TMTB: Morning Wrap

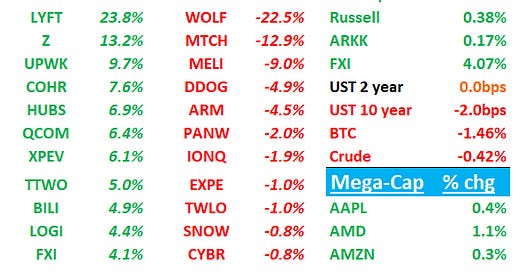

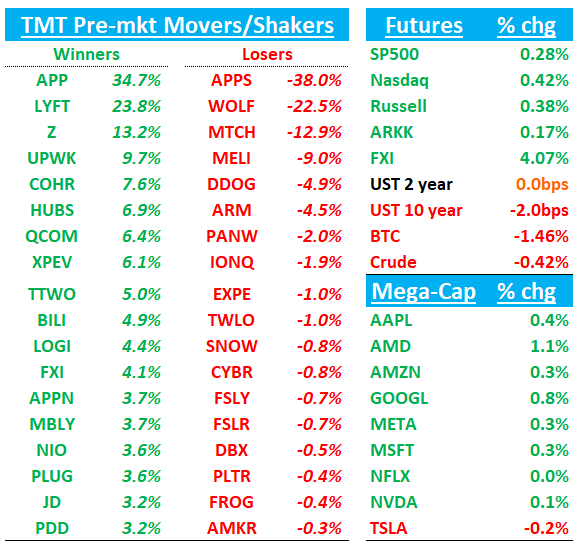

Good morning. QQQs +43bps following through to more new highs. BTC - 1.4%, China +4%. Yields flat to down 2bps across the curve. We’ll hit up EPS recaps first (DDOG, QCOM, LYFT, ARM, APP, Z, MTCH) then move onto News/Research. Let’s get to it…(apologies for typos - lots to get through)

DDOG -4% looks inline with revs in line with bogeys and better than street while guide also looks inline with bogeys

Overall, looks down the middle. Good enough for bulls to stay involved given they’re looking out more towards 2025 when GenAI initiatives/spend begins to ramp and capacity constraints at AWS/Azure ease. Key will be what DDOG’s says around demand on their call. We’ll re-iterate what we wrote on Sunday:

Bulls also expect revs to accelerate on flat comps as we move into 2025 as GenAI initiatives continue to ramp. We generally agree and expect that to happen but timing of it remains elusive to us. We continue to hold DDOG in our Tier 2 sw long bucket, and willing to deal with near-term choppiness in expectations for 2025 accel — we don’t have a strong view on short-term trajectory of the stock…

DDOG F/Y GUIDANCE

- Guides ADJ EPS $1.75 to $1.77, saw $1.62 to $1.66, EST $1.67

- Guides revenue $2.66B to $2.66B, saw $2.62B to $2.63B, EST $2.63B

GUIDANCE: Q4

- Guides ADJ EPS $0.42 to $0.44, EST $0.40

- Guides revenue $709M to $713M, EST $711.9M

RESULTS: Q3

- Revenue $690.0M, +26% y/y, EST $663.8M

- ADJ EPS $0.46 vs. $0.45 y/y, EST $0.40

- Cash and cash equivalents $337.4M, +29% y/y, EST $566.2M

- ADJ gross margin 81% vs. 82% y/y, EST 81.8%

- Adj. R&D expense $195.0M, +25% y/y, EST $192.9M

QCOM +6%: Strong results across the board especially given neg sentiment around handsets (AAPL, QRVO misses) coming into the print. Rev/EPS beat while guide also looks very good with rev guide 3.5% above street. However, no March guide.

Approves $15B repurchase plan. Majority of beat came on strong auto & IoT revs. Stock ended up selling off a bit during the call from +11% to +7% as mgmt chose not to guide the March Q (bears will say bc start of AAPL design—out cycle begins then although mgmt reiterated expectations for 20% iPhone share) and Dec Q guide implies 40% q/q growth in China OEMs (bears will say this is due to some pre buying ahead of tariffs although more likely due to Android flagship launches). Strong guide also due to strength in licensing, which is offset by seasonally weaker IoT.

Overall, #s better than expected and bulls will say stock still very cheap at 15x, which is a 50% discount to SOX. Buyside #s likely going to $11.75+ in FY26. Bears still active in the name with AAPL out-cycle on the horizon + weak handset/PCs + fears around FY27 not really growing.

TMTB’s take: Not really exciting for us either way.

QCOM GUIDANCE: Q1

- Guides revenue $10.5B to $11.3B, EST $10.54B (BEAT)

- Guides ADJ EPS $2.85 to $3.05, EST $2.81 (BEAT)

RESULTS: Q4

- ADJ EPS $2.69 vs. $2.02 y/y, EST $2.56 (BEAT)

- ADJ revenue $10.24B, +18% y/y, EST $9.91B (BEAT)

- QCT revenue $8.68B, +18% y/y, EST $8.42B (BEAT)

- Internet of Things revenue $1.68B, +22% y/y, EST $1.55B

- Handsets revenue $6.10B, +12% y/y, EST $6.04B

- Automotive revenue $899M, +68% y/y, EST $816.2M

- QTL revenue $1.52B, +21% y/y, EST $1.44B

- Adj. reconciling items for revenues $45M, EST $48.5M

- ADJ operating income $3.51B, +31% y/y, EST $3.32B

APP +35% Another blowout as mgmt continues to sound great on the call

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.