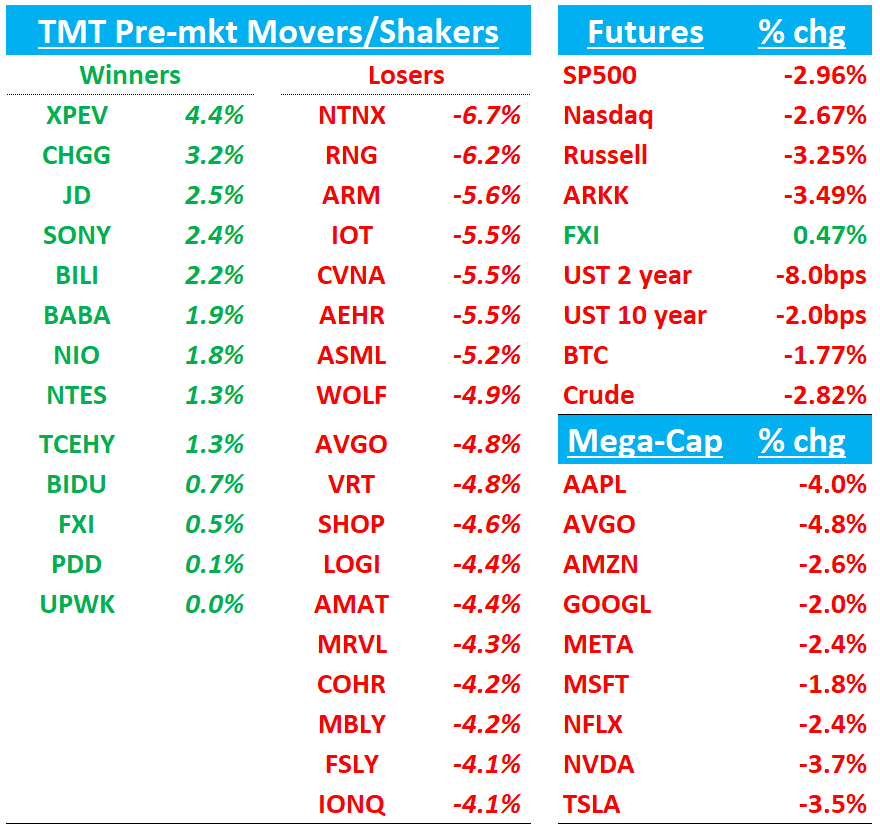

Good morning. QQQs -2.8% giving back some gains from yesterday. CPI came in slightly cooler than expected. BTC -2%. Yields dipping with 2 year dn 8bps and 10 year dn 2bps. China +50bps.

Some headlines from Hassett’s interview this morning:

WHITE HOUSE ECONOMIC ADVISER HASSETT: THERE'S A BIG INVENTORY OF DEALS THAT ARE RIGHT CLOSE TO THE FINISH LINE; CLOSE TO 20 COUNTRIES MAKING OFFERS; WE HAVE SET UP A PROCESS FOR TARIFF DEALS CAN BE ORDERLY

TWO TRADE TRADE DEALS `ALMOST CLOSED' AS OF LAST WEEK

WHITE HOUSE ECONOMIC ADVISER HASSETT: CONVERSATIONS ON CHINA HAVE NOT BEGUN YET

WHITE HOUSE ECONOMIC ADVISER HASSETT: BOND MARKET MAY HAVE CONTRIBUTED TO TARIFF DECISION BUT DID NOT CAUSE A PANIC MOVE

TRUMP NEVER HAD ANY OTHER INTENT THAN GETTING PEOPLE TO THE TABLE

Let’s get to it…

APP: MS upgrades to buy and $350 PT

According to MS, APP represents "ad tech's best executor on sale" after declining 46% since Q4 earnings despite consistently gaining market share in gaming ads and building non-gaming advertising momentum. MS believes APP is "among the most resilient names in ad covering" due to its exposure to direct response budgets and innovation-driven performance. Their analysis indicates APP can improve take rates while maintaining competitive advertiser results, with gaming revenue expected to outpace market growth while non-gaming layers continue contributing to an overall 30% -24-27 CAGR and expect new non-gaming ad products to contribute $750M as checks remain very strong.

RBLX: Opco upgrades to buy on confidence in rewarded Video ads

Opco upgrades RBLX to Buy with a $70 price target, viewing the recent 24% stock decline (versus NASDAQ's 13% drop) as "an excellent entry point for long-term investors." According to Opco's recent checks, revenue contributions from programmatic video ads are set to materialize in 2025, while Q1 user engagement remains strong. After talking with an expert on Roblox's rewarded video ads initiative, Opco reports "meaningfully more confident" that the Google Ad Manager partnership will enable RBLX to build a substantial programmatic video ad business, projecting programmatic ad revenue reaching $100M (run-rate) by 4Q25 and $200M by 4Q26 (still only 2% of revs). The analysts believe RBLX represents "one of the most exciting profitable growth stories in the interactive entertainment industry," with its business insulated from tariff concerns.

Amazon Seeks Partners for $15 Billion Warehouse Expansion Plan

Not the best look for the OI bull case…

Amazon.com Inc. is considering a $15 billion warehouse expansion plan for nearly 80 new logistics facilities in US cities and rural areas that would reverse its post-pandemic construction slowdown, according to people familiar with the matter.

The e-commerce company is asking potential capital partners to submit proposals, the people said, asking not to be identified citing private information. The properties are expected to be mostly delivery hubs, where vans and trucks are loaded for the final leg to shoppers’ homes, but some projects would also include large, multi-story fulfillment centers packed with robots, the people said.

Amazon’s request for information from financing partners predated last week’s tariff announcement from President Donald Trump that roiled global markets and spurred fears of a possible recession. It’s unclear exactly how the stricter trade policies would impact the e-commerce company’s plans.

Third Party Data Roundup:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.