TMTB Morning Wrap

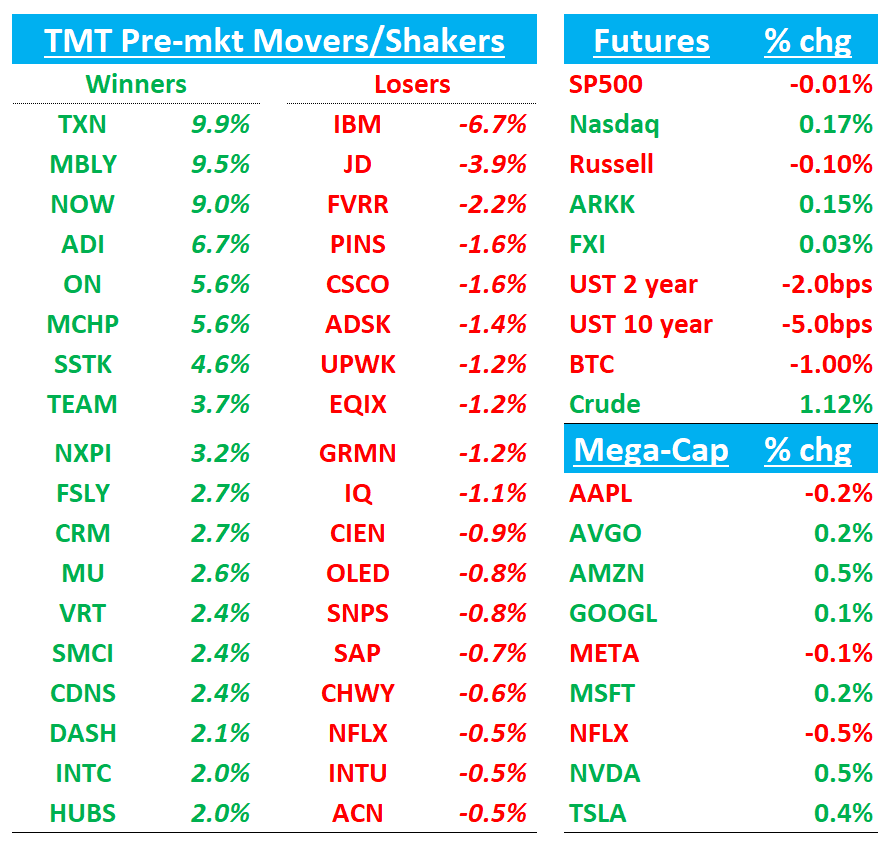

Good morning, QQQs hovering near flat. BTC -1%. Yields ticking down slightly. China flat. We get GOOGL tonight — while they don’t guide, investors are looking for any nuggets around ad spend environment.

I’m traveling today and tomorrow, so there might be no EOD wraps, but will be here early tomorrow for a Morning Wrap.

TRUMP SCHEDULED TO SPEAK BETWEEN 12-1PM TODAY:WH

Headlines post-close yesterday saying Trump will exempt carmakers from some US tariffs. Here’s FT:

The move would exempt car parts from the tariffs that Trump is imposing on imports from China to counter fentanyl production, as well from those levied on steel and aluminium — a “destacking” of the duties, according to two people with knowledge of the matter. The exemptions would leave in place a 25 per cent tariff Trump imposed on all imports of foreign-made cars. A separate 25 per cent levy on parts would also remain and is due to take effect from May 3….Complete vehicles and parts that comply with the terms of the USMCA will have the 25 per cent tariff applied only to their non-US content.

Seeing this floated around China…can’t confirm so take fwiw…would def be a good sign of de-escalation from China’s side and help analogs today….

In Tech, A decent set of good results of overnight with NOW and TXN beating although IBM didn’t look or sound that great. NOW called out a better Federal gov’t spending environment and similar to SAP said saying “demand remains strong with healthy pipelines.” However, IBM said they are seeing clients delay decision making, especially in discretionary projects although talked down magnitude of impact.

