TMTB Morning Wrap

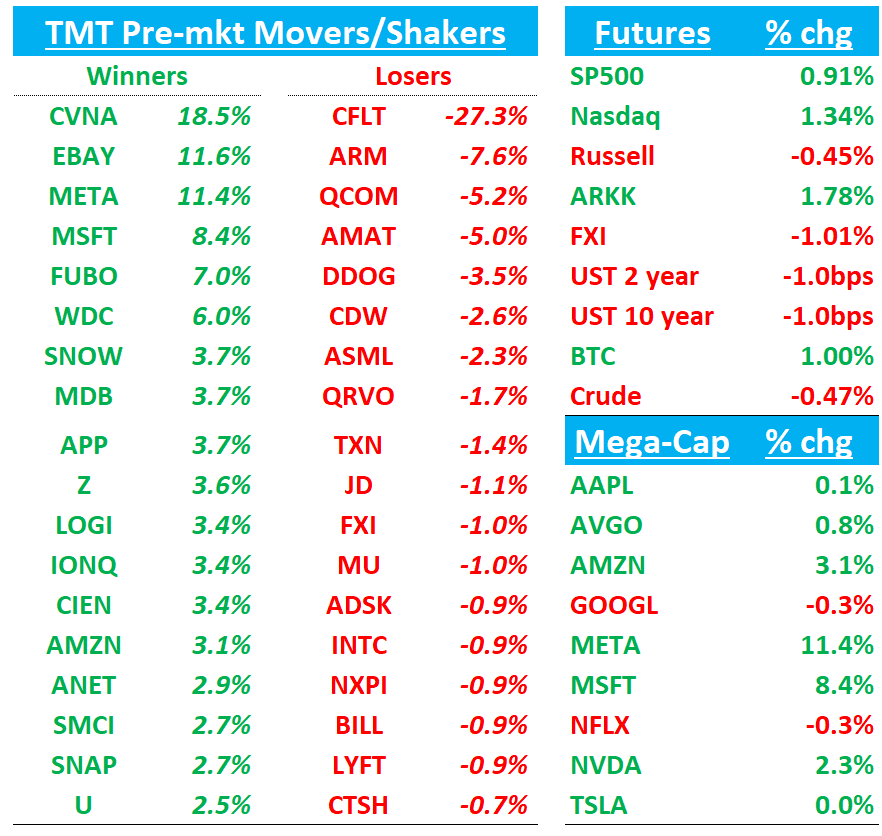

Good morning. QQQs +1.3% being helped by the monster META and MSFT prints — we our thoughts on the names here earlier this morning. The readthroughs: ad names (RDDT +3.5%; PINS +2%) as META crushed revs, the AI semi complex as both META and MSFT talked up strong demand and guided up capex (NVDA +2%; AMD +2% etc although MU weak on Samsung HBM comments), and AMZN (+3% Bogey likely closer to 18% vs. 17% post-Azure).

RBLX +20% as Q2 bookings +50% vs expects of 40% and Q3 guided to 43% at the midpoint. The flywheel is accelerating here and bull case just getting started…This is all happening on tougher comps btw as the comp is 10% harder from Q1 to Q3. Then gets 7 ppts easier in Q4. So it is very possible we see 3 straight quarters of 50% bookings growth, which supports a continued re-rating higher on the stock. As always need to watch the data here, but so far QTD data continues to trend higher. RBLX remains one of our favorite longs.

RDDT +9% catching a bid as this getting passed around: Google Search Posts On Reddit Section Replacing Discussion and Forums? link

Lots to get to so let’s get to it…

DDOG -4% is selling off on CFLT’s warning that a large AI-first customer (widely assumed to be OpenAI) is shifting from Confluent Cloud to a self-managed deployment.

Recall - there are fears out there that OAI spending on DDOG log mgmt will move to its internal ClickHouse-based OLogs solution in 2H, followed by moving metrics onto Chronosphere exiting Q4.

Here’s the key quote from CFLT earnings call:

“Additionally, an AI native customer has been making a broad based move towards self management of internal data platforms, reducing their Confluent Cloud usage as a result. We continue to support their data streaming needs and have now closed a Confluent Platform deal with them in Q3. This represents a significant reduction in total spending with Confluent starting in Q4 and is expected to dampen our Q4 cloud revenue growth rates by low single digits.”

“They're, you know, you know, broadly moving into, you know, a different way of kinda operating internally, and I think this is across a number of different vendors, including us. So we were, you know, happy to be able to support them, you know, with the Confluent platform deal. You know, they continue to use, our cloud product in more limited use cases, but there is a kind of overall reduction in spend, and it's definitely a headwind.”

Rocha at Wells out this morning defending DDOG - hearing the same from other investors — not surprising given the stock is crowded on the long side. The defense boils down to this: DDOG flagged OpenAI’s drive to optimize costs months ago, renewed the contract on lower unit terms last year, and still saw AI-cohort ARR surge to roughly 8.5 % of revenue with triple-digit growth—evidence of rising usage, not abandonment.

Also got sent this interview with DDOG CEO from early July on CNBC, where he sounded good re: OAI and used word “extremely” and “Acceleration” several times - in other words: this doesn’t sound like a mgmt team worried about OAI headwinds, but instead more bullish about AI tailwinds to the biz.

MU/Samsung: MU -1% weak this morning as Samsung talk up HBM3E supply exceeding demand on their EPS call which feeds recent fears of HBMM oversupply in ‘26.

CRWV: Citi Upgrades to Buy/High Risk, Sees 56% Upside on Strengthening AI Demand

Citi upgraded CoreWeave to Buy/High Risk and removed its 90-day downside catalyst watch, citing improved conviction in the durability of AI demand heading into FY26. The firm highlights MSFT’s Azure capex momentum and multi-year contracts with OpenAI and others as key growth drivers, with MSFT contributing 72% of CoreWeave's Q1 revenue. While the upcoming August 15 lockup could introduce some trading noise, Citi argues that the stock’s ~45% decline from peak levels has already priced in much of the risk. The bank is not changing estimates, but notes it is already 4–6% ahead of the Street on FY26–27 revenue and sees 56% potential upside to its $160 PT, which is based on a 7x FY26 EV/Sales multiple or 25–26x P/E on 2028 earnings.

QUICK HIT EARNINGS:

EBAY +12% after the biggest top-line surprise in 19 quarters. Q2 GMV rose 4 % cc to $19.5 B (buyside ~ $19.3B) and Q3 GMV is guided up 3-5 % cc — expects were high given better 3p data but this is better than expected. Management lifted the full-year GMV outlook to the high end (or a touch above) the prior low-single-digit range and now expects EPS up 10-12 % (previously high-single digits). Strength spanned all “focus” categories and advertising revenue accelerated sequentially, though some tailwinds—Nintendo Switch resales and tariff-driven price hikes—are likely transitory.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.