TMTB Morning Wrap

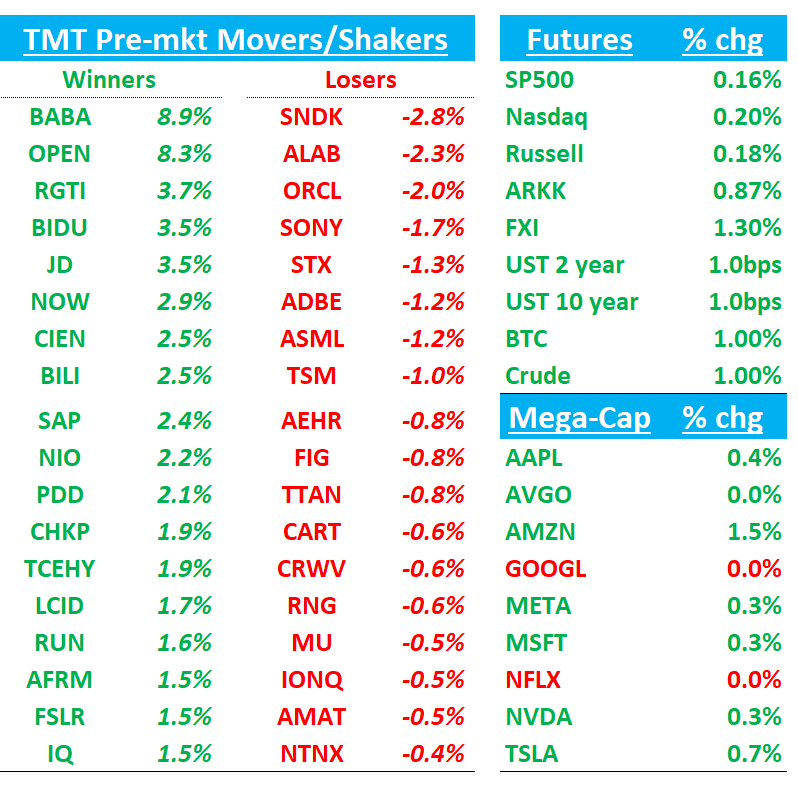

Good morning. Futures +20bps to start the morning. MU -1% trading down slightly on a set of strong numbers given high expectations and some concerns which remain around HBM, although the call sounded v bullish on demand. BABA +8% early after talking up capex and announcing partnership with NVDA around Robotics at their cloud conference More OpenAI compute spending news overnight and I’m getting the sense investors feeling a little bit of fatigue from all these announcements.

We’ll hit up MU first, then move onto the OpenAI compute spend news, and finish with the usual Tech/Research.

Let’s get to it…

MU -1%: Very solid numbers as GMs surprise to the upside; bullish commentary around server demand; some concerns around HBMs remain

Expectations were very high going in, but overall MU met them, with the 51.5% GM guide for Q1 and soft guide for sequential improvement in Q2 the biggest positive surprises.

MU talked up DRAM demand, particularly coming from traditional server:

“The calendar 2025 traditional server growth outlook has strengthened significantly from flat to growth in the mid-single digit range.”

“We believe this change in outlook is in part related to the growth of AI agents and the traditional server workloads agents initiate, as they execute tasks on behalf of users” (h/t JT)

MU now sees CY25 total server units +~10% (up from MSD), with traditional servers re‑accelerating; PC units MSD growth (Win10 EOL, AI PCs), smartphones LSD, and auto/industrial strengthening. Industry DRAM bit demand CY25: high‑teens; NAND: low‑to‑mid teens

On HBMs, MU said they now have six HBM customers, has pricing agreements for the vast majority of CY26 HBM3E supply, and expects to sell out the remainder of CY26 HBM within months.

Bull vs. Bear debate:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.