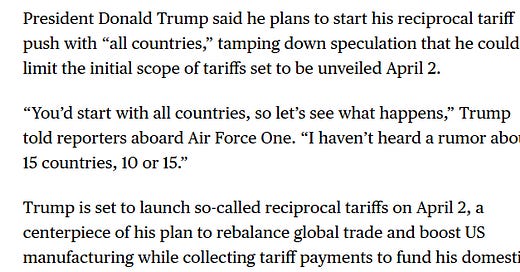

QQQs - 1.4% as the Trump Tariff news flow turned negative over the weekend with a Trump wanting to stay in White House again Wapo has an article saying Trump is pushing aides to go bigger on tariffs as key deadline nears as it looks like Trump’s tariff campaign is going to be more dramatic than most thought while uncertainty and chaos continues to dominate around how exactly the roll out will look. Trump said he didn’t know where the 10-15 country rumors started and that tariffs would start with all countries:

Peter Navarro over the weekend talked about how Trump’s tariff campaign will raise ~$6T over 10 years which suggests something close to a 15-20% levy (GS raised their forecast from 5% to 15% over the weekend). To make matters worse media reports suggest Republicans are considering various tax increases to make their reconciliation math work (including raising the top individual tax rate and eliminating the corporate SALT deduction). So tax hikes on tax hikes. To top it all off, Trump sounded serious about exploring a third term, telling NBC there are “methods” to do it, even though the Constitution clearly prohibits it.

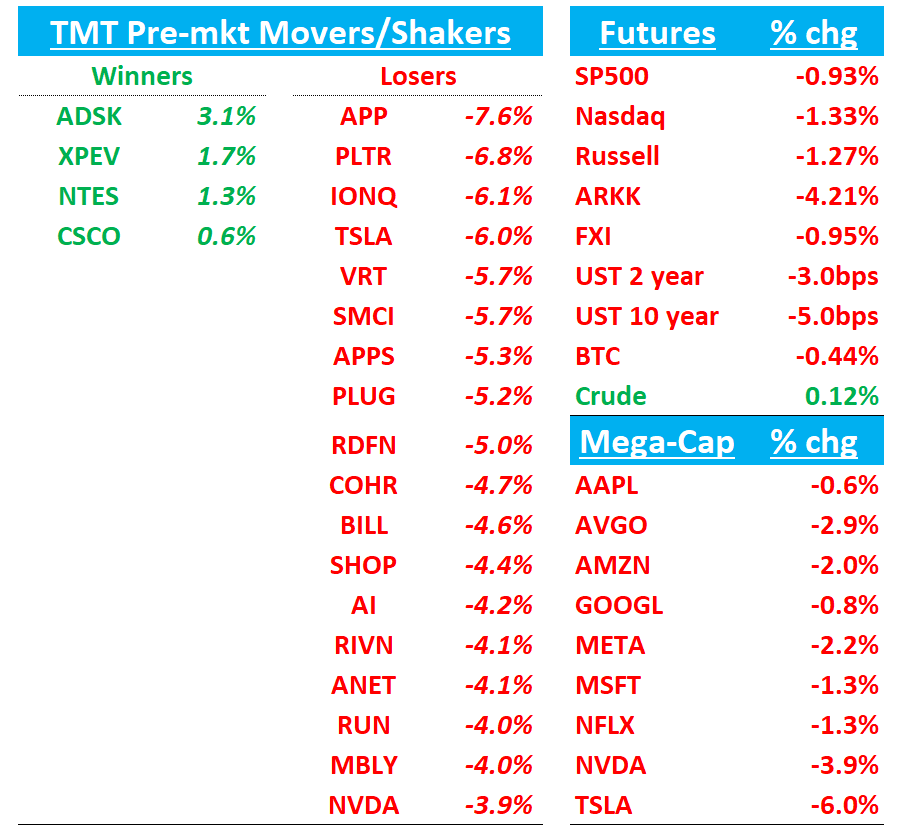

GS said HFs net sold global Info Tech stocks across all regions at the fastest pace in 6 months last week (“second largest net selling in the last 5 years”) and lowered their 3 month target to $5,300. Positioning and flows no longer being blamed as the reasons for the sell off as diminished confidence in near-term earnings, IT spending concerns (ACN, PATH, DOGE, etc.), loss of momentum in the GenAI narrative, high-level themes like Europe bringing investment $’s back home (along with Trump uncertainty), and weaker sell-side/3p checks (Ad names, AMZN retail, etc.) + weak consumer datapoints (the latest Virgin Atlantic Airways CEO said we "have started to see some signals that US demand is slowing in last few weeks") hitting Megacap in Tech. Over the weekend, we got a negative TheInformation article on GenAI spend (see below) which is hitting some AI semi names early. Also more noise around GB200 delays that we began hearing early last week from the supply chain not helping.

