TMTB Morning Wrap

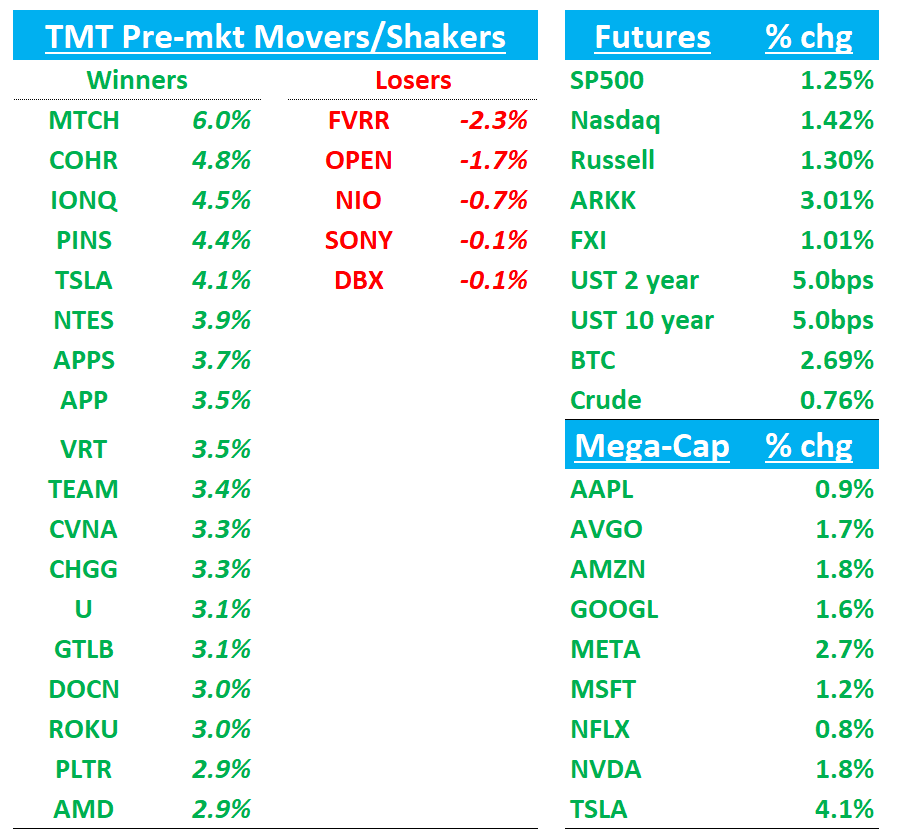

QQQs +1.6% rallying early on tariff optimism over the weekend as press reporting Apr 2 announcement will be more “target” than feared. We covered our thoughts on the news and Tariffs yesterday in our weekly. China +1%; BTC +3%; yields ticking up 4-5bps across the curve.

Let’s get to it…

SMCI: GS downgrades to Sell, PT to $32 from $40 on AI server competition, margin pressures

Analyst Michael Ng identifies three primary risks: 1) Increasing competition in AI servers due to reduced product differentiation following competitors' R&D investments, threatening SMCI's early market leadership; 2) Expected gross margin declines in F2025-27 driven by competition, Blackwell product transition, and pressure from major customers and suppliers, compounded by SMCI's high concentration; 3) Anticipated convergence of SMCI's valuation premium (12x NTM+1 P/E) with server OEM peers (e.g., DELL at 9x) due to diminishing product differentiation and concentration risks. Despite SMCI being the best-performing stock in Goldman's Hardware coverage (up 38% year-to-date), the firm views the risk-reward as unfavorable with shares trading at 16x F2025E P/E.

PINS: Guggenheim sees attractive entry point after pullback, upgrades Pinterest to Buy

Guggenheim upgrades Pinterest (PINS) to Buy from Neutral with a raised price target of $40 (from $39). The firm views the recent share price pullback as an attractive entry point for Pinterest's early-stage global growth opportunity. Their data indicates healthy user growth in Q1, with management confirming record-high engagement per user. Guggenheim expects above-market monetization growth during 2025-27, driven by volume growth and AI-enabled advertising improvements. With over two-thirds of revenue from performance-based advertisers, the firm believes Pinterest is better positioned than brand-focused competitors amid macro concerns. Gen-Z now represents 40% of platform usage, advertising formats are showing 90%+ growth in clicks, and partnerships with Amazon and Google are strengthening auction density.

Jack Ma-Backed Ant Touts AI Breakthrough Using Chinese Chips

Jack Ma-backed Ant Group Co. used Chinese-made semiconductors to develop techniques for training AI models that would cut costs by 20%, according to people familiar with the matter.

Ant used domestic chips, including from affiliate Alibaba Group Holding Ltd. and Huawei Technologies Co., to train models using the so-called Mixture of Experts machine learning approach, the people said. It got results similar to those from Nvidia Corp. chips like the H800, they said, asking not to be named as the information isn’t public.

Hangzhou-based Ant is still using Nvidia for AI development but is now relying mostly on alternatives including from AMD and Chinese chips for its latest models, one of the people said.

Third-Party Data roundup:

PINS: Yipti saying MAUs tracking inline to slightly below street

AMD: Cleveland out positive saying

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.