TMTB Morning Wrap

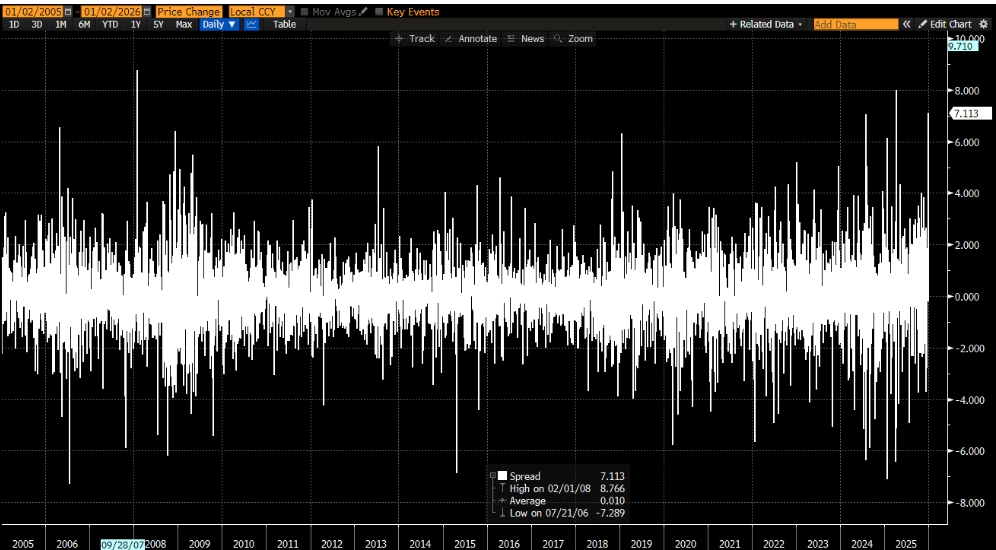

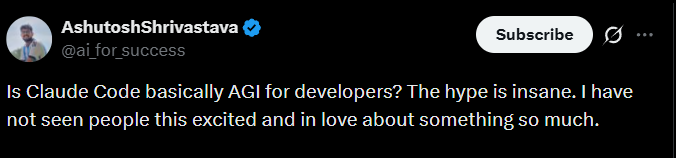

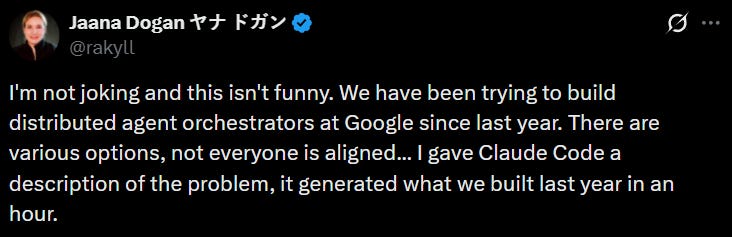

Good morning. Futures +65bps. The AI Vibes are back in full force — kicked off with the OpenAI fundraising news right before the holidays marking the lows and accelerated with a lot of continued positive news flow over the break, the most important in our view being how good Claude Code/Opus 4.5 is. Among the many major releases we’ve seen over the last three years around AI that have wow’d us, this one feels like a top-three moment in terms of real, tangible step-function improvement rather than incremental progress. We find it hard to disagree that it’s “coding AGI.” While the discussion was loud on X, given the holiday break, talking to some other investors we got the sense it went relatively under the radar. But to us, it played a not so small part in the moves on Friday with the semi vs. software spread blowing out (Friday saw one of the 3 largest daily spreads in 20+ years)

On that note, with the help of Claude code, we launched TMTB Archive yesterday in case you missed it, which helps you easily search and sort through all of TMTB’s historical posts (both Morning Wraps and EOD Wraps) by tickers and other things. Check it out and let me know what you think.

