TMTB Morning Wrap

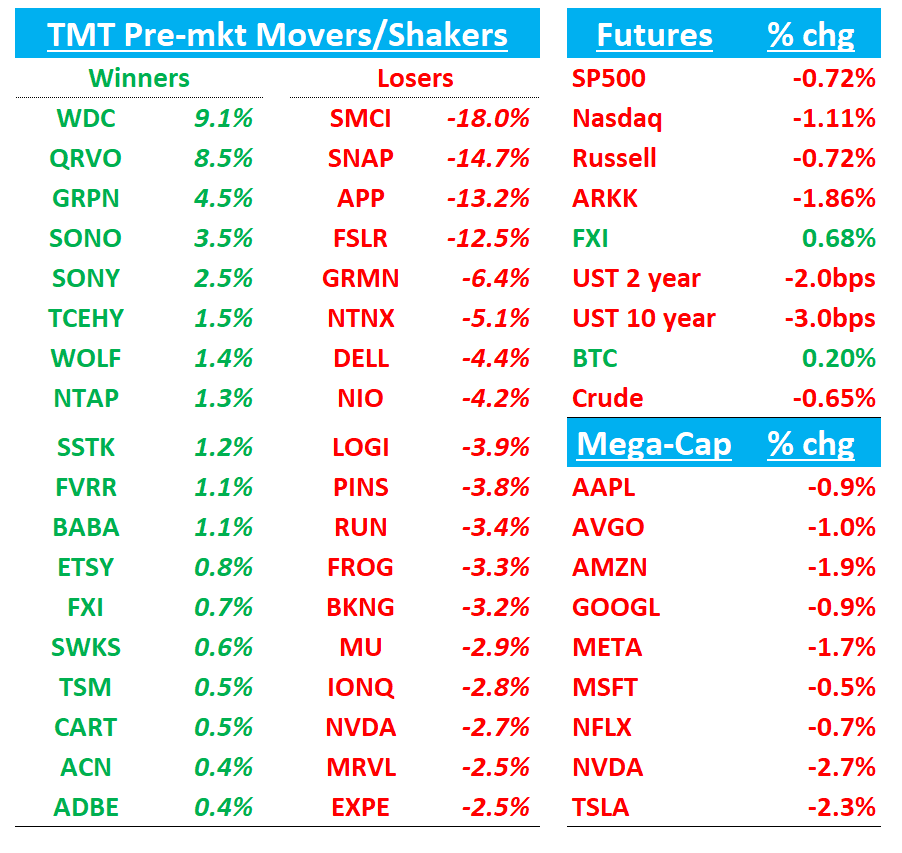

Good morning. QQQs -1%, yields ticking lower (10yr sneakily now below 4.2% again…), China +70bps, BTC flat.

We’ll start with NVDA, move onto some earnings (SNAP -14% pulls Q2 guide, BKNG -3% lower guide; QRVO +8% beat and raise; ETSY ok; FRSH +10% beat and raise).

APP -13% getting hit on a neg piece by Edgewater (below) + some turbulence from SNAP print…

Wrote up some earnings call summaries for BKNG SNAP SPOT PYPL here last night in case you missed it.

Let’s get to it…

NVDA

Several news items as they relate to NVDA: SMCI neg pre, then AI diffusion rule chg (out pre-close yesterday), Huawei article in FT, and Seaport initiation at sell…

SMCI -15% neg pre’d saying some customer platform decisions were delayed, shifting sales to Q4.

The company now forecasts net sales of $4.5B–$4.6B, below the Street’s $5.4B estimate and prior guidance of $5.0B–$6.0B. Non-GAAP EPS is expected at $0.29–$0.31, down from the Street’s $0.55 and previous guidance of $0.46–$0.62. Management pointed to a 220bps sequential gross margin decline (vs. Street at 12.0%) driven by higher inventory reserves and expedited shipping costs.

In terms of read for NVDA:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.