TMTB Morning Wrap

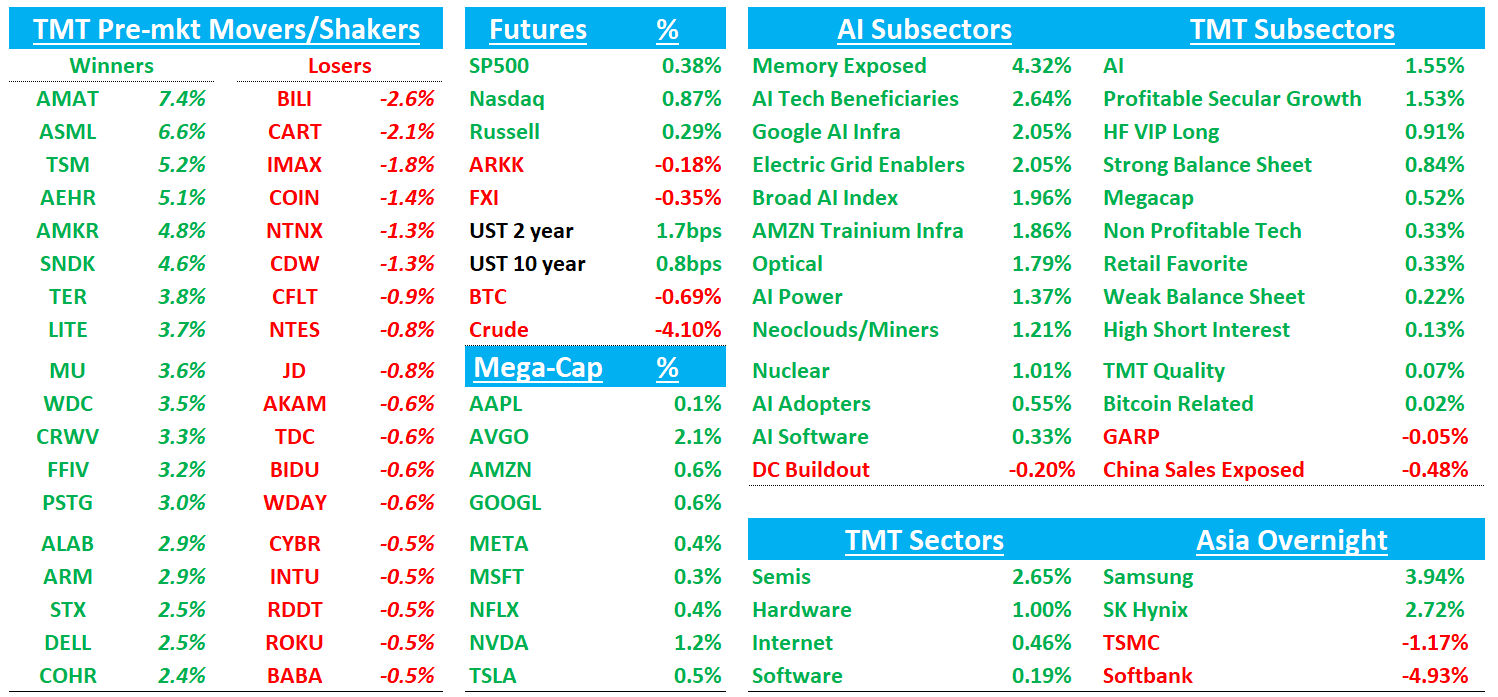

Good morning. Futures+90bps and the whole AI complex bid as TSM absolutely crushed EPS. Asia saw mixed price action on Thursday: TPX +0.68%, NKY -0.42%, Hang Seng -0.28%, HSCEI -0.52%, SHCOMP -0.33%, Shenzhen -0.13%, Taiwan TAIEX -0.42%, Korea KOSPI +1.58%.

Let’s get straight to the good stuff…

TSM +7%: Blowout quarter across the board, beating both consensus and buy-side bogeys. Huge numbers from what is typically a very conservative company.

Key takeaways:

FY26 capex of $52–$56B, well above bogeys in the high-$40Bs to $50B range (and even above many bulls’ $50B+). They also said the next three years’ capex should be “significantly higher” than the $101B spent across FY23–FY25, reinforcing the view that FY27 could trend toward “high-$50Bs” capex

GMs much better: 4Q gross margin came in at 62.3% versus street at 60.0% and ahead of buy-side 61–62%.1Q GPM guide of 63–65% was miles above street at 60.0% and buyside close to 60-61%

1Q revenue guide of $34.6–$35.8B (up 3–6% q/q) crushed expectations for roughly flat

For FY26, management lifted the outlook to ~30% y/y USD revenue growth, versus the market bracing for a mid-20s guide

On the call, management framed the margin strength as driven by cost improvements, AI-driven productivity gains, and higher utilization, and emphasized they’re planning capacity expansion deliberately based on direct discussions with customers (and even customers’ customers), signaling high confidence in multi-year demand visibility. They implied end customers started working on power constraints years ago, and today the bottleneck is increasingly silicon supply, which supports sustained tightness and elevated capex

They also upgraded their AI outlook: AI accelerator revenue growth is now expected to run at a mid-to-high-50% CAGR over 2024–2029 (up from mid-40s), and they raised the company’s long-term revenue growth target to ~25% USD CAGR over the same five-year period (from 15–20%), with AI accelerators the largest incremental driver even as all four platforms contribute.

Longer term, they reiterated confidence that 56%+ structural gross margins are achievable and that the business can deliver high-20s ROE through the cycle

In terms of read-throughs, whole AI complex bid today. with the knee-jerk beneficiary is semicap: LRCX/AMAT/KLAC etc all up sharply higher pre-market, even after last week’s big rally.

AI Demand quotes:

““Revenue from AI accelerator accounted for high teens percent of our total revenue in 2025. Looking ahead, we observe increasing AI model adoption across consumer, enterprise, and sovereign AI segments. This is driving need for more and more computation, which supports the robust demand for leading-edge silicon. Our customers continue to provide us with their positive outlook. In addition, our customers' customers, who are many in the cloud service providers, also providing strong signals and reaching out directly to request the capacity to support their business.”

“As process technology complexity increases, the engagement time with customers is now at least two to three years in advance. Internally, as we have said before, TSMC employs a disciplined capacity planning system to assess the market demand from both top-down and bottom-up approaches.”

“You essentially try to ask us whether the AI demand is real or not. I'm also very nervous about it, you bet. Because we have to invest about $52 billion to $56 billion for the CapEx, right? If we didn't do it carefully, and that would be a big disaster to TSMC, for sure. So, of course, I spent a lot of time in the last three, four months talking to my customer and then customers' customer.”

“I talked to those cloud service providers, all of them. Their answer is -- I'm quite satisfied with the answer. Actually, they show me the evidence that the AI really helped their business. So they grow their business successfully and heresy in their financial return. So, I also double check their financial status. They are very rich.”

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.