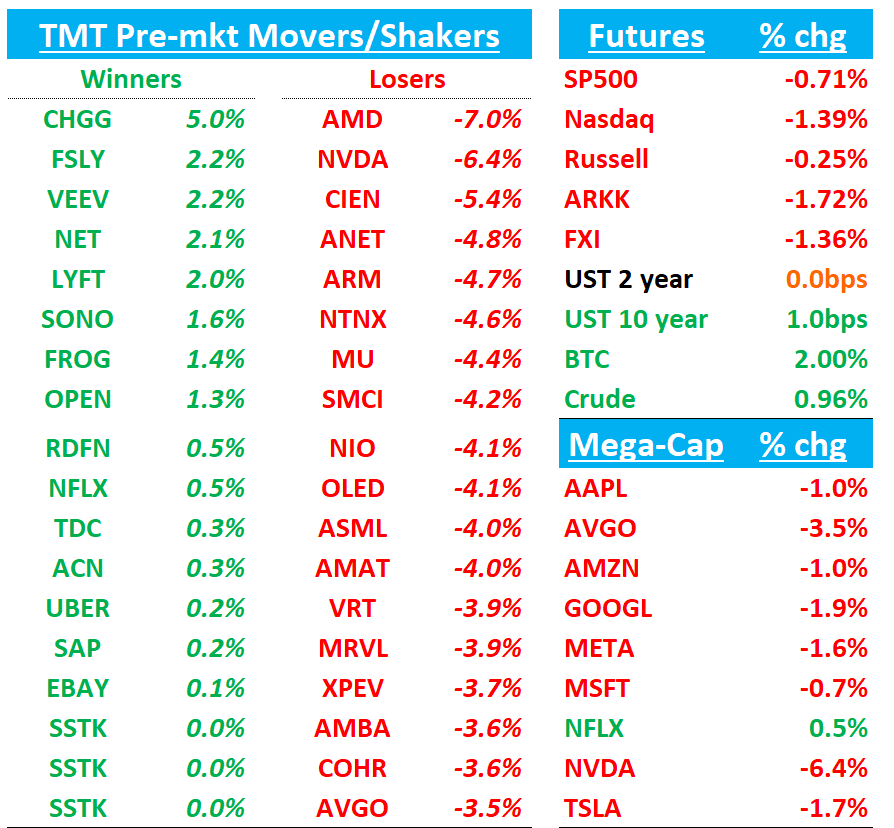

QQQs -1.4% as futures were hit following the NVDA H20 news yesterday. Semis taking the brunt of the pain this morning. Yields flattish. China -1.3%. BTC flat.

We get NAHB Housing Index at 10am, Fed Pres Hammack at 12pm and Fed Chair Powell at 1:30pm (giving speech on the economic outlook at the Economic Club of Chicago. Q&A is expected).

Let’s get right to it…

NVDA: Files 8-k saying US gov’t bans H20s resulting in $5.5B of charges to COGS

Reuters saying NVDA had secured $18 billion of H20 orders since the start of the year. Seeing estimates about $14-$15B hit to revenue based on the $5.5B of charges.

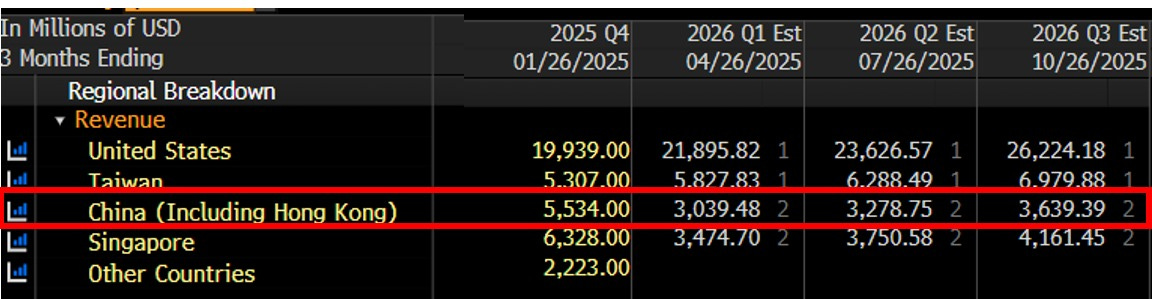

China revs also include gaming, networking and auto (Bernstein estimates 70% of China revs are H20s). While buyside didn’t have much modeled in for H20s going forward, sell-side still had call it ~$2-3B from H20s, although some like Citi’s Danley’s had already cut #s. GMs likely hit by around 12-14 ppts implying 57-59% vs street at 71%. Bernstein pegs EPS imapct at around 18-20% for Q1. Here’s where sell side was on China revenue going into yesterday…

Beyond October, estimates don’t change much on the sell side as most modeled H20s to decline.

