TMTB Morning Wrap

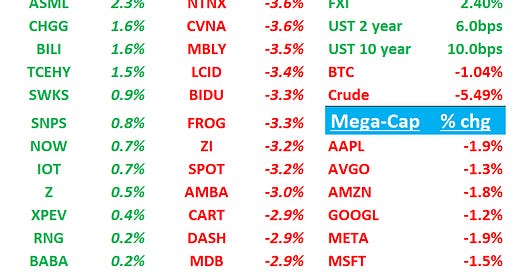

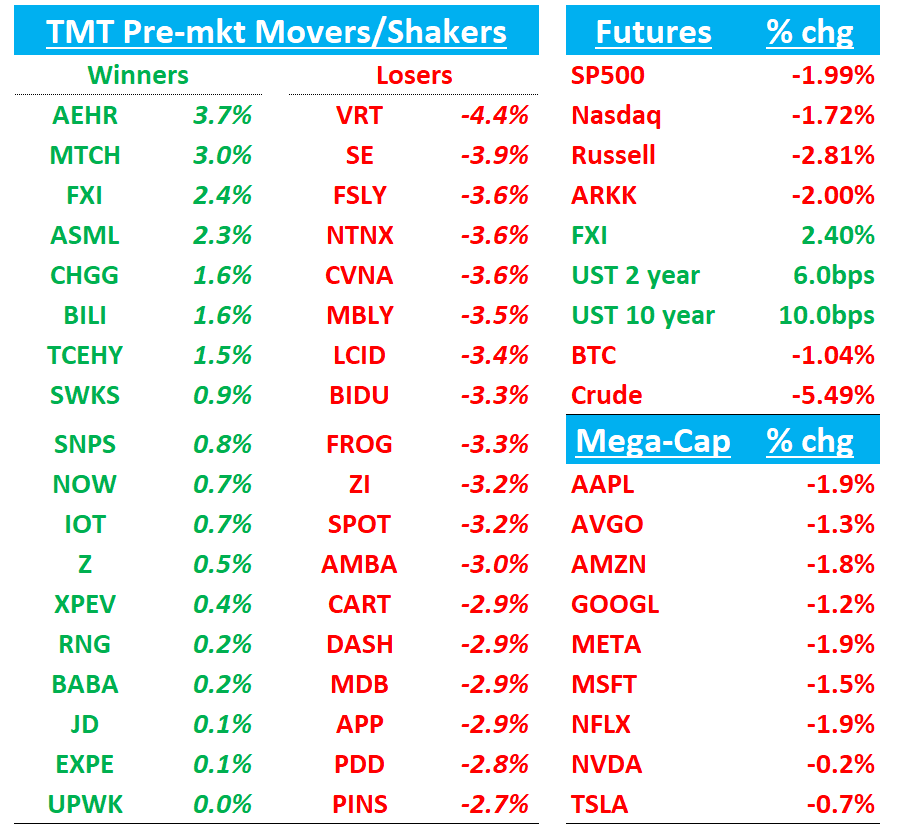

Good morning. QQQs - 1.7% after China announced 84% tariffs on US.

BESSENT: CHINA'S ESCALATION IS A LOSER FOR THEM

Yields continue to escalate alongside the trade war with 10yr/30yr +15bps getting close to 4.5% / 5% respectively. 2 year is only up 6bps.

China +2.5%. BTC -1%.

Looks like another fun one. Let’s get to it…

MACRO/TARIFF

CIEN: planning to offset some tariff-related costs by implementing a surcharge on hardware parts for some customers - WSJ

DAL -1%: ” with broad economic uncertainty around global trade, growth has largely stalled”

DAL's forecast for the June quarter projects total revenue between -2% and +2% year-over-year, with "resilience in premium, loyalty and international partially offsetting Domestic and main cabin softness." Additionally, they're adjusting second-half capacity to remain flat compared to last year, while providing no full-year guidance update. DAL maintaining consistent messaging regarding premium/international segments while acknowledging "it is premature at this time to provide an updated full-year outlook" due to economic uncertainty.

Walmart Maintains Sales Forecast Despite Tariff Pressure

Walmart Inc. reiterated its sales guidance despite President Donald Trump’s barrage of tariffs and weakening consumer sentiment, suggesting the world’s largest retailer is in a good position to navigate a historic period of economic uncertainty.

The company still sees net sales growing 3% to 4% this year, according to a statement. The retailer plans to combat the levies by investing in keeping prices low.

Walmart shares declined 1.2% at 7:35 a.m. New York time. The stock was down 9.5% year-to-date through Tuesday’s close.

The retailer also kept its outlook for operating income for this year, but widened the range for the current quarter because of several factors, including the impact of tariffs. Walmart wants to be flexible to invest in prices as the levies roll out.

Merchants Hike Prices on Amazon, DTC Sites

Online sellers are responding to President Donald Trump’s tariff announcements by tacking on checkout fees—some with cheeky names—or planning to do so. At the same time, sellers are gaming out exactly how much to increase their list prices and when, based on fast-evolving trade policies and competitive pressures.

Jolie Skin Co, a New York–based showerhead seller that makes its products in China, is planning to hike prices once final tariffs are set by adding a “Trump liberation tariff” fee at checkout. While the brand has been planning for tariffs for several months, Jolie CEO Ryan Babenzien said he hadn’t been expecting the proposed levies to be so high.

Starting to see pauses in shipments… Asus, Acer, DELL, HPQ and Lenovo have all reportedly notified the supply chain to suspend shipments of notebooks and related consumer electronics components to the US for two weeks – Commercial Times

US Raises Charges on Small Parcels, Targeting Chinese Retailers

The US will tax imports of items priced up to $800 at the rate of 90% of their value, up from a previous plan to levy a 30% ad valorem tax, according to the amendment on reciprocal tariffs published by the White House Wednesday.

Washington will also increase the per postal item fee on goods entering after May 2 and before June 1 to $75 from the planned $25. Parcels entering after June 1 will pay a fee of $150 per item instead of $50 announced previously, according to the executive order Wednesday

TECH RESEARCH/NEWS

Third Party Roundup:

NFLX: Yipit estimating flattish net ads in Q1 for UCAN, saying gross adds have “fallen to the lowest level since” Q323, which was the first full q of paid sharing as they call out significant churn from px increases

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.