TMTB Morning Wrap (Tariff Edition)

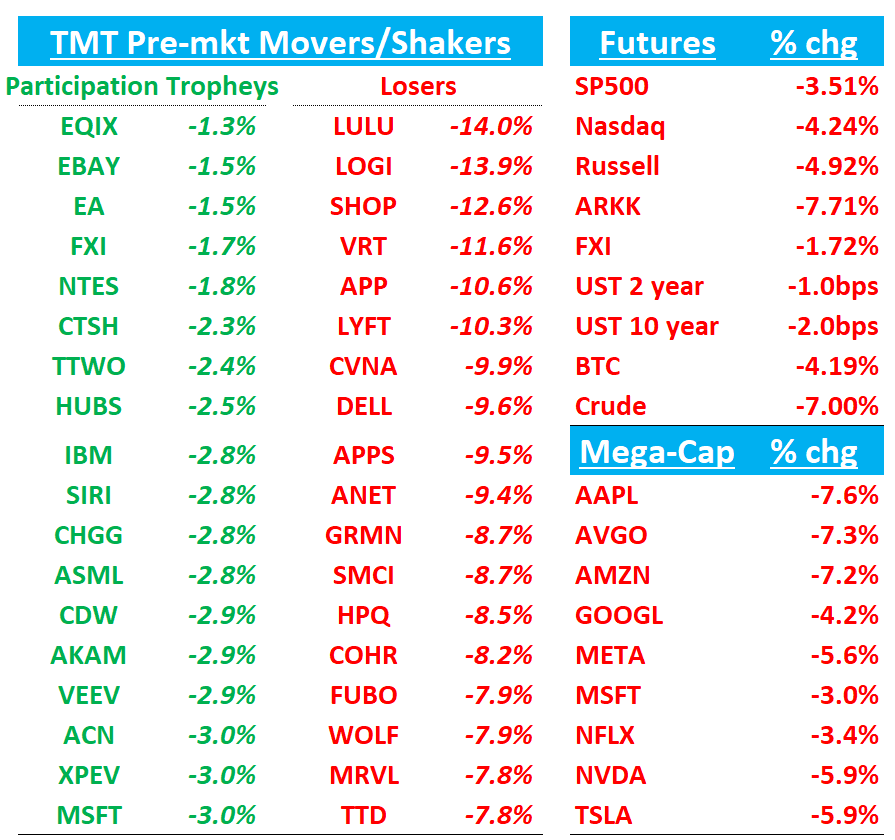

Yesterday was “Liberation Day"; today is “Obliteration Day” for Tech stocks (at least so far) as QQQs -4.2% with many names down 5%+ or more.

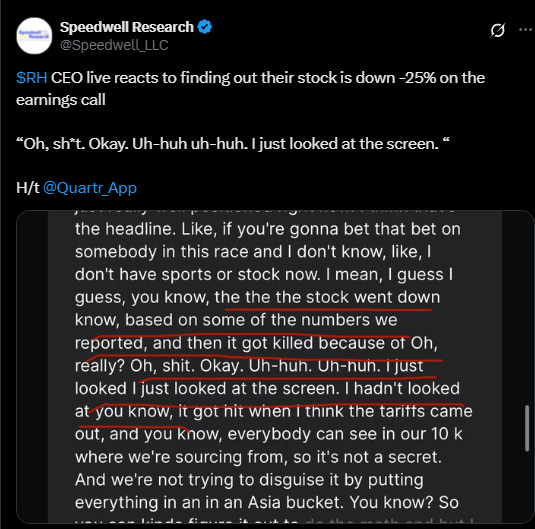

The level of confusion and shock among investors yesterday is an understatement as amount of uncertainty on where specific country rates actually end up is high, not particularly helping the glass half full case of things will get less uncertain for now although bulls will say these tariffs are a “high water mark" and can only get better from here. I’m sure many CEOs were shocked as well:

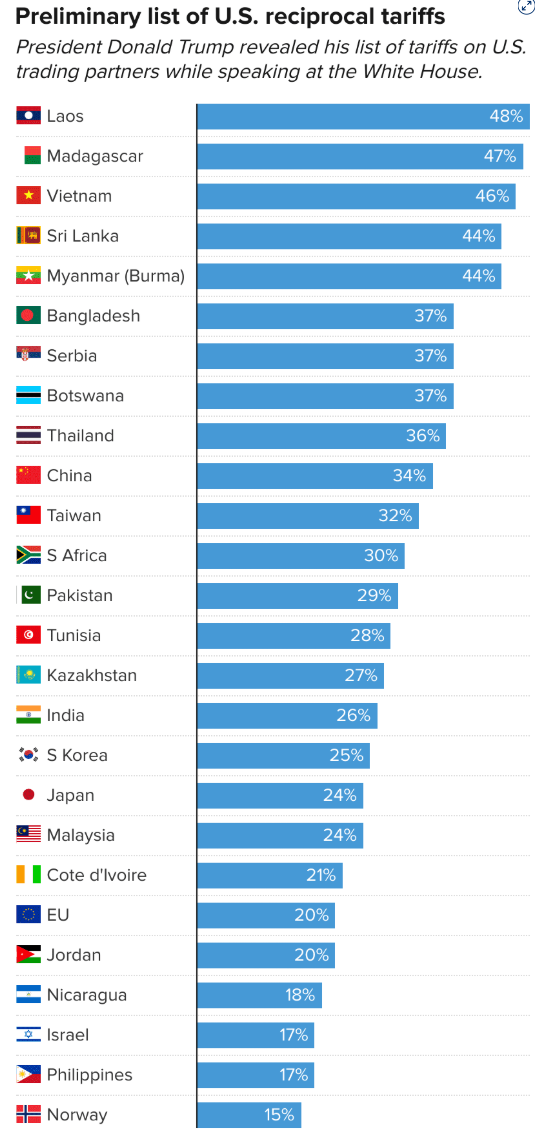

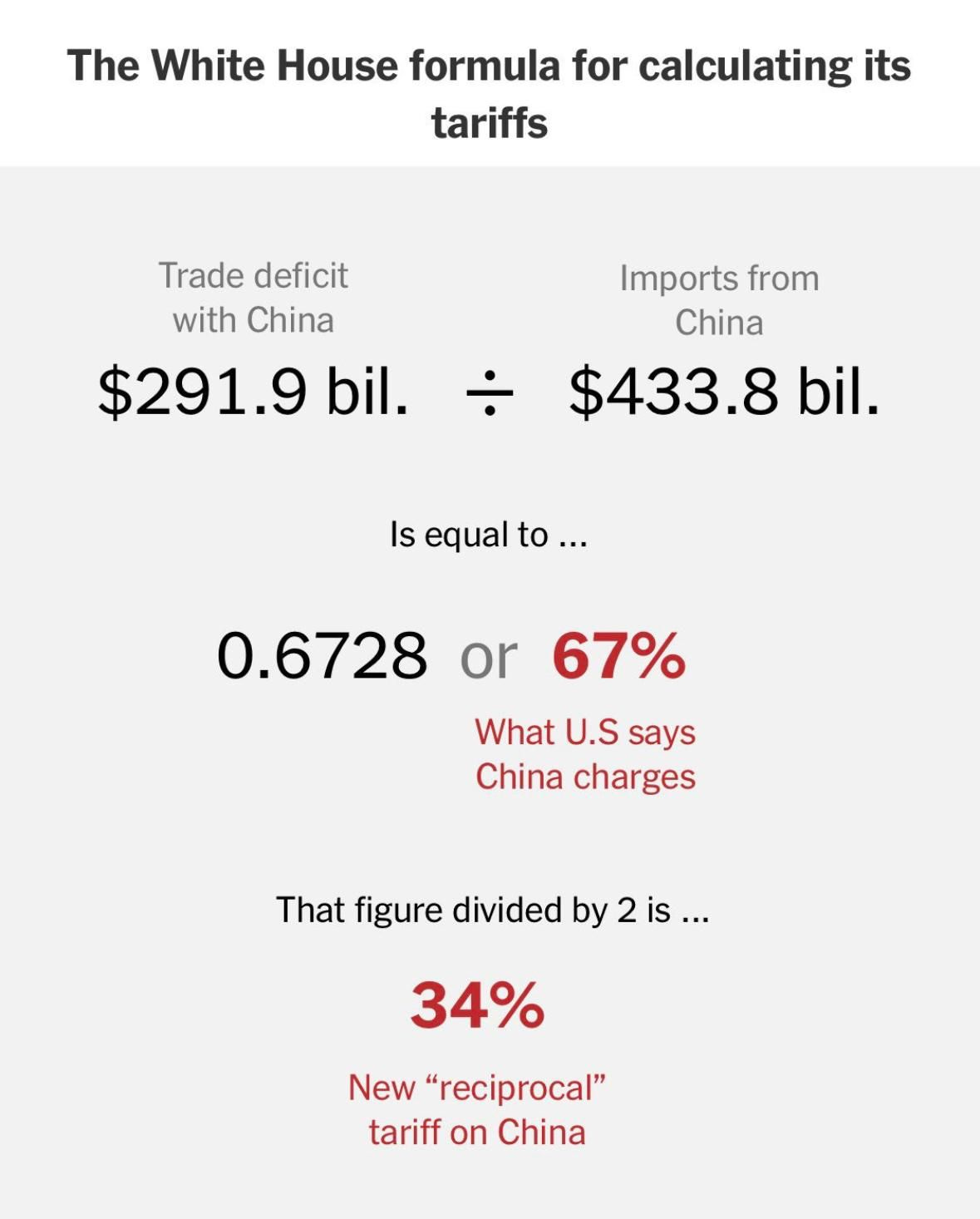

For tech investors, largest shock was the China/Vietnam/Asia tariffs (China 54%, Vietnam 46%, Thailand 36%, Taiwan 32%, Korea 25%, Japan 24%) which were much higher than expected. Stocks abroad acted accordingly although the declines weren’t huge: Nikkei -3%; China -1.5%; India dn 30-40bps although Vietnam took brunt of hit with Ho Chi Minh index -7%.

Tariffs start the Apr 9th for most things announced and plenty of exemptions including semis for now (although this is likely to be short-lived as those will likely be covered by additional tariffs to come under Section 23). Still, it’s unclear exactly how tariffs will be implemented given most chips come into the country in finished goods.

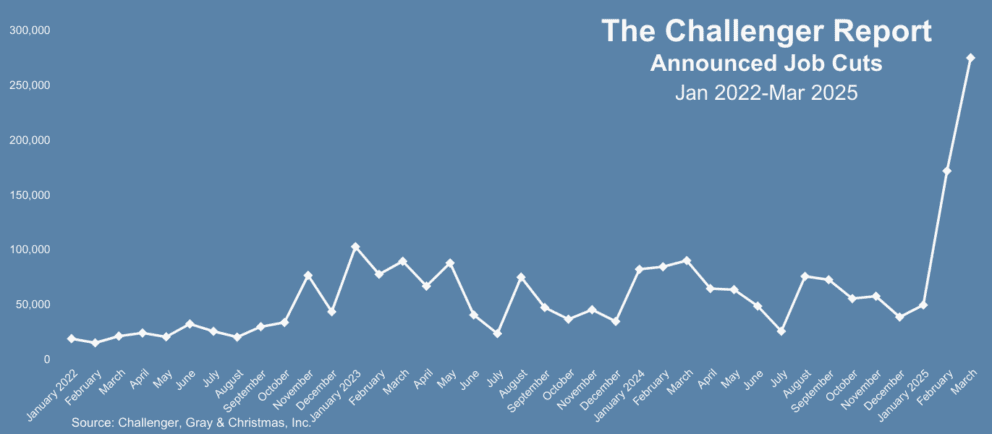

Yields are slipping dn 3-6bps and got some neg jobs news on the macro front this morning as Challenger job cuts surged to 275k, highest since 2020 with DOGE driving 79% of the total and hiring plans dropping to just 13k in March, lowest Q1 total since 2012.

Some standout early movers: SAP flat (Europe); EA/TTWO/NFLX -1-2% (minimal tariff impact) while SHOP -1%, CVNA -10%, DELL -10% AAPL -8% examples of some taking the brunt of the pain.