OFC begins in San Francisco today with investor focus centered on co-packaged optics following NVDA’s recent GTC announcements. MRVL, COHR, and LITE face scrutiny over potential displacement of pluggable transceivers, with debate around adoption timing and business defensibility. The copper vs. optics debate impacts CRDO and MRVL in the AEC market, with potential implications for CSCO, ANET, ALAB, and MTSI. (h/t Rocha at Wells).

Let’s get to it…

NVDA: Taiwan Press overnight builds over the weekend on what we began hearing last re: GB200 delays - link

Nvidia’s next generation GB300 faces a tough sell as Big Cloud firms sour on GB systems due to difficult GB200 assembly and debugging efforts, media report, citing unnamed supply chain sources, who estimate GB200 output at just 15,000 cabinets this year. Cloud firms are turning to highly mature Nvidia HGX 8 systems instead. The GB200 experience has raised fears about GB300 systems, which are to begin pilot production in the 2nd quarter, and due to supply chain stress, test samples may not be sent until end-2025, the report says, likely meaning GB300 will not be in mass production this year. Note: “HGX 8-card systems” likely means HGX 100 8-GPU or HGX A100 8-GPU systems, which have been on the market awhile. Writer of this story does solid semiconductor industry reporting. (h/t @dnystedt)

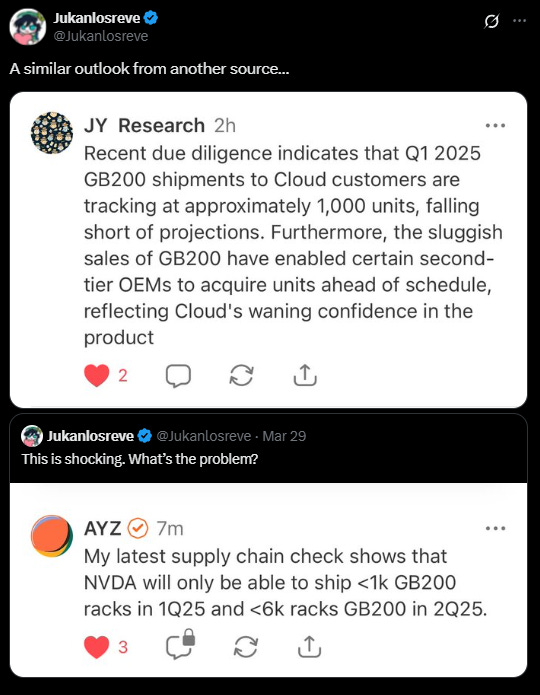

Gen AI/AI semis: Some Large Cloud Customers Slow Down AI Spending as Prices Drop

Some good snippets here…

But Palo Alto Networks recently found that open-source models from DeepSeek, a Chinese developer, could handle the same tasks for just 5% of the cost of the OpenAI models, CEO Nikesh Arora said. As a result, Arora’s firm is expecting to spend less on AI to power its existing products in the near term, he said. “For the tasks where we’re getting efficiencies and driving lower costs, I don’t think the model’s IQ needs to be much higher than it already is…and I don’t want to pay a dollar for that. I’d rather pay five cents,” he said.

For instance, Thomson Reuters, released conversational AI in its tax and legal software products in late 2023 to help customers draft legal documents and answer questions about tax laws. But its overall spending on AI from cloud providers like Microsoft and Google has been “roughly flat” since then, thanks to the falling price of the models powering the features, which include those made by Meta Platforms, Google and DeepSeek, according to Chief Technology Officer Joel Hron….Hron said the cost of running such AI at Thomson Reuters is likely to fall as OpenAI’s rivals make comparable technology available for purchase.

Some firms are slowing down AI spending by switching to cheaper models. TurboTax maker Intuit, for instance, steadily increased its spending on models from OpenAI and other providers, which it purchased through Microsoft’s Azure in 2023 and 2024, exceeding several million dollars per month as of last summer. Since then, however, Intuit has switched to a mix of free, open-source models as well as cheaper models OpenAI recently released, slowing Intuit’s AI spending growth on Azure, according to someone with knowledge of the situation.

