TMTB Morning Wrap

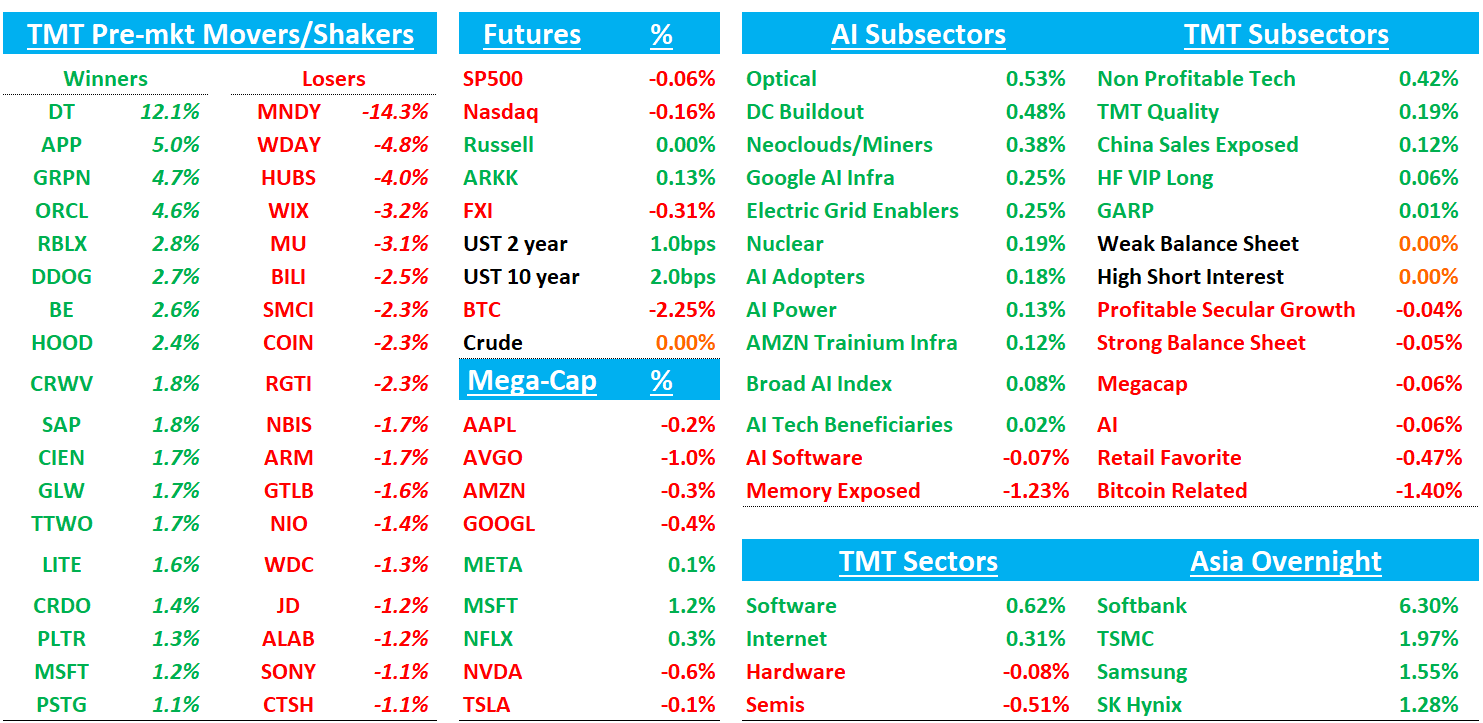

Good morning. Seems like I didn’t much last week: hyperscalers looked at with an increasingly capex intensive lens, Anthropic eating the world, SaaSpocalypse redux (again), internet increasingly viewed as next sector to be disrupted while massive de-grossing took place across Tech (JPM said 4z de-grossing on Wed and another 2x digressing on Thurs). Sounds like a fun week! Good to be back and we’ll have more thoughts on the landscape this week as we get plugged back in and talk with investors. Yields flat to down. BTC sliding below $70k again. Asis generally green with Nikkei and Korea sitting near all time highs: TPX +2.29%, NKY +3.89%, Hang Seng +1.76%, HSCEI +1.52%, SHCOMP +1.41%, Shenzhen +1.91%, Taiwan TAIEX +1.96%, Korea KOSPI +4.1%,

