TMTB Morning Wrap

Good morning. Futures flattish as the talk of the town this morning is the WSJ article calling out a slow Softbank rollout of Stargate. OpenAI came out with guns blazing in a PR that seems directly pointed at the WSJ article, announcing another 4.5gw of additional capacity with ORCL on top of the 10gw announced in Jan:

Together with our Stargate I site in Abilene, Texas, this additional partnership with Oracle will bring us to over 5 gigawatts of Stargate AI data center capacity under development, which will run over 2 million chips. This significantly advances our progress toward the commitment we announced at the White House in January to invest $500 billion into 10 gigawatts of AI infrastructure in the U.S. over the next four years. We now expect to exceed our initial commitment thanks to strong momentum with partners including Oracle and SoftBank.

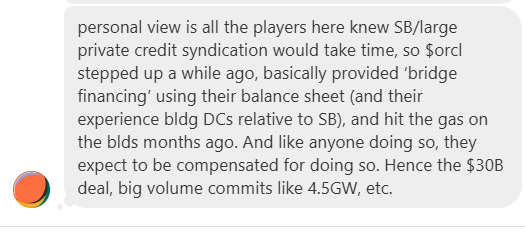

Lots of great discussion between a couple readers in TMTB chat yesterday on the topic. We liked this final take-away from JT, who’s been all over it:

It definitely feels like investors are skittish, looking for any signs to throw some cool water on the Hot AI summer, but we don’t think this is the datapoint that does it.

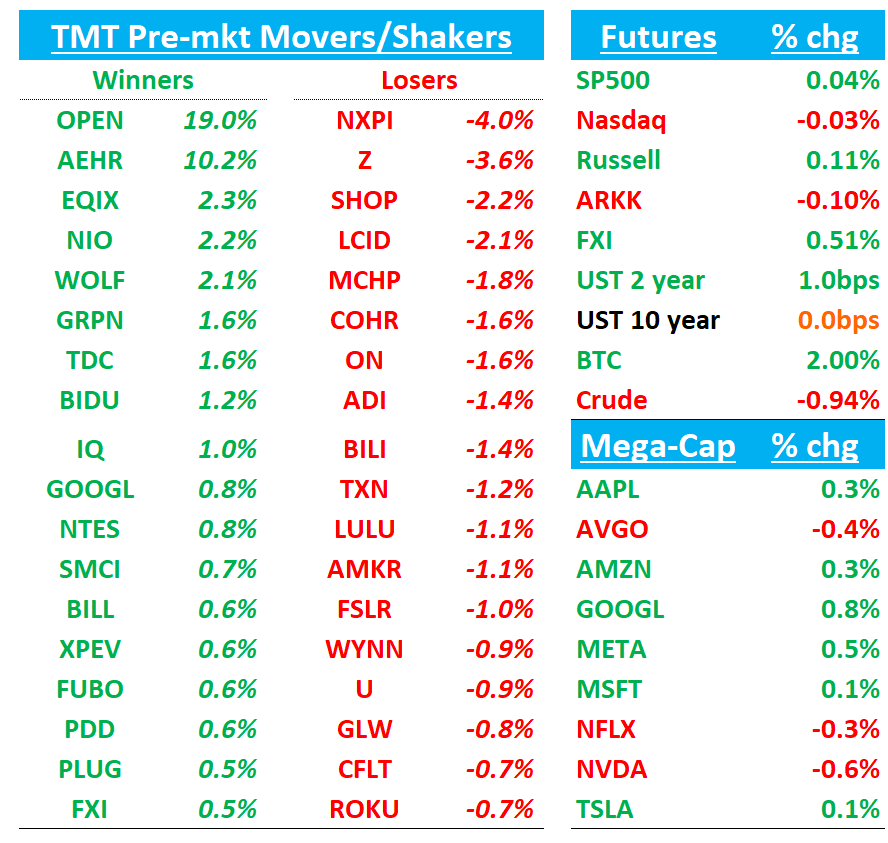

Yields and BTC flat. China +50bps. Let’s get to it…

NXPI -4%: Stock trading down on a slight rev beat and guiding next q above, but a bit light of buyside expectations

Stock has rallied a bit on the call as they said conviction in new upcycle has strengthened since 90 days ago…

Sentiment on analogs has improved significantly over the past couple of months given constructive comments from co’s over and with stocks near YTD highs. Conversations so far this morning have investors a bit surprised its down so much, but earning reactions so far this EPS season continue to show that positioning matters, and NXPI continues this trend. Call on going and focus will be around any color they provide on Q4 and sustainability of the recovery off that level.

TSLA: JPM Highlights Tesla Robotaxi’s Real-World Edge Over Global Peers

JPM analysts, the first to test Tesla’s full-day FSD experience in Austin, called the robotaxi ride solid and consistently safe, noting key differences from peers like German OEMs and others in Asia. Unlike rivals offering limited, geo-fenced or short in-city tests, Tesla enabled an all-day booking through its app with seamless operation across varying traffic and weather. The firm also sees Tesla’s agentic capabilities as materially improving efficiency and customer experience, with some use-cases enabling 9x faster onboarding. Overall, JPM calls the test “well handled,” even during complex scenarios like busy urban pick-up zones or weather disruptions, and suggests Tesla’s model could reshape ADAS and vehicle pricing dynamics industry-wide.

TSLA: Wedbush Sees $1T Autonomous Upside, Reiterates Outperform with $500 PT

Wedbush reiterated its Outperform rating and $500 price target on Tesla (TSLA), calling the setup into earnings “dramatically improved” from the prior quarter. The firm says Elon Musk has shifted from distraction to focus, now acting as a "wartime CEO" driving the Robotaxi rollout in Austin and beyond. Investors are closely watching for updates on Tesla’s AI roadmap, including potential investment in xAI, which will require a shareholder vote later this year. Wedbush also points to Tesla’s broader AI ambitions with Optimus and robotics, positioning the company as a future leader in the space.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.