Declining prices may be having an impact on cloud firms in other ways. Microsoft lowered the sales quotas for multiple Azure sales teams as much as 40% in recent weeks, according to two people with direct knowledge of the matter. It isn’t clear whether slowdowns in AI customer spending prompted the change.

Third-Party Data Roundup:

AAPL: M-sci says rev tracking slightly above street with better U.S. and less negative trends in China

DASH: Similar to Yipit, M-sci says GOV tracking above street and high end of guide.

PINS: Edgewater positive saying stronger-than-expected trends like performance ad growth, CPM inflation, and rising 3P demand outweighing any minor spend cuts in Q1.

Advertising/META/GOOGL/AMZN/PINS: UBS recaps all their ad checks from the last week

UBS summarizes their recent ad industry checks: (1) Four of six advertisers have REDUCED 2025 forecasts, with another considering cuts within the next month (2) Four of six are tracking below initial Q1 projections, with month-by-month performance deteriorating, potentially leading to lower Q2 expectations (3) Brand advertising budgets appear most vulnerable to cuts while direct response/performance marketing shows greater resilience (4) Similar to the brief 2023 downturn, there's natural momentum to shift budgets away from smaller platforms (PINS/SNAP) toward larger players (META/AMZN/GOOGL). UBS notes that while investors have made “peace” with softer Q1 numbers, m/m trends continue to head south.

BABA: Mizuho raises PT to $170 from $140 as AI Deep dive shows clear product roadmap

Mizuho's AI deep dive on BABA yields 3 key points: (1) it believes the company has rock-solid building blocks for AI investments going from scaling model to AGI, building platform for model APIs to accelerate application deployment for customers, and ultimately providing end-user solutions directly across industries; (2) it expects AI investments to also increase productivity internally, enabling improved product recommendations and conversions. Concurrently, Mizuho looks for businesses ex-TTG to reduce losses (11% of EBITA) and potentially reach break-even in 2 years; (3) it raises FY26E cloud revenue growth from 13% to 17% YoY as result of increased confidence in product roadmap and China enterprise spending sentiment improving

Trump says TikTok sale deal to come before Saturday deadline

President Donald Trump said a deal with TikTok's Chinese parent ByteDance to sell the short video app used by 170 million Americans would be struck before a deadline on Saturday.

Trump set the April 5 deadline in January for TikTok to find a non-Chinese buyer or face a U.S. ban on national security grounds due to have taken effect that month under a 2024 law.

GOOGL: Alphabet price target lowered to $167 from $184 at Wells Fargo

Wells Fargo analyst Ken Gawrelski has reduced the firm's price target on Alphabet from $184 to $167 while maintaining an Equal Weight rating. The analyst notes that with shares trading at recent trough multiples and amid bearish investor sentiment, there's an inclination to adopt a more positive outlook on Alphabet. However, Wells Fargo maintains its cautious position as its confidence increases in its search disruption thesis and below-consensus forecasts.

GOOGL: Melius asks if GOOGL has “lost the verb”

The research note "How Google Lost the Verb - and Its Multiple" argues Alphabet's stock has underperformed (+8%) despite 76% EPS growth since ChatGPT's 2022 launch. Rejecting the "cheap on sum of parts" narrative, the analyst draws parallels to Kodak's failure to adapt to digital technology despite technical capabilities. Like Kodak's multiple contracting from 20x to 7x NTM EPS, Alphabet's has fallen ~40% from its 2020 peak. The analyst contends OpenAI represents the "digital camera" threatening Google's "film" business, with advertisers potentially becoming fickle if returns diminish. The report views Google's AI search summaries skeptically, predicting negative impacts by late 2026, and questions whether Google has already "lost the verb" like other dominant companies (Kodak, IBM, Xerox) that failed to disrupt themselves, noting younger users are adopting different search behaviors.

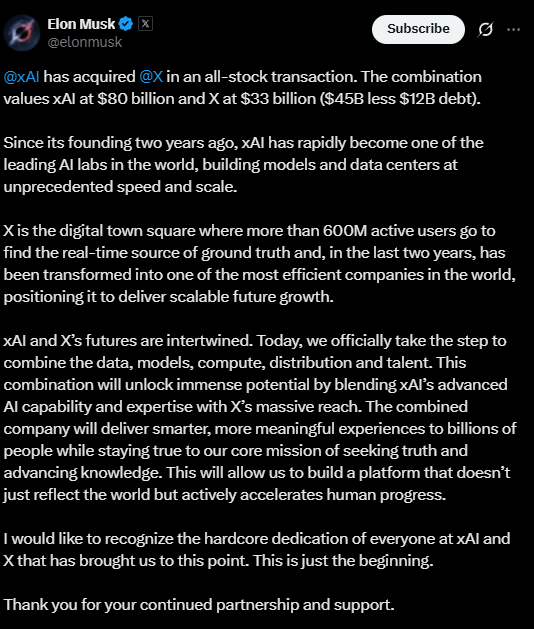

xAI buys X

APP: Citi says AppLovin short report claims not 'particularly credible'

