TMTB Morning Wrap

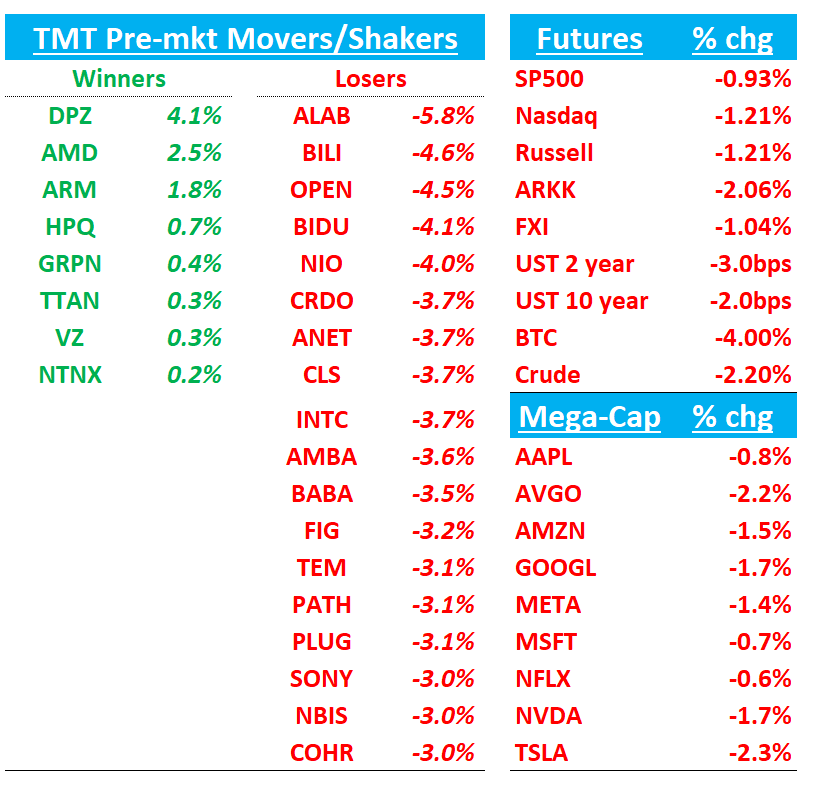

Good morning. Futures 1.3% as China/U.S. tensions increased slightly overnight after China imposed sanctions on the US subsidiaries of a South Korean shipbuilder (Financial Times) and Reuters reported that China in the last few weeks seems to have tightened rare earth export licenses. Asian markets down overnight: NKY -2.5%, Hang Seng -1.7%, SHCOMP -0.6%, TAIEX -0.5%, KOSPI -0.6%. HSTECH -3% as memory was particularly weak and Samsung down despite a v solid beat. BTC -4% early

A couple articles on China/U.S. overnight:

How China and the U.S. Are Racing to De-Escalate the Trade War - WSJ

Scott Bessent slams China: They want to pull everybody else down with them - FinancialTimes:

But they said Li Chenggang, the top trade negotiator for vice-premier He Lifeng — Bessent’s counterpart — had issued threats to Washington in the summer. “In August, Li Chenggang previewed many of China’s current lines of attack that played out over the last week,” a senior US official told the FT. “He was pretty unhinged and very aggressive in stating that the US would face ‘hellfire’ if things didn’t go his way.”

Bessent added: “They are in the middle of a recession/depression, and they are trying to export their way out of it. The problem is they’re exacerbating their standing in the world.”

Let’s get to the good stuff…

AMD

AMD: Oracle Cloud to deploy 50,000 AMD AI chips

50k * $25k ASP = $1.25B, so its a small number but another positive signal for MI450 which should continue to help re-rating.

CNBC:

Oracle Cloud Infrastructure on Tuesday announced that it will deploy 50,000 Advanced Micro Devices graphics processors starting in the second half of 2026.

The move is the latest sign that cloud companies are increasingly offering AMD’s GPUs as an alternative to Nvidia’s market-leading GPUs for artificial intelligence.

“We feel like customers are going to take up AMD very, very well — especially in the inferencing space,” Karan Batta, senior vice president of Oracle Cloud Infrastructure, told CNBC’s Seema Mody.

AMD: Hearing M-sci positive on Mi355x and CPU deployment momentum in Q3

AMD: Wolfe Upgrades to Outperform, PT $300 on OpenAI Deal and EPS Upside

Wolfe Research upgrades AMD to Outperform from Peer Perform with a $300 price target, citing the company’s OpenAI partnership as a major catalyst that could drive $10+ in EPS power over time. The firm says AMD now “simply needs to execute,” with additional upside if momentum extends beyond OpenAI. Wolfe also expects near-term estimate revisions higher, supported by improving traditional server demand and strengthening data center fundamentals.

ARM: OpenAI Is Working WithSoftBank’s Arm on AI Chip Effort

OpenAI’s development of its own artificial intelligence chip could end up benefiting SoftBank, one of its biggest shareholders, which is also helping the ChatGPT maker develop and finance its ambitious data center plan.

OpenAI is talking with SoftBank’s Arm subsidiary about using an Arm-designed central processing unit with OpenAI’s AI server chip, according to three people close to Arm. OpenAI is co-designing its AI chip with Broadcom, and Arm hopes OpenAI will also use the CPU with other AI chips from Nvidia and AMD, one of these people said.

A CPU is necessary because all AI chips work in tandem with CPUs. Arm recently began to develop its own CPU after previously only selling designs for such chips, some of these people said. Arm is responsible for the underlying blueprint in many of the world’s CPUs and mobile chips.

APP

APP: WFS Flags Near-Term Risk to 4Q Guide; Keeps Overweight, PT Raised to $633

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.