We’re about 1/3 of the way through earnings and have a full line up this week (we’ll have some bogeys later today):

Tuesday: DDOG, SPOT, VYX, ALAB, BL, FRSH, HOOD, KVYO, LSCC, LYFT, NET, PEGA, RPD, TDC, Z

Wednesday: GFS, SHOP, TMUS, U, VERX, APP, CSCO, FSLY, HUBS, MSI, PAYC, QTWO, TYL

Thursday: CHKP, TRIP, ABNB, AMAT, ANET, CART, COIN, DKNG, EXPE, FROG, PCOR, PINS, ROKU, TOST, TWLO

DT +12% and MNDY -15% were the first to go this week and tale of two opposites with DT with a nice beat and raise while MNDY’s results will fan fears of SaaS obsolescence. Price action will be interesting today — if this dispersion can hold, will show sw investors could begin to be more discerning across sw names (infra vs. SaaS). We’ll recap those earnings first then get to the usual.

Let’s get to it…

DT +12%: Clean beat and raise

DT posted solid Q3 FY26, with ARR up 16% YoY in constant currency (in-line with H1) and net new ARR of $75m inline with bogeys (+11% YoY). Management’s raised FY26 ARR outlook implies a materially higher net new ARR run-rate (back to levels last seen in FY23), which should support the “acceleration” narrative (we’ll see how much the market cares about that). $1B buyback

DDOG +3% in sympathy

The #s:

Q4 guide):

Subscription rev: $493–$498m (vs $489.9m)

Total rev: $518–$523m (vs $514.6m)

Non-GAAP op income: $133–$138m (vs $135.9m; ~26% margin)

Non-GAAP EPS: $0.38–$0.39 (vs $0.37)

FY26 guide raised:

ARR: $2,053–$2,061m (prior $2,010–$2,025m; consensus $2,020.8m) ~15.5–16% cc growth; implies ~$273m net new ARR (prior ~$252m)

Total rev: $2,005–$2,010m (prior $1,985–$1,995m; consensus $1,991.6m) ~16% cc growth

Subscription rev: $1,917–$1,922m (prior $1,898–$1,908m; consensus $1,903m)

Non-GAAP op income: $582–$587m (prior $571–$581m; consensus $577.3m) ~29% margin

Non-GAAP EPS: $1.67–$1.69 (prior $1.62–$1.64; consensus $1.63)

FCF: $520–$525m (prior $505–$515m; consensus $511m) ~26% FCF margin

MNDY -15%: Smaller Q4 beat + weaker FY26 margin/FCF driving stock to new lows. Will fuel the SW bear case

Q4 came in mixed with a smaller beat (~1.3%) and NDR at 110%, below the prior expects for ~111%. The bigger issue is FY26/Q1 guide which missed and FY26 lower profitability/FCF guidance (23%/30% misses)

Guidance:

Q1 revenue: $338–$340m (vs $343m)

Q1 non-GAAP op income: $37–$39m (vs $46.6m)

FY26 revenue: $1.452–$1.462b (vs $1.477b) ~18–19% growth at midpoint

FY26 non-GAAP EBIT: $165–$175m (vs $219.9m) ~11–12% margin

FY26 adj. FCF: $275–$290m (vs $404.1m) ~19–20% FCF margin (vs 26% in FY25)

