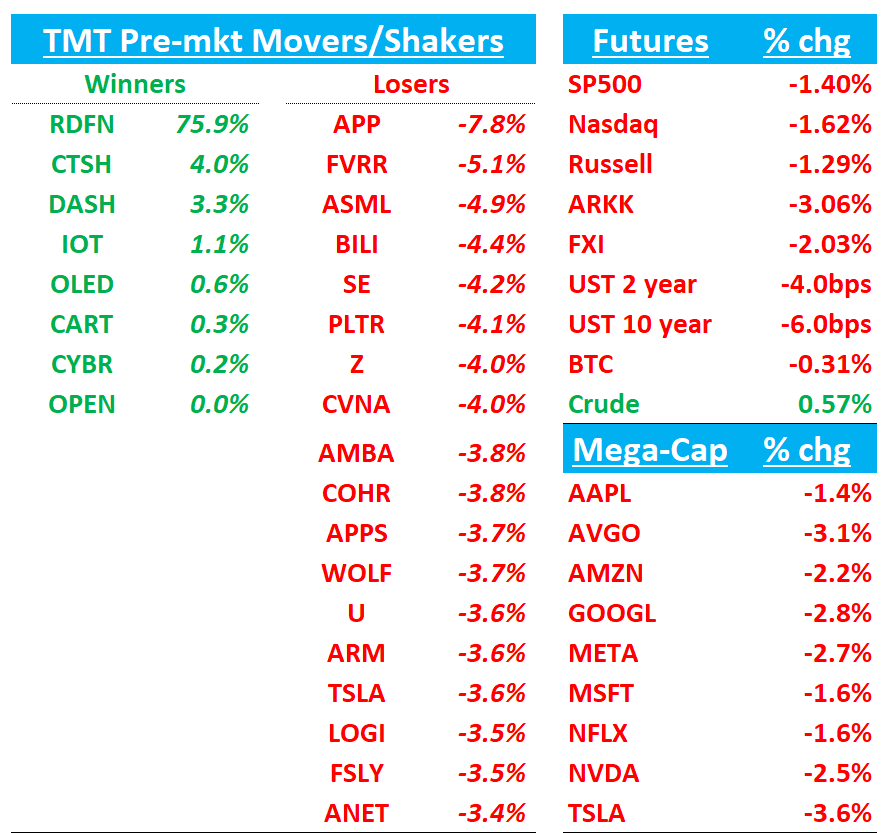

Good morning. QQQs -1.6% as yields down 4-6bps across the curve as investors continue to be worried about growth outlook. Market is now pricing in 77bps worth of cuts with a 6/18 cut at 100%. BTC flat at $82k. China -2%.

Let’s get to it…

DASH +4% + TKO +2% / APP -5%: DASH/TKO get nod for SP500 inclusion

ABNB: Airbnb upgraded to Buy from Hold at Jefferies

Jefferies analyst John Colantuoni elevated Airbnb's rating to Buy from Hold while raising the price target to $185 from $165. The firm anticipates that the company's gains in lodging market share will be enhanced by growing adoption of experiences, an opportunity that Airbnb "is uniquely positioned to capitalize on." Additionally, the analyst suggests the company's growth potential is further strengthened by take rate improvements, primarily driven by the introduction of sponsored listings. Jefferies' valuation work SOTP indicates that Airbnb's current valuation only accounts for its core lodging operations, effectively assigning no value to experiences or take rate potential.

APP: AppLovin pricing in 50% chance of being worth zero, says Citi

Citi analyst Jason Bazinet indicates that investors are currently assigning a 50% probability that AppLovin's equity holds no value. The analyst notes in a research report to investors that the stock has experienced considerable downward pressure following several negative reports, compounded by a broader momentum "reversal." While Citi acknowledges that consensus revenue projections "are ambitious," the firm remains optimistic based on AppLovin's recent announcements suggesting strong performance from its e-commerce pilot. Citi also believes modifications to the company's share repurchase strategy suggest the possibility of directing all free cash flow toward buybacks in 2025. The firm maintains a Buy rating on AppLovin with a $600 price target.

3P Roundup:

ADBE: M-sci says incremental strength in Feb driven by SMB/AI with AI assistant attach rate ticking up to high teens

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.