TMTB Morning Wrap Part 2

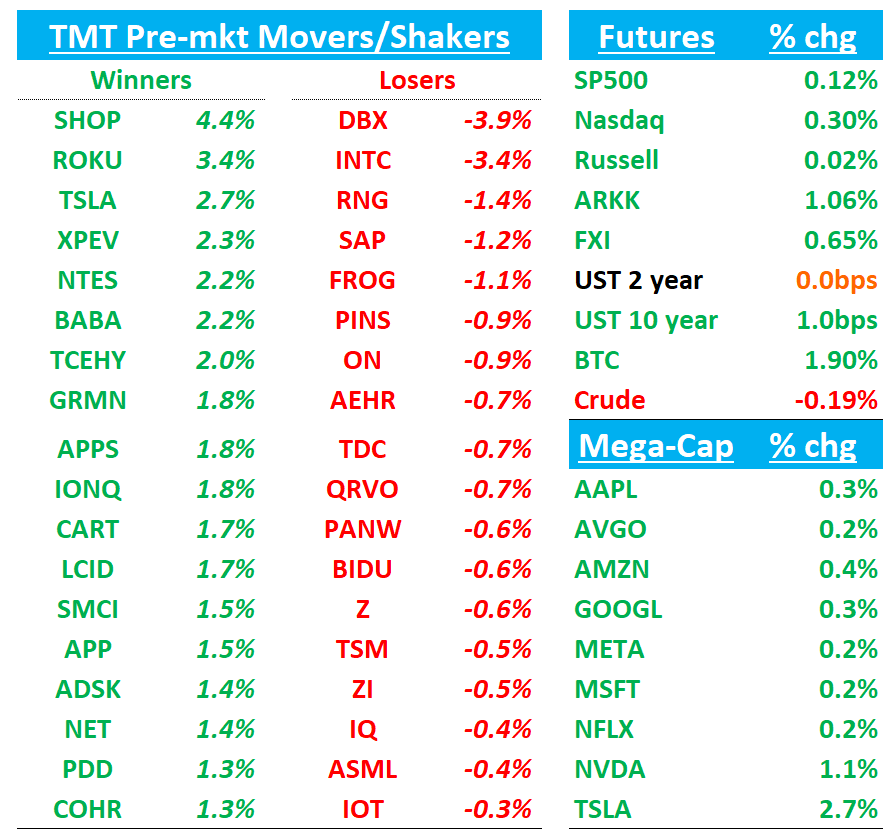

QQQs +30bps ahead of the Fed later today. Jensen on CNBC at 10:15am and analyst day at 11:30am. We sent out thoughts on the key slide from NVDA’s presentation earlier which will be the focus at the analyst day - we took it as a pretty bullish read on revs over the next few q’s…

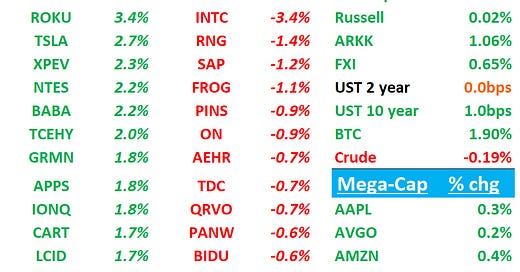

Yields flattish, China +65bps; BTC +2%

Let’s get to it…

TSLA: Tesla upgraded to Overweight ahead of 'material catalysts' at Cantor Fitzgerald

Cantor Fitzgerald analyst Andres Sheppard raised Tesla to Overweight from Neutral while maintaining a $425 pt following visits to Tesla's Cortex AI facilities and manufacturing lines before the upcoming Robotaxi division launch scheduled for June in Austin and later in California during 2025. With Tesla stock declining approximately 45% year-to-date, Cantor perceives "an appealing entry opportunity" for investors with longer-term perspectives exceeding 12 months who can tolerate price fluctuations. Sheppard identifies forthcoming "significant catalysts" including the Robotaxi segment unveiling in June, FSD deployment across Chinese markets, FSD introduction throughout Europe, more affordable vehicle launch in H1 2025, large-scale Optimus Bot production beginning 2026, initial Optimus customer deliveries sometime next year, and the Semi Truck debut.

MU: UBS calls out neg implications for HBM demand from Rubin Ultra disclosure at GTC

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.