TMTB Morning Wrap

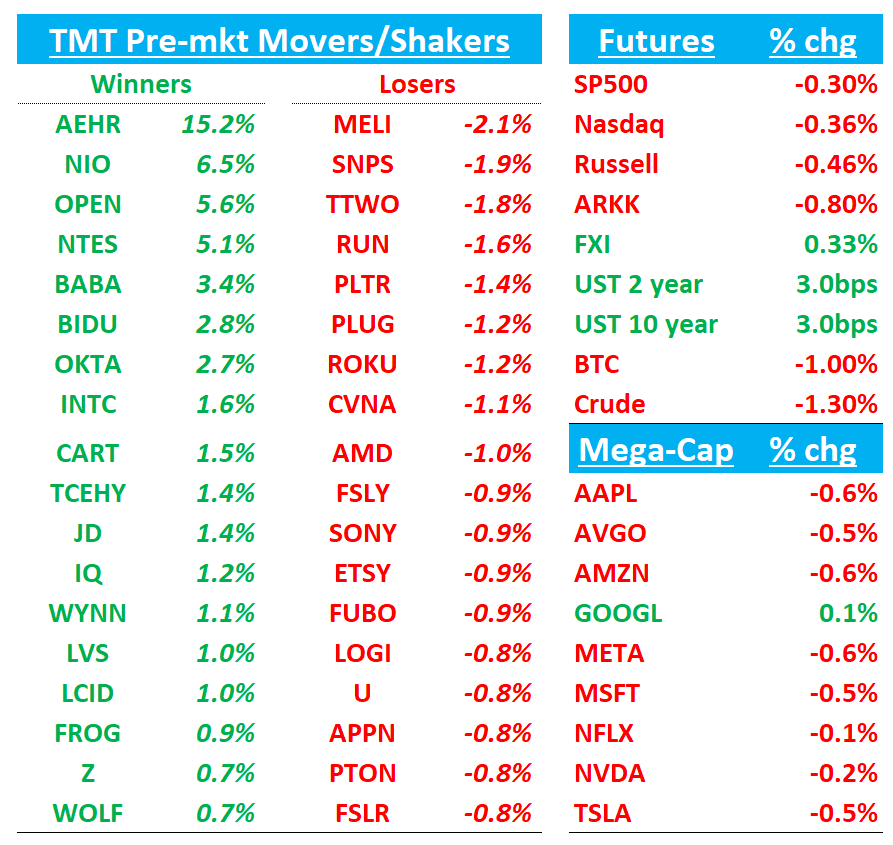

Good morning. Futures -40bps early giving back some gains from Friday. Busy week despite it being the last week of August. The main event is NVDA on Wednesday evening, but we also have MDB and OKTA on Tuesday, NTNX HPQ SNOW VEEV CRWD NTAP on Wednesday, DELL + MRVL on Thursday and BABA on Friday .

BTC -1%; China +33bps; Yields ticking up 3bps across the curve.

Let’s get straight to it…

PDD +1%: 2Q Revs inline as Net Income and EPS beat but stock sells off on call.

PDD Holdings posted 2Q revenue of 103.98B yuan, essentially in line with the 103.93B yuan consensus. Transaction services revenue came in softer at 48.28B yuan versus expectations of 48.91B yuan, while online marketing and other revenue reached 55.7B yuan, slightly ahead of street at 54.94B yuan . Adjusted net income was beat at 32.71B yuan compared with the 22.39B yuan forecast.

A couple comments on the call took stock down from +11% to flat”

“This quarter’s trends may not represent future trends”

“In view, after decades of development, the low local small merchandise market is facing intense commoditized competition. With many merchants and factories operating with same profit margins and low barriers to entry

NVDA: Jensen was in Taiwan over the weekend - video

Blackwell Ultra has now entered full-scale production with output ramping up successfully

Rubin is very advanced and we have now taped out six brand new chips to TSM

NVDA: Nvidia’s Roller Coaster for China AI Chips Takes a New Turn

WSJ:

Nvidia is halting production of an artificial-intelligence chip it developed for China after the government in Beijing told companies not to buy it, the latest twist in the U.S.-China tech war centered on the $4 trillion chip designer.