The key focus and debate among investors this morning is will there be real incremental demand for a stock like NOW? In normal times, it would be easier: beat against low expectations/sentiment, prudent guidance with room to beat, Knowledge conference in two weeks. Ok, stock should hold up well, even get bought. But the reality is we aren’t in normal times.

Bottoms-up investors always get caught off-guard in top-down regime changes. Yes, NOW was better than expected and Bill sounded good on the call, but does any of that matter when one tweet or headline could change the trajectory of the macro economic environment in a dire (or better) way?

The change in tone day to day from Trump in relation to the market feels similar to the dynamic of an abused spouse who stays in a bad marriage. The abused spouse (“market”) gets offered a bouquet of roses (“talks are going great!”) every time the market begins to show signs of stress. Then the spouses make up (“market rally”) and things are looking better, another tantrum ensues. Yesterday, "it was “we’re going to be very nice with China.” Today, its ”If we don’t make a deal with china, it’s ok.” The timelines seem to be getting more and more compressed. I don’t really buy that Trump is all that unpredictable: we’ve seen him blink twice when things get really bad (he really doesn’t want a “breakup” with the market). We know he has trouble losing (couldn’t admit defeat in 2020). So it seems like this cycle is going to repeat over and over again until the abused spouse (market) finally realizes her significant other (Trump) is full of shit and storms off. As investors, we don’t want the market held hostage any longer — the break up is always painful, but then life goes on…It’s my hope that we get a continued de-escalation as we’ve seen with some news flow this week, but my “hope” runs into reality. “Hoping” for the best, but let’s see how Trump sounds at noon today…

The price action among companies beating results yesterday wasn’t great: despite a good set of results many stocks sold off from the open: GEV -6% from open to close, APH -7%; SAP -1%; MANH -6%; VRT -10%. What this price action is telling me is that investors aren’t willing to chase and are v quick to take profits in this environment. Maybe NOW does rally today, but with the above datapoint, it’s really a tough sell, at least for me. One of our rules right now is “don’t be greedy” and I think other investors are feeling the same way.

Side note on NOW: yes results were good, but one thing I haven’t seen get a lot of play among the sell-side this morning is that cRPO accel’d 2.5ppts on a 3.5ppts easier comp. The comp gets 1.5 and then 4 ppts tougher over the next two quarters, which makes it a tough set up heading into an environment where macro headwinds will likely only increase. Does investors want to own NOW over 3-6 months at 30x+ FCF in that environment with cRPO growth likely decel’ing into the teens?

We’ll start with Macro then Earnings then Research (quiet day on that front today)…

MACRO

China Says US Should Revoke Unilateral Tariffs, Denies Talks

China demanded that the US revoke all unilateral tariffs and denied there were talks on reaching a trade deal, maintaining a defiant stance despite President Donald Trump’s recent easing of criticism of the country.

“The US should respond to rational voices in the international community and within its own borders and thoroughly remove all unilateral tariffs imposed on China, if it really wants to solve the problem,” Commerce Ministry spokesman He Yadong said at a regular briefing on Thursday in Beijing.

He also dismissed speculation that progress has been made in bilateral communications, saying “any reports on development in talks are groundless,” and urging the US to “show sincerity” if it wants to make a deal.

The remarks suggest that President Donald Trump’s comments this week signaling that he could lower tariffs on China — which currently stand at 145% for most goods — will not be enough to de-escalate tensions.

EARNINGS:

We had summaries of NOW IBM TXN Earnings calls here last night.

NOW +9%: better with cRPO +22% vs bogeys 21% and street at 20.5%. Q2 cRPO guided to 19.5% better than bogeys of 19% and street at 20%. FY sub rev cc taken down slightly to 19.5% from 19.5% -20%. FY FCF and OM reiterated.

Key quotes:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.