Glass half full: this is a tailwind to gross margins, NVDA now truly has very little China risk, and doesn’t really change the story much. We tend to agree. Yes, stock weak today and takes excitement away from this upcoming q, but with numbers reset and China exposure close to 0, we’re in a similar spot to where we were yesterday.

Glass half empty: Potentially negative read-through for implementation of AI diffusion rules from Trump admin, although not sure I buy that given Trump’s new posture seems to be China vs. ROW. But who knows with them.

Impact to AMD could be worse as H20 restrictions will impact AMD’s Mi308 which could be material headwind to AI revs in Q2. Recall - we’ve heard about better China demand for AMD products this q.

A couple sell-side snippets:

Citi keeps its Nvidia artificial intelligence units and sales estimates intact as it previously de-risked sales estimates amid the expectations that all China AI GPUs will be eventually subject to restriction. However, it acknowledges the news could impact Nvidia's July quarter guide's ability to beat Street estimates comfortably, which it thinks currently bake in 10% China contribution to data center sales. Citi keeps a Buy rating on the shares with a $150 price target.

Citi says the U.S. Commerce Department issuing export licensing requirements for Nvidia's (NVDA) H20 and AMD's (AMD) MI308 chips into China will negatively impact AMD's GPU, Micron's (MU) high bandwidth memory and Broadcom's (AVGO) shipments to China. However, these are already incorporated in Citi's recently trimmed estimates, the analyst tells investors in a research note. The firm estimates at most "low-single digit risk" for AMD and points out Micron is already mostly cut off from China.

BofA interprets the charge as indicative of high probability of H20 restriction and low probability of future licenses, as well as a 20% hit to Q1 GAAP EPS, though perhaps less impactful to non-GAAP sales and EPS, the analyst tells investors. The restriction is "unwelcome but somewhat expected," and the risk is "manageable," says BofA, which reiterates a Buy rating and $160 price target on Nvidia shares, which had been lowered from $200 earlier this morning as part of a broader note on the semis sector.

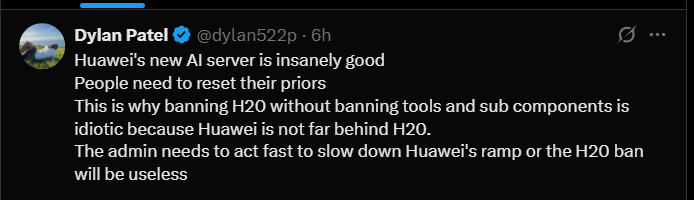

SemiAnalysis out with its analysis on Huawei’s new AI accelerator and rack scale architecture - the CloudMatrix 384 built using the Ascend 910C.

The CloudMatrix 384 Supernode was described as a “nuclear-level product” that matched Nvidia’s NVL72 system in alleviating computing bottlenecks for AI data centres.

While the Ascend chip can be fabricated in China, we note that this is a global chip that has HBM from Korea, primary wafer production from TSMC, and is fabricated by 10s of billions of wafer fabrication equipment from the US, Netherlands, and Japan.

Nvidia kept some China customers in the dark about new US chip clampdown

Reuters:

Nvidia did not warn at least some major customers in advance about new U.S. export rules it was told about a week ago requiring it to obtain licenses to sell its China-focused artificial intelligence chip, according to two sources familiar with the matter.

Major Chinese cloud companies were still anticipating H20 deliveries by year-end, unaware of the impending restrictions, according to the two sources, who said Nvidia's China sales team also did not appear to be informed ahead of the public announcement. They spoke on condition of anonymity because of the sensitivity of the matter.

The export controls threaten Nvidia's business in China, one of its largest markets. Nvidia had secured $18 billion of H20 orders since the start of the year, according to one of the two sources and a third source.

ASML -5% after Q1 net bookings missed and said tariffs were increasing uncertainty around its outlook for ‘25 and ‘26 but kept annual guide. Q2 guide 7.2B - 7.7B vs street at 7.73B

Despite weaker Q1 orders, ASML maintained its 2025 sales guidance of €30-35bn and reiterated expectations for 2026 to be a growth year. For Q2 2025, ASML guided sales of €7.2-7.7bn (4% below consensus) and gross margins of 50-53% (with wider range reflecting tariff uncertainties), implying EBIT 10% below consensus at €2.34bn. China contribution was stronger than anticipated at 27% of net system sales (up from previous 20% expectation), which helped offset weakness in non-China DUV demand.

Third Party Data Roundup:

EBAY: Yipit says GMV finished 1-2ppts above street / M-sci says UK strength drove outperformance

SNOW: Cleveland says

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.