TMTB Morning Wrap

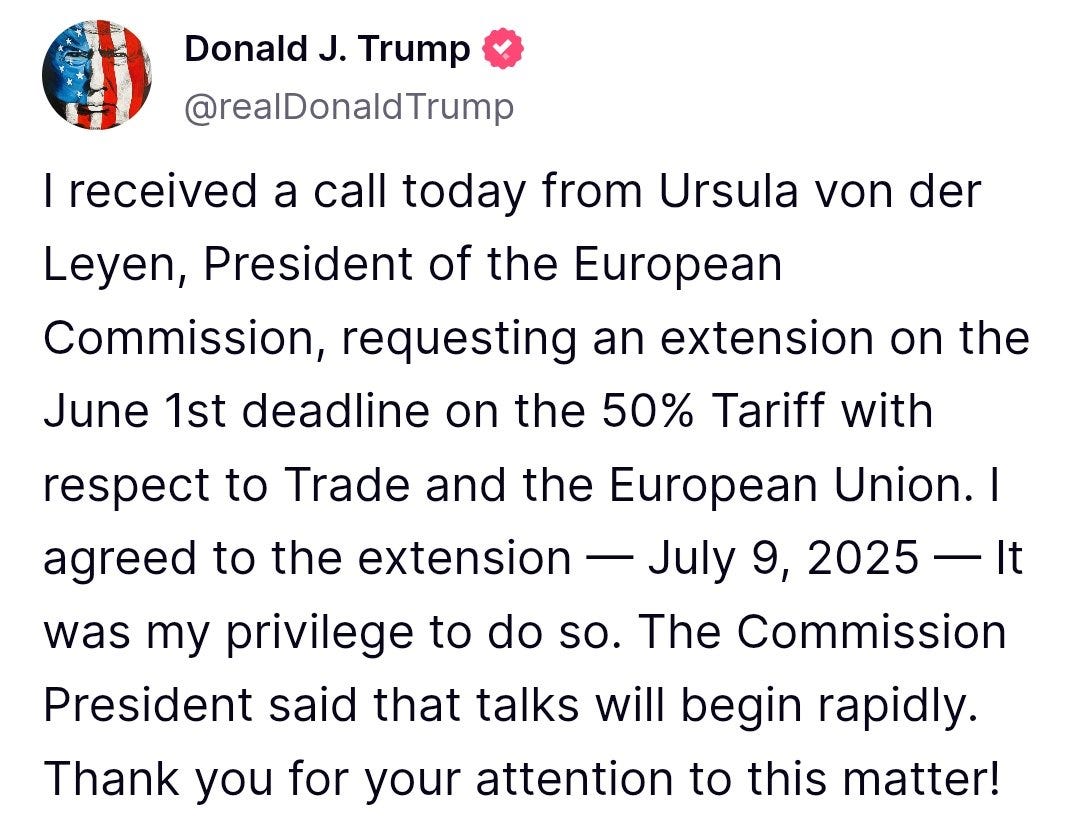

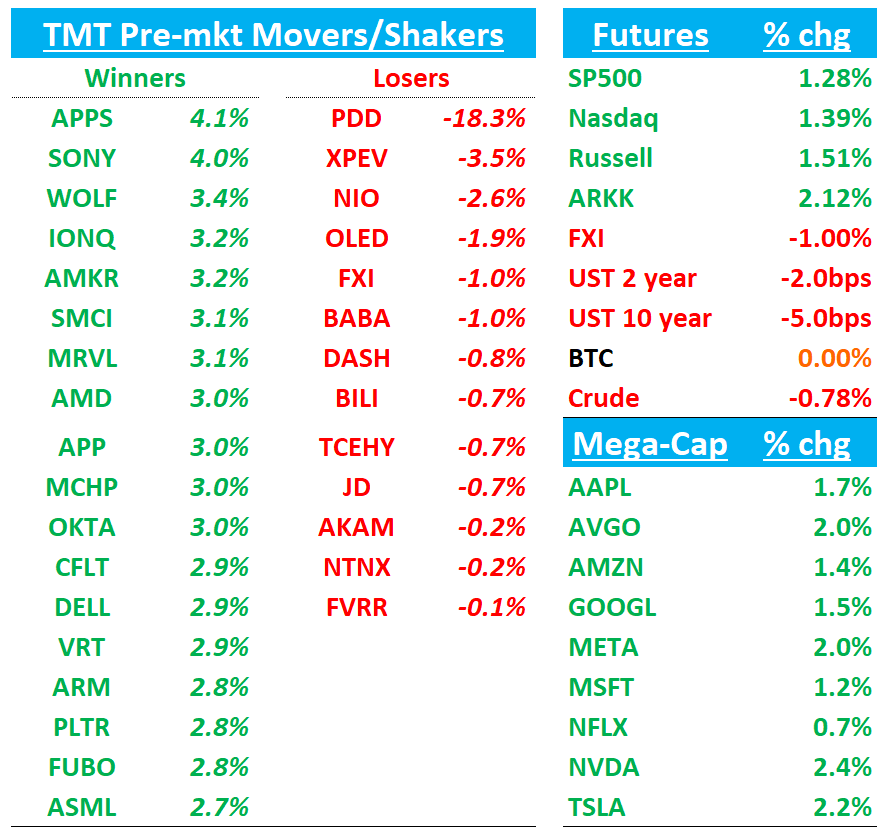

Good morning. QQQs +1.5% as Trump walked back his 50% European tariffs over the weekend and treasuries rally (10 year down 5 bps) after Japan signaled it will reduce super-long bond issuance, which is fueling speculation that demand for US long bonds could rise.

