at Mizuho $84 SOTP; BABA miss share overhang; WMT miss; CHGG neg checks;

Good morning - QQQs are down 35ps. China is down 4% as some shine comes off post Biden/Xi meeting. Treasuries are rebounding modestly after yesterday with yields down 2-3bps across the curve. DXY is unchanged and Crude is flat.

Lots to get to in TMT today:

PANW (-6%): Fodder for both bulls and bears in last night’s prints as billings missed and they guided down blaming “cost of money” – in other words, customers asking for bigger discounts or financing on multi-year deals.

Billings guide came in at 15-18% vs bogeys of 18-19% y/y growth. PANW reported revenue/EPS of $1.88b/$1.38 vs. Street at $1.84b/$1.16. Next gen security ARR of $3.23b was slightly ahead of Street at $3.11b.

Bulls (see MS note) will point to better next gen ARR (+53% y/y vs bogeys of 50%), better operating margins (up 760bps y/y, large deal strength, commentary saying demand environment was ok (low churn rate), and keeping their $12 in FCF and $8 in Fy25 EPS intact (stock trading at 22x FCF).

From the call: "The billings difference is not a change in demand for us or not a function of our pipeline. The billings change is a consequence of negotiations with customers and the customer says, you want me to pay you for three years upfront, you got to give me a bigger discount. You want to pay me, want me to do a three-year deal, you got to go finance it in benefits. I can do that, but I can say just pay me on an annual basis, I'm okay. I'll collect my money every year. If I go in that direction my billings changes. It does not change anything in my pipeline, in my close rates or in my demand function."

Bears have several things to help question the demand holding steady narrative and what that means for the stock, especially given sentiment heading into the print.

Bears will say 1) current deferred rev was weaker, only growing 1% q/q vs. 2-5% over the last 5 years (avg of 4%) and that a sudden increase in annual billings mix shouldn’t have an effect on current deferred so quickly, pointing to weaker demand. 2) Incremental RPO was down q/q for first time in 4 years while cRPO was approx. flat q/q, indicating more than just duration weighing on results.

I thought there was some great back and forth pointing out some more bearish learning views around duration impact in the TMTB chat yesterday (which is what I envision the chat to be at its best). I’ll quote a couple here:

Techwrecked: It's bouncing a bit because the guide down is all duration related (and NGARR good, guide there ok). To software investors this is not a new phenomenon. Issue is PANW fcf has always been low quality due the massive amount of long term deferred..it's massively more expensive than the low quality fcf suggests - if they survive keeping LTDR mix here with rates at 5, then they'll probably never rip the band aid off. It should derate even if demand stays consistent from here

DJIA: billings beats have compressed each of the last 5qtrs. cost of money has been high for 2yrs at this point -- is lower versus last quarter -- not sure how it's just impacting the business now. nikesh spent all last year suggesting they could out-execute against macro headwinds…would guess network security mkt overall is rolling (they've said as much; we see it at FTNT) but it's also impacting SASE (should've accelerated on easy comp; didn't) while prisma cloud is probably facing similar cloud optimization headwinds that DDOG etc. have suffered from this year. only biz seeming to do OK is cortex and that has hard comps on XSIAM's launch last year.

Techwrecked: I dont think anyones expecting this to accelerate in this environment, things are difficult. We know PANW has been playing financing games to buffer LTDR but cant keep outrunning it, I was short on that thesis 18months ago and quickly realized not gonna be able to time when it would break. Bulls will cling to NGARR and every pod tomorrow will flip short because next 90 days its going to be a nonstop debate of demand impact vs duration. Even if your generous and give him benefit of the doubt on demand, lots of generalists In PANW flying blind on that fcf number thinking it's cheap and now cant ignore it. Your worst case scenario is pretty epic, like adsk in 2022, demand weakened AND they pulled the plug on multi year billings (don't think nikesh ever does that though).

TMTB’s take: I don’t think either side is wrong – nothing structurally wrong with the story, numbers missed but also weren’t horrible and a few bright spots, but there are also several things to call out to make bulls question the demand narrative and whether billings duration issue is just 1Q so the short/medium term story here becomes more muddied.

CSCO (-10%) with a very weak guide. Despite sentiment leaning neg heading into the print (see Clev checks), this still looks a lot worse than expected with a big drop to jan rev guide and full year guide

CSCO reported October revenue/EPS of $14.7b/$1.11 vs. Street at $14.63b/$1.03… Orders down 21% in Q1.. CSCO order growth by geography (Americas -19%, EMEA -13%, APJC -38%) and end market (Enterprise -26%, Service Provider & Cloud -38%, Public Sector +2%)

CSCO guided January revenue/EPS of $12.7b/$0.83 vs. Street at $14.19b/$0.99 - yup that’s revs 11% below street!

Also lowered full-year revenue guide to $53.8-$55.0b from $57.0-58.2B further indicating that this is not just a one quarter correction.

CSCO notes order slowdown concentrated among large customers and not immune to macro but primary issue is onboarding.

They are saying this shipment timing issue had already existed in SP but then shifted to enterprise recently - lots of product shipped to customers but just waiting to be implemented.

Read-throughs: Watch DELL, NTAP, NTNX, JNPR, and FFIV

FN – 16% revs from CSCO

FLEX: 3% revs from CSCO

JBL: 2% revs from CSCO

COHR: 11% revs from CSCO

BABA – CMR soft but improving profitability / Will not proceed with a full spin off of Cloud biz/ Jack Ma’s family trust selling 10M ADS

CMR grew 3%, 2pts below street due to a slower seasonally q and merchant support and EBITDA came in 2% above street. . They pointed out good traction in price match and good growth in participating merchants, buyers, and order volumes at recent singles day.

No Cloud spinoff, but logistics and int’l digital commerce biz group spins remain on track. Core commerce beat, cloud beat and digital media was light.

"Under our capital management plan, we are prioritizing investment in technology and innovations for our businesses to drive new growth. We are confident in our business fundamentals and are pleased to announce our first annual dividend distribution for FY23, with an aggregate amount of approximately $2.5B, as part of our continued efforts to enhance shareholders' return in addition to the ongoing share repurchase program."

INTC – Upgraded at Mizuho to Buy

Mizuho believes that INTC is lining up significant NEW server product launches and foundry customer announcements in the next 6 months. They also call out 1) better ’24 computer and DCF product rollout 2) PC and DC troughing with potential upcycle in ’24 3) Alteral spinoff adding $17/share. Mizuho think SOTP is $84 and trades at a significant discount to NVDA and AMD.

3p roundup:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.