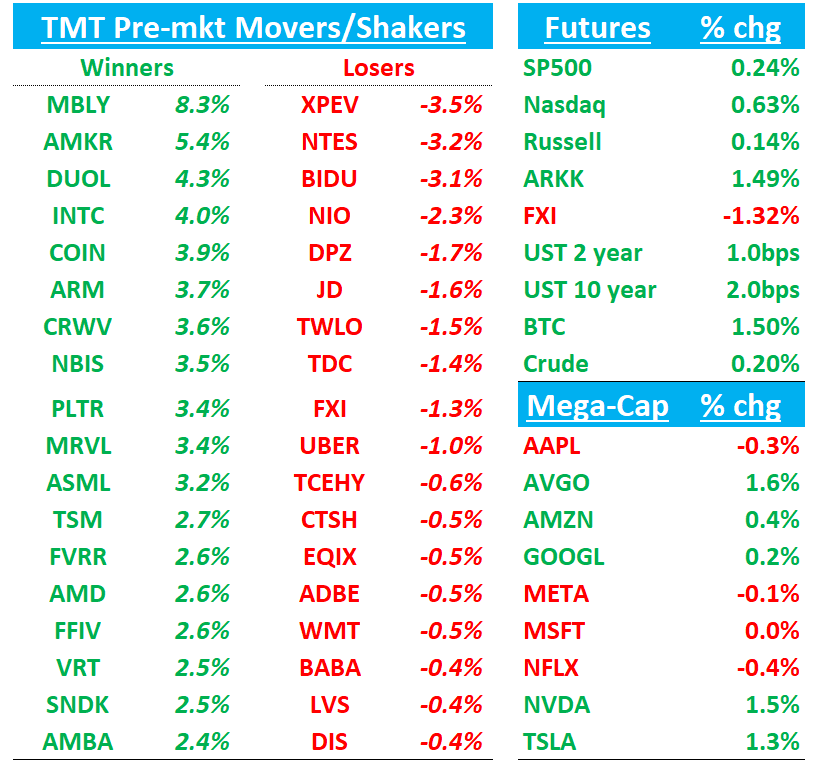

Asian markets up overnight: TPX +2.01%, NKY +2.97%, Hang Seng +0.03%, HSCEI -0.22%, SHCOMP +1.38%, Shenzhen +2%, Taiwan TAIEX +2.57%, Korea KOSPI +3.43%. HSTECH up small (Alibaba, Semis led while EVs lagged). Semi index +4%+ helped b2 Memory/AI/Semicaps. BTC +2% popping above $93k. Yields down 1-2 bps across the curve. Next Fed Cut priced for 4/29. Polymarket is showing a tight race to replace Powell, with Hassett at 41% vs. Warsh at 37%.