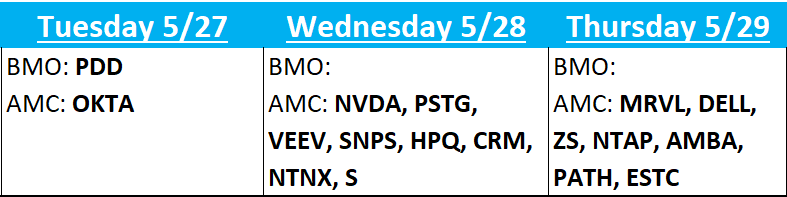

Busy week in TMT with NVDA, CRM, MRVL, DELL earnings among others:

Cowen TMT Conference (agenda) starts on Wednesday.

We got confirmation CRM is going after INFA this morning while PDD missed across the board (recap all the way near end).

Let’s get to it…

NVDA: Nvidia to launch cheaper Blackwell AI chip for China after US export curbs, sources say

Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said.

The GPU or graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources.

NVDA: MS Previews the Q / Asia team walks away more positive on GB200/GB300 after Computex

Morgan Stanley emphasizes that while H20 restrictions create complications, their primary focus remains on what they call "explosive token growth" as the key long-term driver. MS notes that "literally everyone we talk to in the space is telling us that they have been surprised by inference demand," with hyperscalers reporting unanticipated strong token growth beyond their expectations. The firm highlights that this demand surge is driven by actual usage and revenue generation rather than speculative investments, stating "this is proof that the models are being used, and driving revenue." MS notes they reduced April estimates to $42.2bn (from $43bn guidance) due to 23 days of lost H20 revenue, but emphasizes their $43.5bn July estimate "looks much better excluding H20, as April would be closer to $37bn, indicating a remarkable $6.5bn of sequential revenue growth." The analyst Joe Moore maintains their optimistic view around GB200 improvements and strong demand, suggesting the stock should perform well even if headline numbers don't change significantly due to the underlying growth trajectory.

MS’s Asia team says GB200 is finally ramping as they walked away more positive from Computex which they now think is 25-30k racks (vs. 20-25k previously) of GB200/300 servers is a more reasonable number for the industry in 2025.

Salesforce Nears $8 Billion Deal for Informatica

WSJ:

Salesforce is expected to pay $25 a share for Informatica, in a deal set to be announced later Tuesday, the people said.

The process was competitive, with Salesforce beating out multiple other strategic and private-equity suitors, the people added.

A deal for Informatica would rank among its largest and be its biggest since it closed the roughly $28 billion acquisition of workplace-collaboration company Slack Technologies in 2021. A few years before the Slack transaction, Salesforce agreed to buy data-analytics platform Tableau Software for more than $15 billion, and MuleSoft for around $6.5 billion.

Salesforce’s big appetite for dealmaking cooled somewhat after the company in 2023 drew a swarm of activist investors including Elliott Investment Management, Starboard Value and ValueAct Capital.

Couple sell-side notes out before deal was confirmed…

CRM: BofA sees several strategic positives if Salesforce acquired Informatica

BofA notes that Bloomberg is "once again speculating" about potential acquisition talks between CRM and INFA, highlighting "several strategic positives" from such a transaction. BofA suggests the combination could enhance "the velocity of data loaded into Salesforce Data Cloud, which is the underpinning of Salesforce's AI offering, Agentforce." While acknowledging that Salesforce's Mulesoft provides leading cloud-based application integration, BofA indicates Informatica could complement this with "a large pipe on the premise data set." BofA notes that while this "would not be a small acquisition for Salesforce, we think a potential deal is certainly digestible" and reiterates their Buy rating with $360 price target on "top pick" Salesforce.

CRM: Salesforce buyout of Informatica would make sense, says Jefferies

Jefferies analyst Brent Thill maintains a Buy rating on CRM with a $375 price target following Bloomberg's report of acquisition discussions with Informatica (INFA). Thill notes that "a 10% premium to Friday's close implies a deal at 5.1-times forward revenue versus 7.4-times when chatter last circulated in April 2024." Jefferies observes that since the previous speculation, "growth has decelerated at Informatica and Salesforce is facing growing pressure to increase adoption of Agentforce, which Informatica could help with." As a result, Jefferies believes such a transaction would be strategically sound and considers "the deal price is more attractive now than last year."

CRWV: Barclays downgrades to Hold after Rally

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.