Tech News/Research

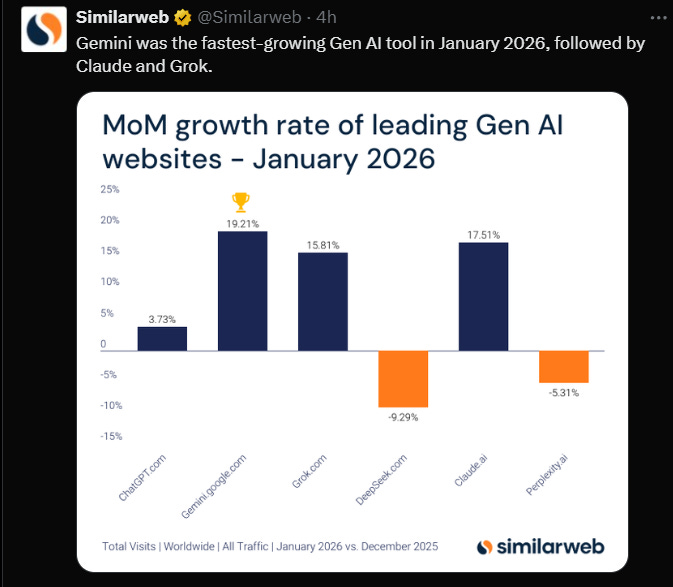

OpenAI: Sam Altman touts ChatGPT’s reaccelerating growth to employees as OpenAI closes in on $100 billion funding

(Softbank +6% overnight)

CNBC:

Altman told OpenAI employees on Friday that ChatGPT, the company’s popular artificial intelligence chatbot, is “back to exceeding 10% monthly growth,” according to an internal Slack message viewed by CNBC. OpenAI is also preparing to launch “an updated Chat model” this week, Altman said.

In his message on Friday, Altman said OpenAI’s coding product, Codex, grew about 50% from a week ago. OpenAI has been circulating charts as part of the discussions. One chart shows that Codex, based on internal data, is eating into Claude Code’s market share, according to a screenshot seen by CNBC.

In private meetings, the executives are highlighting OpenAI’s strength with consumers, growing enterprise business and access to compute, according one person, who asked not to be named because the talks are private.

MU -3.5% premarket after South Korea’s Yonhap reported that Samsung will start large-scale production of the next Generation of high-bandwidth memory chips as soon as this month. Semianalysis was out Firday saying NVDA plans to source HBM4 for VR entirely from SK Hynix and Samsung (70/30 split)

MU: Goldman Sachs stays Neutral on balanced risk/reward despite HBM share opportunity

GS notes it expects Micron to execute on its HBM roadmap and capture roughly 20% share of a rapidly expanding, high-margin market, though management commentary points to ongoing cleanroom capacity constraints limiting bit growth to about 20% in 2026. GS remains Neutral on the stock, citing a roughly balanced risk/reward profile and the potential for HBM pricing pressure in 2026 as additional suppliers, including Samsung, come through qualification. The firm says it would turn more constructive if industry supply growth discipline extends into 2027. GS’s $235 price target is based on 15x its normalized EPS estimate of $15.65, with key risks tied to Micron’s HBM execution and share gains, upside to HBM content per AI accelerator, and potential DRAM pricing pressure from CXMT share gains.

WDAY CEO leaving - Cofounder and Bhuri taking over

AMZN/STM: Amazon Deepens Ties With Chipmaker STMicro for Data Centers

Amazon.com Inc.’s cloud service AWS is deepening its ties with Franco-Italian chipmaker STMicroelectronics NV to secure semiconductor technologies for its data centers.

STMicro will supply various semiconductors to AWS, including chips to support high-bandwidth connectivity and for energy-efficient power management required for hyperscale data center operations, STMicro said in a statement on Monday.

APP +4%: CapitalWatch issues correction and apology regarding prior 20-Jan report regarding Tang Hao, but reaffirms other part of short report - link on X

Our stance regarding the complex financial structure of AppLovin (NASDAQ: APP) remains unchanged. While removing specific allegations against an individual, we reserve the right to independently analyze public market data. In our follow-up and related report, “Nine Questions for AppLovin,” we will continue to utilize mathematical models and financial reports to raise professional and necessary inquiries regarding figures that lack reasonable explanation.

CIEN: To be added to SP500

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.