TMTB Morning Wrap

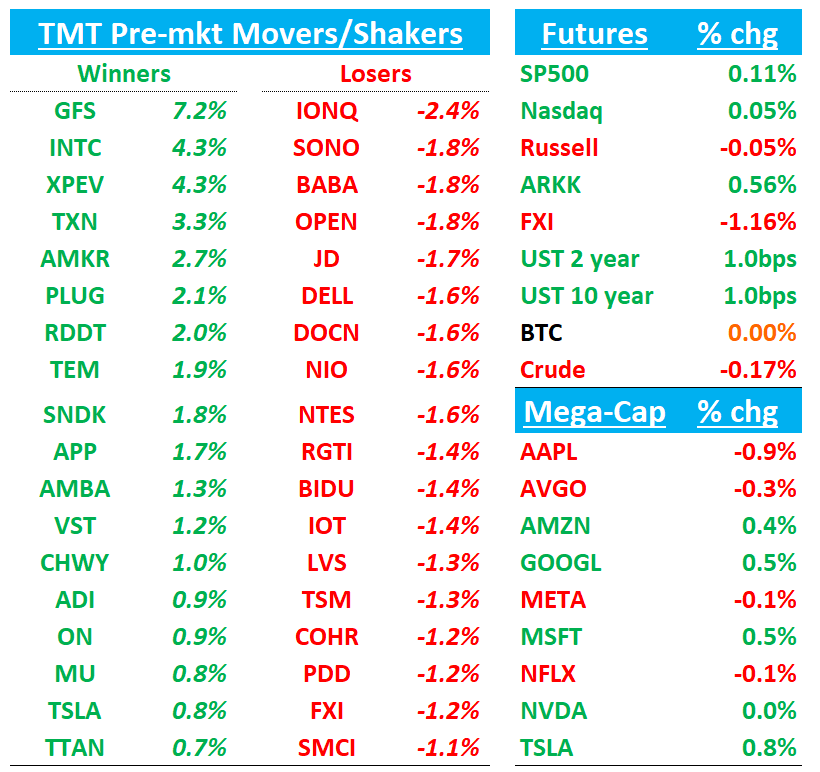

Happy Friday. Futures up slightly ahead of PCE at 8:30am. Semis were weak overnight in Asia as Korea (-3%) and Taiwan (-2%) led declines, with AI proxies down 3–6% (Hynix -5%, Samsung -3%, TSMC -1.5%). Other Asian markets weaker as well: Nikkei -0.8%, Hang Seng -1%, SHCOMP -0.6%, India -1%, with memory and Japanese semi-caps (-4–8%) hit hardest. BTC flat. Yields slightly down.

Some negative Trump semi/furniture tariff news out this morning…

Jensen was on the BG2 podcast yesterday. Full video here. We sent out some key quotes earlier here.

Let’s get to it…

Semis: Trump Takes Aim at Chip Makers With New Plan to Throttle Imports

More good news for INTC. Good for GFS and MU. Neg for AAPL/DELL

WSJ:

The Trump administration is weighing a new plan to reduce dramatically the U.S.’s reliance on semiconductors made overseas, hoping to spur domestic manufacturing and reshape global supply chains.

The policy’s goal is to have chip companies manufacture the same number of semiconductors in the U.S. as their customers import from overseas producers. Companies that don’t maintain a 1:1 ratio over time would have to pay a tariff, according to people familiar with the concept.

The process could challenge the biggest tech companies such as Apple and Dell Technologies, which import products containing a host of different chips from all over the world. Under the proposed system, companies would potentially have to keep track of where all those chips were made and work with chip makers to match the number of U.S. and overseas products over time.

It could be a boon for companies increasing U.S. production such as Taiwan Semiconductor Manufacturing Co., Micron Technology and GlobalFoundries, which would get more leverage in discussions with customers.

MSFT: Morgan Stanley Raises PT to $625, Maintains Overweight; Names Top Pick in Large-Cap Software

Morgan Stanley lifted its price target on Microsoft to $625 from $582, citing strong momentum across GenAI, cloud, and cybersecurity, which it sees as the biggest wallet share gainers. The firm notes Microsoft’s cybersecurity scale at over $40B in revenue cements its position as the #1 vendor, while consolidation of spend trends reinforce durability. MSFT is trading at <26x CY27 EPS, versus a large-cap software average of 32x non-GAAP EPS, which the analysts see as underappreciating Microsoft’s high-teens total return profile. With strong fundamentals and secular tailwinds, the firm reiterates Overweight and calls Microsoft its Top Pick in large-cap software, citing the clearest and highest-probability risk/reward setup in the sector.

CIEN: Rosenblatt Upgrades to Buy, PT $175 on “Scale Across” AI Data Center Opportunity

Rosenblatt raised Ciena to Buy from Neutral with a $175 target, pointing to what it calls the “Scale Across” opportunity—linking AI data centers into clusters. The firm notes Ciena has already secured a hyperscale win, connecting two 100,000-GPU facilities 100km apart with WaveLogic 6 Nano 800G ZR pluggables. The analyst highlights that this deployment includes ~20 petabytes of capacity and is spurring development of multi-rail amplifiers that cut space requirements by ~98% and power usage by ~30% when lighting hundreds of fiber pairs. Rosenblatt estimates the contract could generate roughly $200M in revenue, spanning 800G ZR/ZR+ pluggables and core amplifier gear. The firm adds that this is likely the first of many such wins, as demand to cluster AI data centers accelerates and Ciena is well-positioned with pluggables and DWDM solutions to capture future deals.

WIX: Piper Raises PT to $210 on Base44 Growth Momentum / better growth in Sept

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.