TMTB Morning Wrap

Good morning. I sent out earnings recaps earlier here and here.

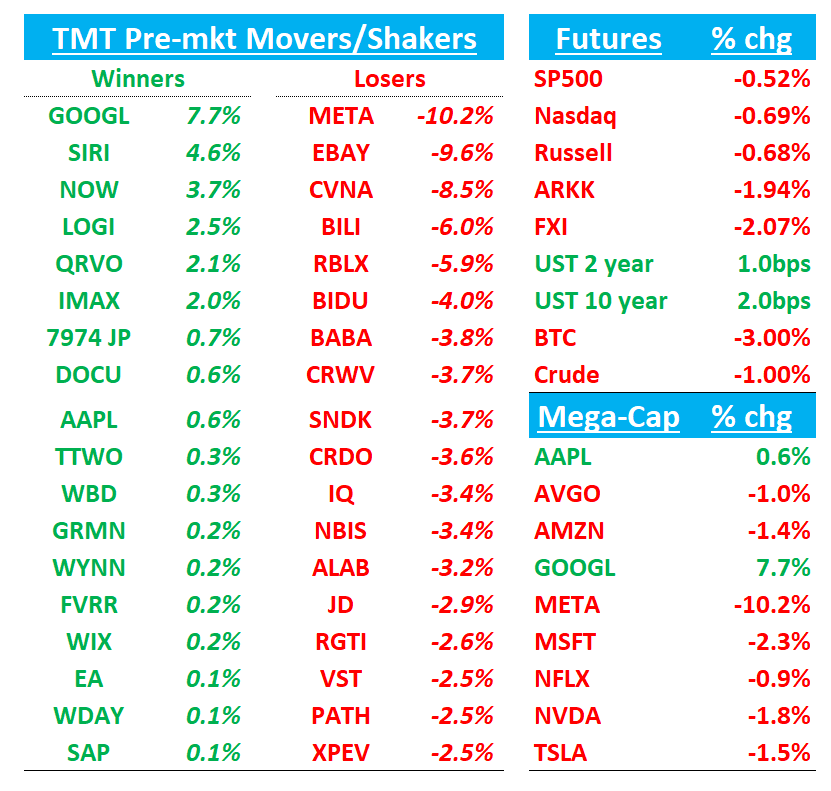

Futures lower by 65bps to start the day as we’re seeing a bit of sell the news after the Trump/Xi meeting, which seemed to go well (Trump: 12 out of 10) but no mention of NVDA Blackwell chips.

Trump and Xi Ease Tension With Truce on Tariffs, Rare Earths

No discussion on NVDA Blackwell chips. Here’s Bloomberg:

In the first sitdown between the leaders since Trump’s return to the White House, the pair agreed China would pause sweeping controls on rare-earth magnets in exchange for what Beijing said was a US agreement to roll back an expansion of restrictions on Chinese companies. The US will also halve fentanyl-related tariffs on Chinese goods, while Beijing resumes purchases of soybeans and other American agricultural products.

Despite speculation that Trump might make additional concessions — including the US opening access to Nvidia Corp.’s most advanced Blackwell line or changing its policy toward Taiwan — the president indicated that those issues hadn’t been part of the discussions. Trump and Xi did discuss access to some of the chipmaker’s other products, however, with the US president saying he planned to speak with Nvidia CEO Jensen Huang.

Capex #s going up across the board for GOOGL, META, and MSFT. Here are key quotes:

MSFT: “Total spend will increase sequentially, and we now expect the FY ‘26 growth rate to be higher than FY ‘25.”

META: “As a result, our current expectation is that capital expenditures dollar growth will be notably larger in 2026 than 2025. We also anticipate total expenses will grow at a significantly faster percentage rate in 2026 than 2025…”

Last PR: “provide meaningful upward pressure on our 2026 total expense growth rate.”

GOOGL: “We now expect capex to be in the range of $91 billion to 93 billion in 2025 up from our previous estimate of $85 billion…Looking out to 2026 we expect a significant increase in Capex and we will provide more detail on our fourth quarter earnings call.”

Stocks in Asia generally saw losses on Thursday: TPX +0.69%, NKY +0.04%, Hang Seng -0.24%, HSCEI -0.31%, SHCOMP -0.73%, Shenzhen -1.27%, Taiwan TAIEX -0.03%, Korea KOSPI +0.14%, (h/t VK). Memory names strong overnight on a better Samsung print and +ve commentary.

BTC -3%. Yields up 2-3 bps across the board.

Not a ton out on the research front this morning outside of earnings, but let’s get to it…

OpenAI lays groundwork for juggernaut IPO at up to $1 trillion valuation

OpenAI is laying the groundwork for an initial public offering that could value the company at up to $1 trillion, three people familiar with the matter said, in what could be one of the biggest IPOs of all time.

OpenAI is considering filing with securities regulators as soon as the second half of 2026, some of the people said. In preliminary discussions, the company has looked at raising $60 billion at the low end and likely more, the people said. They cautioned that talks are early and plans - including the figures and timing - could change depending on business growth and market conditions.

Meta Looks to Raise at Least $25 Billion From Its Bond Offering

Meta Platforms Inc. aims to raise at least $25 billion from a bond sale, according to people familiar with the matter, raising cash amid surging growth of artificial intelligence spending.

The firm has begun marketing a dollar-bond sale in as many as six parts, ranging from five to 40 years in length, according to one person, who also asked not to be identified as they’re not authorized to speak publicly.

Initial price talk of the 40-year note is for a premium of about 1.4 percentage points above Treasuries, the person said. Proceeds would go toward general corporate purposes.

NVDA: New Street Sees 30%+ Upside to 2026 Estimates; Raises TP to $307

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.