TMTB Morning Wrap

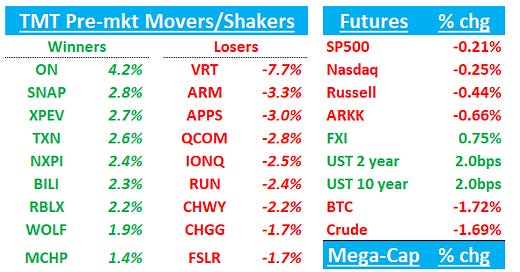

Good morning. QQQs -25bps as yields ticking up slightly again. BTC - 1.6% and China +1%. The DXY is rising 20bp, with the USD up ~90bp vs. the JPY and 10bp against the EUR. Brent is down ~90bp to ~$75.40, reversing some of its gains from Mon and Tues. MCD - 6% on E-coli outbreak.

Let’s get to it…TXN/T recaps first then news/research/3p…

TXN +3.6%: Inline Q3 and weaker guide, but short positioning heading into the print + better China commentary on the call has stock higher in the pre

Top end of the rev guide missed street and more bearish bogeys (-7% q/q at midpt vs street at -2% and bogeys at -5-6%) Same with EPS. GMs beat at 59.6% vs street at 58.2% while implied Q4 GM is 57% vs syreet at 58.8% due to lower revs, under-utilization headwinds and high depreciation related to TXN’s 1st fab in Sherman fab.

In terms of end markets, key pt is autos — which has been one of main reasons investors negative on the analog space — grew 7-8% q/q driven by China autos +20% q/q. Industrial was still bad but non-industrial segments recovered slightly. TXN highlighted above seasonal growth in Personal Electronics (+30% QoQ), Enterprise Systems (+20% QoQ), and Comms Equipment (+25% QoQ) – and expects cyclical recovery to continue as revenues in those end-markets remain 25-to-50% below prior peak levels

Bears will say typical seasonality only -4-5% over last 15 years and stock still trading at 30x while missing estimates, while bulls will say this might be a clearing event, China autos is better, and other end markets will begin to grow going fwd while you want to buy analog stocks when they are expensive. ISI, who is a big bull on the stock, models $4.1B above high end of the guide in Q4 saying that EMS and Disti inventory declines falling below LT trendlines and TXN shipping well below consumption is setting stage for upside surprises in 2025 while company is “exiting its capex cycle which will drive FCF /shr to increase from TTM trough of $1 to $12 by 2027” Highs 20s multiple = $300.

Summit upgrades to Buy saying they think TXN is seeing a cyclical recovery in the PC, smartphone, consumer, enterprise systems, and communications infrastructure end markets, and the firm anticipates earnings outperformance in 2025 as cyclical demand recovery gains momentum, the analyst tells investors in a research note. Summit says while global industrial and automotive end-markets remained mixed, Texas Instruments is also seeing gains in the China EV market.

T +3%: Top line miss, but postpaid inline (better churn than feared) + better profitability and FCF - overall relatively inline print

Headline rev miss, fios net adds a bit light bc of weather, 2024 guide reiiterated and T is on track to hit 2.5x leverage in H1’25 + 30m fiber locations by end of 2025. No 2025 capex shock here like VZ yesterday. Call starts at 8:30 est. webcast here.

Q3 revenue/EBITDA/EPS of $30.2b/$11.6b/$0.60 vs. Street estimates of $30.45b/$11.4b/$0.57.

Postpaid phone net ads +403k vs St +393k

Fiber net adds +226k vs St +258k

Wireless service revs +4.0% (Q2 +3.4%, St +3.3%).

2024 Guide: T reiterated its FY24 guide, guiding EPS to $2.20, FCF to $17.5b, capex of 21-22b, wireless to grow ~3%, broadband +7%, EBITDA growth of ~3%.

Bulls like the print with better churn than feared/better FCF and EBITDA #s and Dec investor day and potential buyback announcement ahead.

Arm to Scrap Qualcomm Chip Design License in Feud Escalation

Arm Holdings Plc is canceling a license that allowed longtime partner Qualcomm Inc. to use Arm intellectual property to design chips, escalating a legal dispute over vital smartphone technology.

Arm, based in the UK, has given Qualcomm a mandated 60-day notice of the cancellation of their so-called architectural license agreement, according to a document seen by Bloomberg. The contract allows Qualcomm to create its own chips based on standards owned by Arm.

The showdown threatens to roil the smartphone and personal computer markets, as well as disrupting the finances and operations of two of the most influential companies in the semiconductor industry.

JPM out saying they think ARM license cancelation is just a negotiation tactic versus QCOM

JPM notes QCOM has relied on the architecture license to design custom Arm chips for both the smartphone and PC markets, and could potentially explore future efforts in relation to entering the server market as well based on existing capabilities at Nuvia. JPM thinks the cancellation of the license will mark an escalation of the disagreement between the companies, but an eventual settlement is still the most likely outcome given that the move will impact revenues for both companies (JPM notes QCOM accounted for 11% of ARM’s revs in F23) and JPM thinks QCOM is most likely to move to get an injunction on the cancellation.

Pot’l INTC acquisition makes more sense now if ARM IP harder to get…

SNAP: JMP upgrades to Buy from Hold with $17PT

JMP notes that with Snap set to roll out Simple Snapchat and launch Sponsored Snaps, it will see an inflection in impression growth. JMP believes SNAP can grow U.S. and North American engagement and drive greater advertising load with its new ad products while channel checks with larger performance advertisers also are coming back favorably as Snap's direct response product improvements are gaining traction.

Reminder, SNAP reports next week and stock has lagged barely up YTD

3P Roundup:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.