Citi addresses the recent bearish report on AppLovin that made two primary allegations: first, that AppLovin collects data from social media competitors and e-commerce platforms to build persistent user identity profiles potentially violating Apple's policies and risking de-platforming; and second, that 23% of e-commerce pilot customers abandoned the platform during Q1. According to Citi's analysis, "neither claim is particularly credible." The analyst notes that these accusations focus solely on AppLovin's "much smaller" e-commerce segment, and clarifies that using social media pixels doesn't constitute fingerprinting. Citi further points out that the two claims are "inherently contradictory" - if AppLovin were gaining unfair advantages through data collection practices, it's unlikely e-commerce customers would be leaving at such high rates. Citi maintains its Buy rating on AppLovin with a $600 price target.

APP: Muddy short seller report targeting AppLovin 'fails the sniff test,' says BofA

BofA highlights that AppLovin's CEO released a blog post on March 27 addressing issues raised in Muddy Waters' short report published the same day, marking the fifth such report targeting the company this year. After analyzing both perspectives and consulting an independent expert, BofA concludes that the report "fails the sniff test" and considers de-platforming concerns "unfounded," maintaining its existing rating and forecast. According to BofA's analyst, the short report "appears to us to describe business as usual in the online advertising industry." BofA continues to view AppLovin as a top pick, maintaining its Buy rating and $580 price target.

Micron initiates price increase; Samsung and SK Hynix may follow suit – DigiTimes

MDB: Barclays out saying that MDB deserves a 2nd look

Barclays analyst Raimo Lenschow recommends revisiting MDB based on three factors. First, Enterprise Advanced growth slowdown is largely due to accounting effects from multi-year deals creating tough comparisons. Second, negative impacts from FY24 sales compensation changes are fading. Third, Barclays calculates that Atlas alone justifies more than the current share price with proper cloud valuation multiples. Barclays explains that MongoDB's EA business (23% CAGR from FY19-FY24) appears weaker due to lumpy deals requiring upfront license recognition. Meanwhile, Atlas grew at ~60% CAGR (FY21-FY24) before slowing to ~27% in FY25, with FY26 guidance of ~21%. Barclays notes MongoDB's history of conservative guidance and attributes growth challenges to their transition toward consumption-based incentives, which management has addressed.

NFLX: Netflix U.S. and Japan survey results 'tilt positive,' says Evercore ISI

Evercore ISI reiterates an Outperform rating on Netflix with a $1,100 price target following U.S. and Japan surveys. The firm views Netflix as addressing a $650B+ global entertainment market (ex-China & Russia) while holding single-digit share. Evercore highlights Netflix's strong management team, growing value proposition supporting pricing power, and innovation track record across content and features. The business model shows positive inflection in margins and cash flow, enabling buybacks and potentially dividends. During a recession, Evercore believes Netflix's $7.99 ad-tier may offer the best entertainment value available. Their only hesitation is valuation—Netflix trades within 18% of their target at 31x 2026E EPS of $30. A price closer to $750 (25x P/E) would make it a top pick as a "Dislocated High Quality" stock.

AMZN: ISI reiterates Buy highlighting key seller takeaways on tiktok, tariffs, and ad strategy

Evercore ISI reiterates an Outperform rating on Amazon ($270 target), highlighting five key seller insights: 1) TikTok Shop generates intense seller interest despite smaller GMV compared to Amazon, with non-participants expressing FOMO; 2) Tariff impacts create uncertainty, with sellers and manufacturers negotiating who absorbs costs; 3) Recession concerns exist, but sellers have identified cost-cutting levers including marketing reductions, with some seeing opportunity in potential market consolidation; 4) Off-Amazon advertising via Amazon Attribution and DSP is increasingly valued for building audience, improving search rankings, and increasing customer loyalty; 5) TikTok's Live selling format has driven some account growth but fallen short of promised GMV uplift, with sellers comparing it unfavorably to "QVC" and Evercore believing the format won't resonate strongly with U.S. consumers despite its Asian popularity.