Nvidia in recent days has told some partners to stop work related to making its H20 product, which was approved by the Trump administration for sale in China in exchange for 15% of the sales going to the U.S. government, people familiar with the matter said. The pause came after Chinese officials raised concerns about potential security risks in the chips.

The company and its Chinese customers are now hoping for approval to sell a more advanced AI chip, the people said. Trump recently said he would approve a chip based on Nvidia’s Blackwell architecture that was 30% to 50% worse than the company’s top product.

FN: JPMorgan Upgrades to Overweight, PT Raised to $345 — Pullback Creates Entry Point

JPMorgan upgraded Fabrinet to Overweight from Neutral and raised its PT to $345 (from $318), saying the recent post-earnings pullback offers an attractive setup. The firm attributes the decline to disappointment around the pace of Datacom ramps and near-term supply constraints, but stresses this does not alter Fabrinet’s positioning with Nvidia in 1.6T transceivers or its broader TAM exposure. JPMorgan highlights several large program ramps on deck: (1) Nvidia’s 1.6T transceiver market could be a $1.5B opportunity in CY26, potentially doubling thereafter; (2) Ciena’s modem business, expected to surpass Infinera’s ~$330M FY23 revenue at scale; and (3) Amazon, where the HPC market represents $1.5B of potential, alongside a $2B+ transceiver opportunity in the back half of this fiscal year.

INTC: US Takes Nearly 10% Intel Stake, Clinching Unorthodox Deal

President Donald Trump sealed a deal that gives the US government a nearly 10% stake in Intel Corp., part of an unconventional bid to reinvigorate the beleaguered company and boost domestic chip manufacturing.

Under the agreement, the US will receive 433.3 million shares of common stock — representing 9.9% of the fully diluted common shares in Intel — according to a statement from the company. The $8.9 billion investment will be funded by grants from the US Chips and Science Act and Secure Enclave program that had previously been extended but not yet paid, Intel said, confirming a report by Bloomberg News . The government will be a passive owner, with no board seat or other governance or information rights, Intel said

W/RH: Trump says furniture tariffs are coming later this year

CNBC:

The Trump administration has launched an investigation into imported furniture, President Donald Trump said Friday, setting the stage for new tariffs on a wide range of products.

“Within the next 50 days, that Investigation will be completed, and Furniture coming from other Countries into the United States will be Tariffed at a Rate yet to be determined,” Trump wrote on his Truth Social platform. “This will bring the Furniture Business back to North Carolina, South Carolina, Michigan, and States all across the Union.”

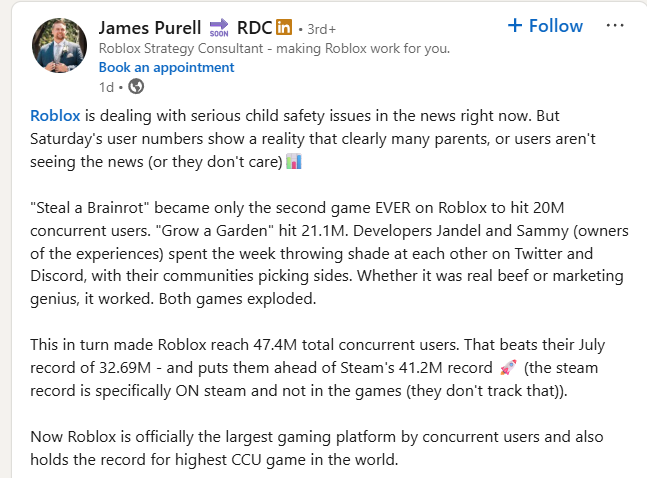

RBLX: Record CCUs over the weekend

OKTA: Truist Upgrades to Buy, PT Raised to $125 Ahead of Q2 Print

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.