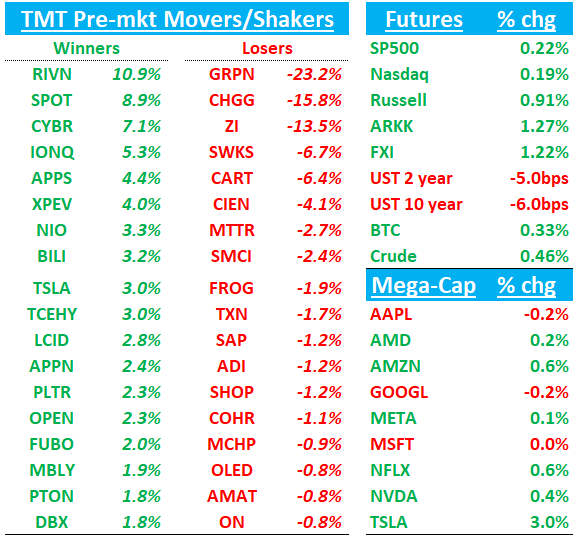

QQQs +15bps rallying a roughly inline print as yields fall 5-6bps across the curve. BTC flat, China +1%. We’ll recap SPOT + CART + CYBR earnings first then move onto News/Research, where it was a fairly slow morning although some intg items surrounding AMD. Let’s get to it…

SPOT +8%: Another solid q for what is one of the cleanest stories in internet right now. GMs beat and co guided up by 100bps, near high end of bogeys. Premium subs beat. Operating margins much better and OI guided well above street and near high end of bogeys

The bright spot was another beat on the margin side. The impact from recent price increases more than offset weakness in ad-supported revenue (hit by fx), driving gross margins to 31.1% vs street at 30.2%. Sequentially, Premium GM grew 210bp, while Ad-Supported GM declined 30bp. GMs have now increased 440bps since Q4’23. Operating margin numbers also going up ~25% for FY25. MAUs were roughly inline with Premium ARPU increased 9% y/y, helped by px increases but partially offset by geo mix shifts.

Bulls will say structural bear case around SPOT’s margins continues to take a hit as price increases combined with music/audiobook bundle structure are driving big GM jumps and that shouldn’t be an issue anymore. Bulls also believe that there is more room for price increases as SPOT’s product continues to improve with AI innovation. SPOT’s story is one of the cleanest in internet right now and bulls will say 35x 2025 FCF of $15.50+= $550+.

Not much for bears to hang their hat on after this print although they will nitpick ad revs coming in a bit light. Phillips downgrades this morning citing valuation. Bears will ask how much GM expansion is left in the model and that SPOT doesn’t have much room to raise prices right now with Apple Music at $11.99/mo and AMZN Music at $9.99/month for prime users.

CEO Daniel Ek's Commentary:

"We've reached a strong position thanks to outstanding execution. Our relentless focus on innovation and growth enables us to deliver the most valuable user experience in the industry. I'm excited about what lies ahead as we move closer to sustained profitability."

Revenue of €3.99b was mostly in line with the Street at €4.02b

Gross margins of 31.1% was above the Street at 30.2%

Operating margins of 11.4% was above Street at 9.7%

Premium subscribers of 252m vs. Street at 251m.

Q4 Guide:

Revenue of €4.1b vs. Street at €4.25

Gross margin of 31.8% vs. Street at 30.8%

Operating income of €481m vs. Street at €433m

Total premium subscribers of 260m, Street 259.5M

CART -7%: Weak Q4 EBITDA guide and slightly lower Q4 GTV guide outshines Q3 GTV beat

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.