IT Spend: UBS’ Karl Keristead dives into macro/tariff impact and implications for software

While checks show IT spending pressure, UBS notes few companies have actually begun restraining expenses. UBS highlights one consumer hotel CIO who's deferring projects to the second half, though they note enterprise-focused firms typically experience delayed impacts from external factors. Looking at 2025 IT budgets, UBS sees reprioritization toward AI initiatives, data science/analytics, cybersecurity, and cloud migration. Areas being cut include software licenses, HR/ERP upgrades, cloud migration projects, on-premise hardware (extending lifecycles), external services, and cloud infrastructure optimization. UBS recommends stocks with valuation support, exposure to resilient markets, or unique advantages. They identify ORCL, CYBR & BRZE as best positioned amid the current environment.

OKTA: Okta initiated with an Overweight at Cantor with demand inflection underway and $130 PT

The analyst observes that Okta, "a leader in identity security," has been facing growth challenges recently, with projections of "just" 10% growth for FY26. Despite this slowdown, the analyst points to Okta's history of aggressive acquisition strategy and flexible balance sheet as indicators that further deals may be forthcoming. The analyst highlights Okta's "solid margins," forecasting 25% operating margins and 26% free cash flow margins in FY26, while expressing confidence that "a meaningful demand inflection is underway.

TSLA: Tesla price target lowered to $455 from $474 at Stifel

Stifel has reduced its price target on Tesla from $474 to $455 while maintaining a Buy rating on the stock. The firm is lowering its near-term delivery projections to account for the introduction of the new Model Y "Juniper" as well as challenges from "the anti-Elon Musk crowd." Stifel's analyst notes that Tesla's favorability rating among Democrats has significantly declined, creating short-term sales obstacles, and is adjusting forecasts to reflect these lower near-term sales expectations.

WDAY: Workday price target lowered to $325 from $350 at Jefferies

Jefferies has reduced its price target for Workday from $350 to $325 while maintaining a Buy rating. The firm is cutting price targets across its U.S. software coverage universe in response to recent multiple compression and early indicators of weakening macroeconomic factors affecting technology purchasing decisions. Jefferies' analyst suggests "we may have another 'mullet' year in software" characterized by a choppy first half followed by smoother performance in the second half. The firm hasn't reduced its estimates "yet" as it awaits first-quarter data points, noting that recent guidance already assumed no significant improvement. However, Jefferies observes that ongoing uncertainty has resulted in investors taking a cautious approach, "waiting on the sidelines to assess the impact."

TTD: Trade Desk price target lowered to $72 from $101 at Wells Fargo

Wells Fargo has decreased its price target for Trade Desk from $101 to $72 while maintaining an Overweight rating. The firm indicates that their research shows stable first-quarter performance, but notes that deteriorating automotive spending toward the quarter's end could negatively impact second-quarter guidance. Wells Fargo adds that multiple conversations regarding Kokai suggest that product issues and agency relationship challenges are resolvable if Trade Desk is willing to make some concessions.

KLAC: MS upgrades to buy and PT to $870 from $748

MS expects KLAC to outpace the broader wafer fabrication equipment market, forecasting 8% revenue growth in 2025 and 12% in 2026 versus WFE growth of -3% and +4%. Two key factors drive this outlook for Morgan Stanley: increasing process control intensity (evidenced by KLA's growing share of TSMC capex and memory market presence) due to larger die sizes and more design starts; and continued market share gains from KLA's first-mover advantage at technology inflections, leading-edge technology, and superior data processing capabilities. These elements strengthen KLA's competitive position in semiconductor equipment.

ROCKET BUYS MR. COOPER IN $9.4B ALL-STOCK DEAL RKT is acquiring COOP for $9.4 billion, bringing together two major mortgage players under one roof.

The deal gives Rocket control of a $2.1 trillion servicing portfolio, covering nearly 10 million clients—or about one in six U.S. mortgages. Rocket’s aiming to leverage its AI and recapture strengths across a much bigger base, promising stronger long-term client retention, lower acquisition costs, and more stable earnings. The deal is expected to be immediately accretive to earnings, with $500 million in combined pre-tax revenue and cost synergies projected. Deal closes Q4.

OTHER NEWS

AAPL: Foxconn reportedly plans to double iPhone production in India by 2025, aiming to produce 25-30 million units annually – Digitimes

AAPL: French Competition Watchdog Fines Apple $162.4 Million Over App Tracking Transparency – WSJ

AAPL: Apple and Musk Clash Over Satellite Expansion Plans – WSJ

AAPL, Healthcare: Apple Readies Its Biggest Push Into Health Yet With New AI Doctor – Bloomberg

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.