TMTB Morning Wrap

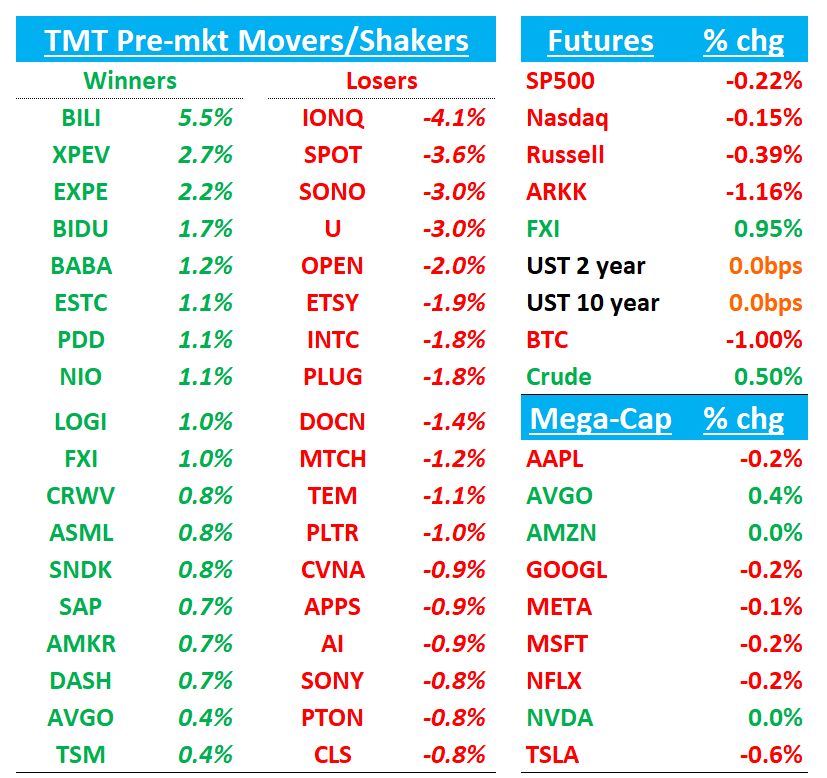

Good morning. Futures off -15bps to start the day as we finish off our best Sept since 2010 (+5%) and now focus shifts to earnings preview season in early October.

BTC -1%. China strong overnight with Hang Seng +1% and HSTECH 2% (BABA/BIDU +1-2%). Yields flattish.

Gov’t shutdown a focus today Here’s VitalKnowledge:

A meeting at the WH on Monday btwn Trump and Congressional leaders ended without a deaand a shutdown is nearly certain to happen starting Wed am. However, Republicans signaled an openness to extending some ObamaCare subsidies, which is the single most important “ask” of the Democrats, and bc of this common ground, it seems like a deal can be reached relatively quickly

Lots to get to this morning, so let’s get straight to it…

SPOT: Spotify Founder Daniel Ek Leaving CEO Job

WSJ:

Spotify Chief Executive Daniel Ek plans to step away from the top job nearly two decades after he founded the music-streaming company, and will be succeeded by new co-CEOs.

Alex Norström and Gustav Söderström, Spotify’s co-presidents, will become co-CEOs on Jan. 1, the audiostreaming giant said Tuesday.

Norström, co-president and chief business officer, has overseen subscriptions, advertising and content on the platform. Söderström, co-president and chief product and technology officer, has overseen product, design and engineering.

“We couldn’t be better positioned. And to be clear, I’m not leaving. I’ll remain deeply involved in the big, defining decisions about our future,” Ek, 42 years old, said in a note to employees Tuesday.

SPOT: Goldman Sachs Downgrades to Neutral, PT $770 on Balanced Risk/Reward

Goldman Sachs downgraded Spotify to Neutral from Buy, lifting its price target slightly to $770 (from $765), saying much of the forward growth story is already priced in after strong share gains. The firm still sees mid-teens % revenue CAGR over the next 3–4 years, supported by premium price increases, new tiers, MAU growth, and ad revenue reacceleration from 2026. Gross profit and margin expansion should come from better music unit economics, cost leverage, and scaling high-margin ad streams. However, with ~5% annual Premium ARPU growth and 100–150bps yearly margin expansion already in estimates, GS views upside as more limited at current levels.

NVDA: Citi Raises PT to $210 on Stronger AI Infrastructure Outlook

Citi lifted its price target on NVIDIA to $210 from $200, citing a more constructive stance on AI infrastructure spending and the upcoming Rubin CPX GPU launch. The firm says it now models October/January quarters at $54B/$62B in sales and lifted CY26/27 forecasts modestly to reflect its higher capex assumptions. Citi highlights management’s unchanged view on the Google GPU vs ASIC debate and notes the CPX product cadence remains intact, with Rubin CPX expected alongside Vera Rubin at the end of CY26 as a standalone GPU aimed at large-context inference. Citi maintains a Buy rating and flags the GTC event in late October as a potential near-term catalyst.

NVDA: KeyBanc Lifts PT to $250 on Higher CoWoS Supply and Rubin Upside

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.