TMTB Morning Wrap

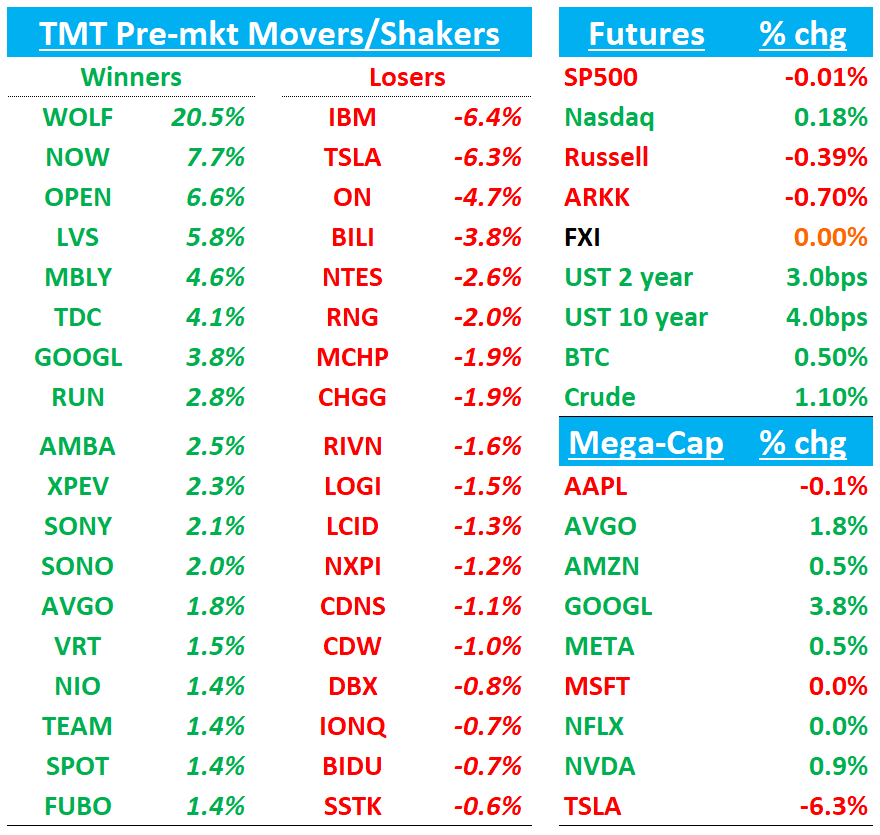

Good morning. QQQs +20bps as GOOGL + NOW were better than expected, and the TSLA call disappointed. Some big earnings moves in Tech the last couple of days: TXN -13% (2nd worst day in 25 years); TEL +12% (best day since ‘09); STM -13% this morning.

Yields are ticking up 3-5bps across the curve. BTC +50bps.

We’ll cover GOOGL NOW TSLA and other earnings first then dive into Tech/Research

GOOGL +4%: Clean Beat across the board strengthens AI narrative

Top line acceleration across all key KPIs:

Search 11.7% vs 9.8% last q and buyside expects of 10.5%+ …comps get 400bps easier over the next 3 quarters

Youtube accel to 13% from 10.3% last q and buyside expects of 12%

GCP accel to 31.6% from 28% last q and expects of 28%.

Paid click growth 4% vs 2% last q

Token growth is accel’ing, as Sundar pointed out token growth has 2x' just since May - that’s 43% per month vs 37% per month growth from Dec ‘24 to May ‘25.

Ex a $1.4B one time item, OMs were in-line at 34%

CY25 Capex goes from $75 to $85B

Really not much to say here other than what you’d expect: Expectations were high, but Google threaded the needle and put up a great quarter with mgmt sounding bullish on the call, helping continue to cement the burgeoning narrative that Google is an AI winner. With 3p data showing a further acceleration in search in July to high teens and Gemini continuing to gain share + the q3 search comp 160bps easier, we think nits around higher capex will fall by the wayside as long as the business keeps accelerating. The DOJ remedies complicates things a bit (especially for LOs), but we think it is more than not to be a clearing even.

Buyside EPS likely going up LSD this morning and hovering around $10.50-$10.75, 20x -22x = $210-$240. We think new highs are on the horizon.

Sundar with a couple good tweet threads here and here - he sounds bulled up and excited.

In terms of read-through, Capex obviously good for AI semis, particularly AVGO, CLS and NVDA

Search a good read-through for META and PINS (GOOG called out strength in retail).

NOW +7%: Solid print with Q2 cRPO above and FY subscription revs raised as strength in enterprise helped offset ongoing headwinds in U.S. Federal sector

Subscription revs were raised 50bps at the high end to 19.5% -20% cc.

Q3 cRPO guide 18% vs vs bogeys closer to 18.7%, as mgmt guided prudently bc of continued federal headwinds

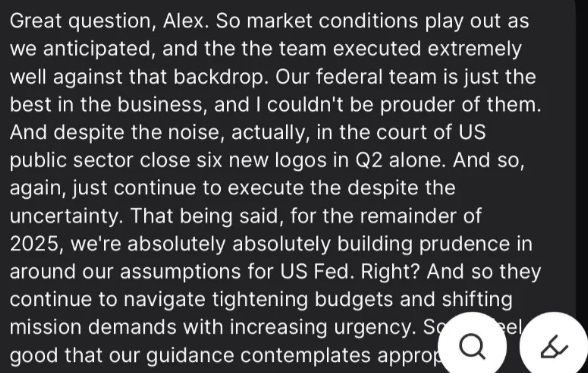

On Federal, Mgmt cited continued elongated sales cycles and tighter budge scrutiny. Key quote from the call:

AI tea leaves were positive on the call as Bill and co executed well: NOW Assist (GenAI) delivered NNACV results ahead of expectations, driven by both increased deal volumes and larger deal sizes. Notably, Pro+ deal count rose over 50% quarter-over-quarter, the company closed its largest NOW Assist deal to date at over $20M, and the new Workflow Data Fabric was included in 17 of the top 20 deals. Now Assist is driving larger deal sizes, incl. 21 deals w/ 5+ Now Assist Products and a >$20m ACV Now Assist deal in the qtr, the largest deal to date. Pro+ continues to carry a ~30% ACV uplift.

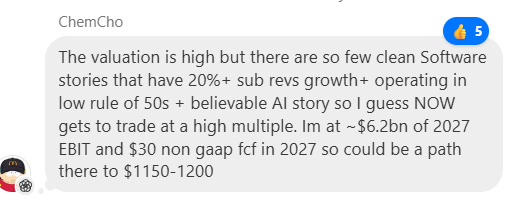

We liked this take from one of our readers:

Question is do investors believe the 19% sub revenue growth for next year is too low or too high. We don’t have a clear answer right now. Along with SAP, we think NOW is the app sw story with the best AI story, but both are facing headwinds from weaker federal. Bill and co. continue to execute very well and there’s a scarcity value here as mentioned above from being one of the cleanest app sw stories. We like it, but we don’t love it at 40x, and we continue to favor more heavily exposed infra/AI sw stocks.

TSLA -6%: Ok quarter with better GMs (15% vs 13%) but worse FCF- unlikely to settle bull/bear debate

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.