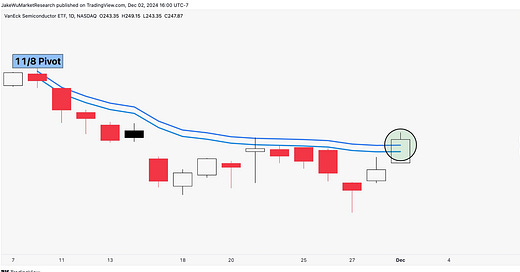

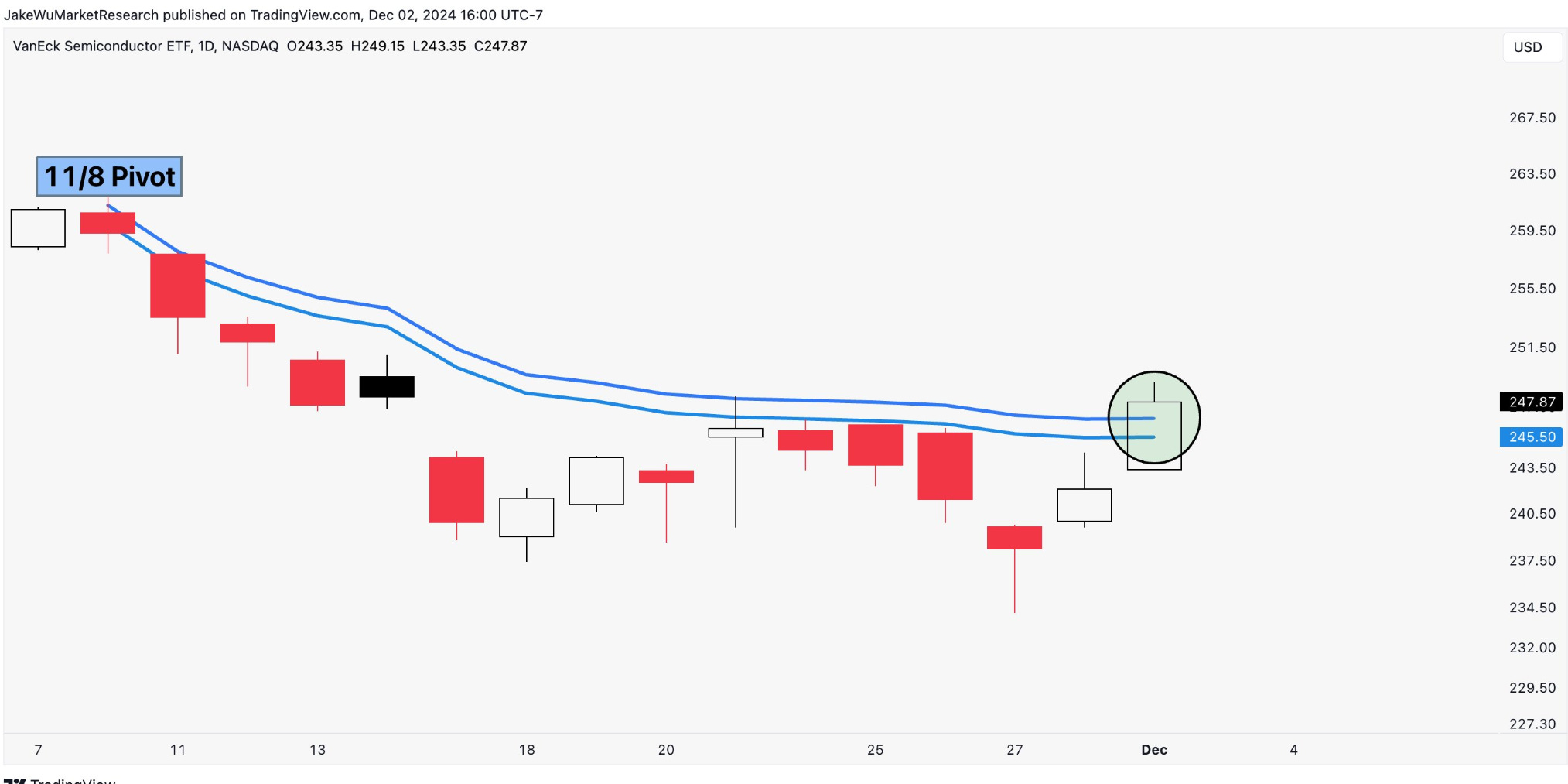

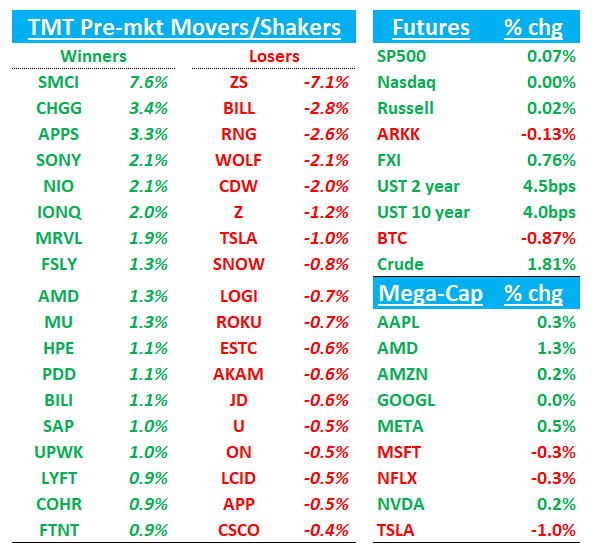

Good morning. QQQs hovering around flat. We’ve seen a reversal of Nov trends the first day of December with QQQs > IWM and Semis > SW, both of which were notable given NVDA underperformance. Tonight, we get MRVL and CRM, which could help decide trajectory of semi vs. sw performance for the rest of Dec (recall, semi seasonality better than sw and typically likes to rally into CES at the beginning of Jan). Semi charts beginning to look better (MRVL hitting 52wk highs, TSM back above prev highs) and overall the index is trying to regain some short-term footing, with VWAP now above 11/8 pivot:

A huge blowout from CRDO will help sentiment among AI networking names today.

BTC -60bps; yields flat to up; China +50bps. Relatively slow morning. We got bogeys for this week, recaps of ZS and CRDO prints, then move onto news/research. Might get a BFCM PR from AMZN later in the morning and we get AWS CEO keynote at AWS re-invent. UBS TMT conference and Wells Fargo TMT Summit start today.

Key presos today At UBS: NVDA CFO at 9:35am est.; ADSK 10:15am est; PANW CEO at 11:35am est.; DDOG CFO 10:55am est.; SHOP CFO at 3:35pm est.; FRSH CFO at 3:35pm est.; SNOW CEO at 4:55pm est; NOW CFO at 5:35pm Est.

Let’s get to it…

Bogeys for this earnings week (CRM, MRVL, CHWY, GTLB)

CRM:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.