We’ll hit some macro takeaways first then dive into tech impact…

Macro Takeaways:

Wolfe estimates impact includes $610B in reciprocal tariffs with total Trump 2.0 tariffs reaching $1008B ($880B excluding Canada/Mexico), though partial relief comes from non-stacking components for certain sectors like steel, autos, and future targets (pharma, semiconductors, copper, lumber). Tobin at Wolfe believes these tariffs will be durable, citing senior White House officials who described it as "not a negotiation" but "a national emergency" that addresses non-tariff barriers. On economic impact, Stephanie at Wolfe notes the tariffs exceeded their expectations, potentially creating a ~2% hit to GDP and 2-point boost to inflation—potentially flattening GDP growth while pushing inflation to 4.5%. She questions how the Fed will respond, suggesting Powell may view this as stagflationary with a one-time price shock, requiring patience until actual growth impacts materialize before acting and increases recession odds

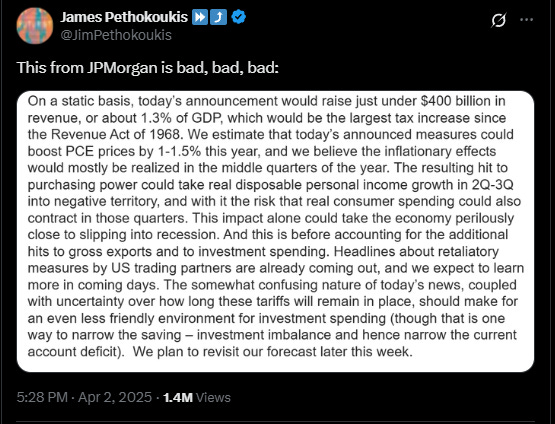

JPM:

Goldman Sachs:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.