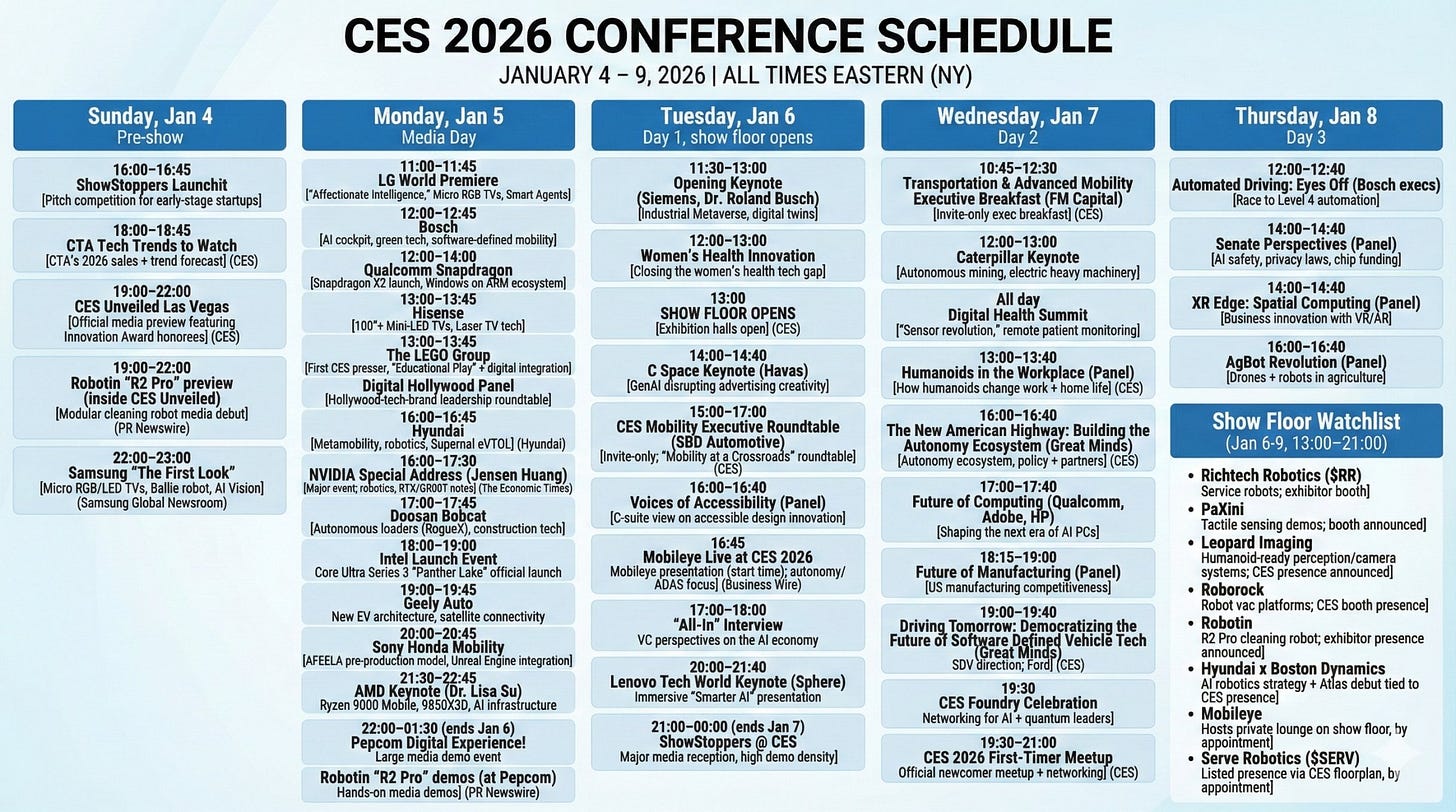

CES kicks off today with Jensen speaking at 4pm est. and Lisa Su at 9:30pm est.

Lots of companies hosting 1x1 meetings with investors, including NVDA, MU, SWKS, ON, INTC, MRVL, ADI, SLAB CRUS, QCOM

JPM fireside chat with NVDA tomorrow -link here … MRVL also fireside chat tomorrow

Jefferies software bus tour in SF also starts today. Agenda here…Good lineup

Lots to get to, so let’s get straight to it…

ASML: Bernstein Upgrades to Outperform and Names Top EU Semi Pick for 2026; PT €1,300

Bernstein upgrades ASML to Outperform and makes it its top EU semis pick for 2026, with the firm saying the next DRAM upcycle materially lifts EUV demand as memory makers expand greenfield capacity and push node migration to 1c. Bernstein notes lithography intensity rises to ~28% at 1c (vs. low-20s prior nodes), while advanced logic adds a second leg of demand as TSMC ramps 3nm capacity, driving what the analyst sees as strong EUV growth in 2026–27. The firm lifts ASML’s EPS growth outlook to an 18% CAGR over 2025–27 and argues valuation remains reasonable at ~1x premium to SPE peers, below its historical average. Bernstein raises its price target to €1,300, implying ~32% upside.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.