TMTB Morning Wrap

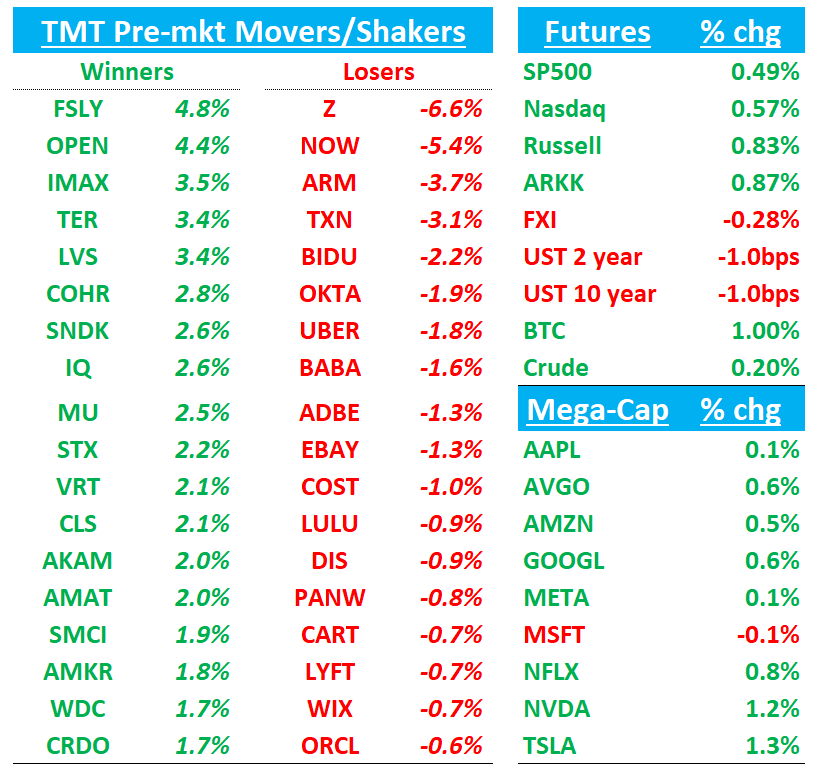

Good morning. Futures +56bps to start the week. BTC +1% hovering around 90k. Yields down 1-2bps across the curve. Asian stocks mainly down overnight playing catchup to U.S. mkt on Friday: TPX +0.22%, NKY -1.31%, Hang Seng -1.34%, HSCEI -1.78%, SHCOMP -0.55%, Shenzhen -0.77%, Taiwan TAIEX -1.17%, Korea KOSPI -1.84%.

Lots to get to, so let’s get to it…

NVDA: Nvidia considers increasing H200 chip output due to robust China demand, sources say

Nvidia has told Chinese clients it is evaluating adding production capacity for its powerful H200 AI chips after orders exceeded its current output level, according to two sources briefed on the matter.

The move comes after U.S. President Donald Trump said on Tuesday the U.S. government would allow Nvidia to export H200 processors, its second-fastest AI chips, to China and collect a 25% fee on such sales.

NOW: ServiceNow Nears Up to $7 Billion Deal for Armis

ServiceNow Inc. is in advanced talks to buy the cybersecurity startup Armis in a deal that may be valued at as much as $7 billion and would represent the tech company’s largest acquisition to date.

A deal may be announced in the coming days, according to people familiar with the situation, asking not to be identified because the talks are private. While discussions are advanced, they may still fall apart or another potential bidder may emerge, the people said.

Bears louder this morning in the bull vs. bear debate. Bulls see a clean “secure-the-workflow” adjacency: Armis’ real-time cyber exposure / asset visibility across IT + OT + IoT can feed richer context into ServiceNow SecOps + risk workflows, improving prioritization and speeding remediation. With Armis citing >$300M ARR (up from $200M in under 12 months), NOW’s enterprise distribution could accelerate Armis growth while creating meaningful cross-sell/up-sell and expanding NOW’s security TAM.

Bears focus on price/execution: a ~$7B takeout is roughly a ~15% premium to Armis’ $6.1B pre-IPO round and implies ~23x ARR on ~$300M+ ARR—tough to underwrite without flawless integration and sustained hyper-growth. It also pulls NOW further into a crowded cyber market (and signals “core is maturing / we need new adjacencies”), while layering another major integration effort on top of the $2.85B Moveworks deal that was expected to close in 2H25

NOW: KeyBanc Downgrades to Underweight, Sets $775 PT on Seat Risk and AI Competition

KeyBanc says it is downgrading ServiceNow to Underweight with a $775 price target, pointing to softening IT back-office employment trends that raise the risk of seat-based pressure and a growing “at-risk-from-AI” narrative. The firm notes that while ServiceNow’s hybrid monetization structure may help offset some headwinds, similar frameworks have not shielded other SaaS names in past cycles. KeyBanc adds that ServiceNow’s perceived lead in AI orchestration could erode into 2026 as Microsoft’s competitive footprint expands. While government spending concerns appear less acute and broader enterprise demand is improving, the firm argues valuation remains premium and risk-reward has turned less favorable.

TSLA: Robotaxis seen without monitor in Austin - link

TER: GS Dbl Upgrades to Buy, Raises PT to $230 on AI Test Upside

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.