TMTB: Morning Wrap

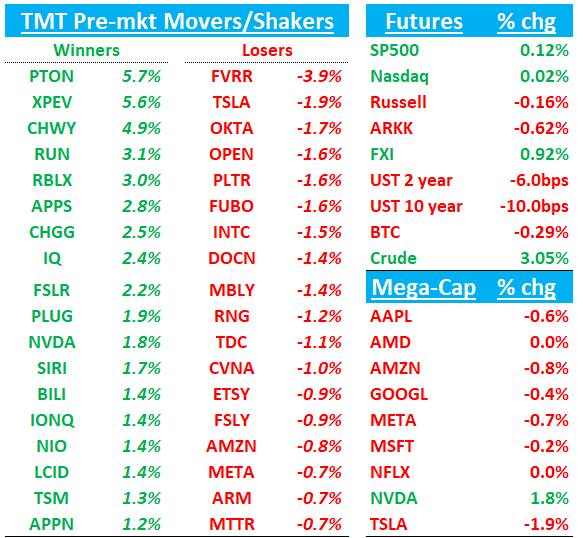

Good morning. QQQs hovering around flat this morning. The big news over the weekend was the final Des Moines Register/Selzer poll of Iowa which showed Harris up 3 points when all other pollsters have Trump up significantly. Nate Silver now has election 50/50 as do most betting markets. Treasuries bid with this shift towards Harris —- yields down 5-10bps across the curve. Dollar is also sliding 50bps. China +1%; BTC -30bps. Crude is +3% due to geopolitical tensions and the OPEC+ production hike delay.

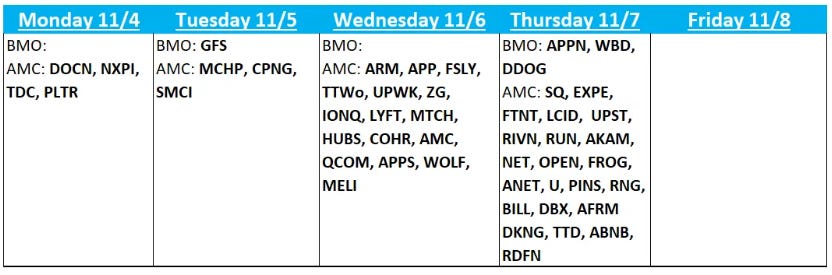

Got another week of earnings coming up, with majority of the group reporting Wed/Thurs…

Let’s get to it…

NVDA +2.4%: Will replace INTC in DJI (out post-close Friday)

BAML projects 12.6M shares of NVDA to BUY (~5% ADV), 13.4M of INTC to SELL (~25% ADV)

NVDA/DELL/SMCI: Nvidia steps in to restructure Supermicro orders, reshaping AI supply chain - Digitimes

According to a report from Digitimes, NVIDIA is redirecting orders from Supermicro to other providers due to Supermicro’s ongoing financial reporting issues, which risk a delisting if unresolved by Nov. 20.

Despite strong AI server performance, Supermicro’s credibility has been impacted by past non-compliance and potential penalties. NVIDIA’s actions aim to reduce potential disruptions in the AI server supply chain.

MU/Hynix/NVDA: Hynix +6% overnight on news NVDA pulling forward HBM 4 orders

NVIDIA CEO Jensen Huang Reportedly Asked SK hynix to Expedite HBM4 Supply by 6 Months

While introducing the industry’s first 48GB 16-high HBM3E at SK AI Summit in Seoul today, South Korean memory giant SK hynix has reportedly seen strong demand for its next-gen HBM. According to reports by Reuters and South Korean media outlet ZDNet, NVIDIA CEO Jensen Huang requested SK hynix to accelerate the supply of HBM4 by six months.

The information was disclosed by SK Group Chairman Chey Tae-won earlier today at the SK AI Summit, according to the reports. In October, the company said that it planned to deliver the chips to customers in the second half of 2025, according to the reports.

AMZN/Power: US regulators reject amended interconnect agreement for Amazon data center

News is hitting power names early today: TLN -13%; PEG - 4%; CEG - 9%; VST -5%

U.S. energy regulators rejected an amended interconnection agreement for an Amazon data center connected directly to a nuclear power plant in Pennsylvania, a filing showed on Friday.

Members of the Federal Energy Regulatory Commission said the agreement to increase the capacity of the data center located on the site of Talen Energy's Susquehanna nuclear generating facility could raise power bills for the public and affect the grid's reliability.

RBLX: MS upgrades to Buy with $65 PT ($100 Bull case)

MS is increasingly bullish on RBLX’s ability to capture market share while expanding its audience reach and platform diversity. 41% of Daily Active Users are now over 17 years old, and the platform is showing strong performance on PlayStation. The firm believes these indicators point to a larger story: Roblox's market opportunity is expanding rather than maturing. The console gaming push alone could increase Total Addressable Market by approximately $45 billion (30%), while success across mobile and PC platforms suggests the UGC model has sustainable momentum.

While advertising and e-commerce revenue streams remain minor contributors in MS's base case, they represent significant potential upside in a bull case ($100 PT). Looking ahead, MS estimates exceed consensus by 7% and 11% for '25/'26 bookings respectively, with even more upside to EBITDA projections due to anticipated scale benefits.

TMTB: We agree and wrote up warming up to RBLX yesterday in our weekly:

We are warming up to narrative here, enough to have a starter long position. Our issue with RBLX has generally been that it’s a trading stock that has lacked a good narrative. But we think that is beginning to change with advertising ramping up in ‘25, better search and discovery, optimizing monetization, onboarding more games with a cut to developer fees, better app performance, and live events. Engagement/DAU data also the best its been in a long time. We also think the RBLX platform is primed to benefit from AI tools making it easier for developers to create games (eg Tweet)

CRM: ISI dives into Agentforce opportunity and raises PT to $400, 26x FCF

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.