TMTB Morning Wrap

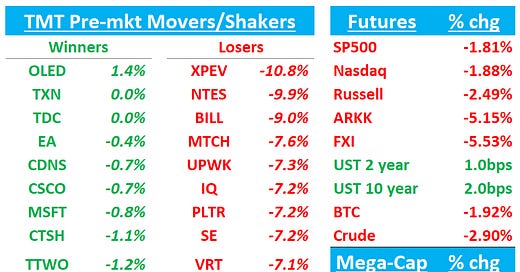

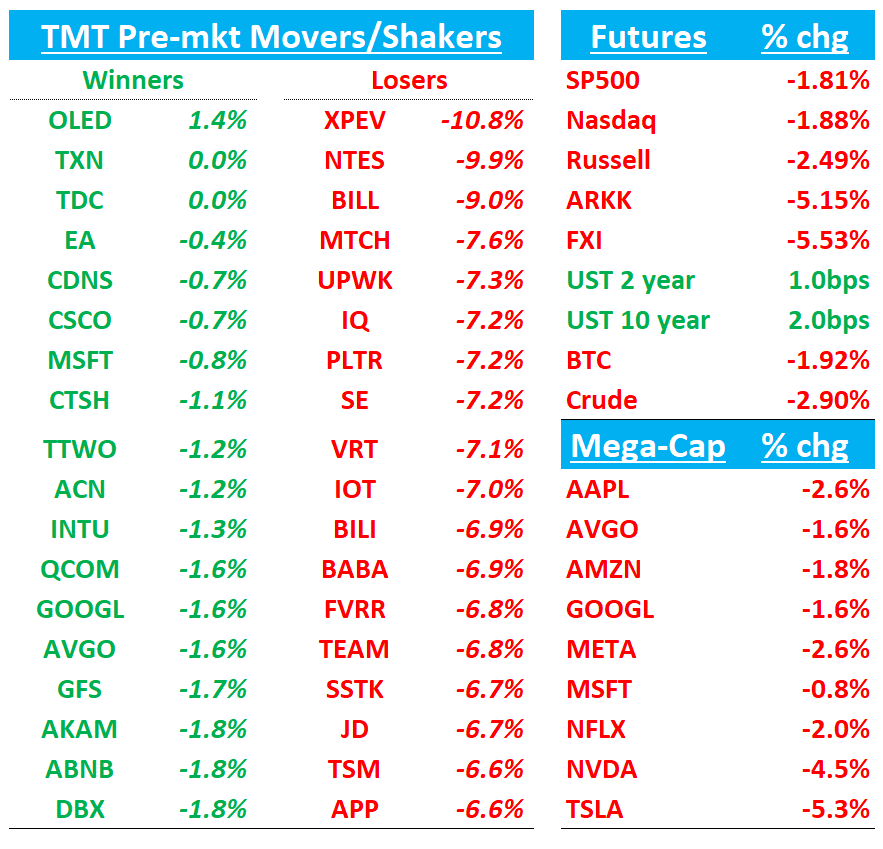

Good morning. QQQs -2% well off their overnight lows. Lots of limit breakers overnight in Asia given some markets were closed there on Friday. Yields slightly up. China -5.5%. BTC -2% at $77k. Navarro on CNBC in a few minutes at 8:45am est.

We’ll do some Macro stuff first then dive into Tech Research/News.

Lots to get to, so lets get to it…

MACRO

MACRO: GS Lowers GDP forecast and increases recession probability

GS is lowering their 2025 Q4/Q4 GDP growth forecast to 0.5% and raising their 12-month recession probability from 35% to 45%, citing tightened financial conditions, foreign consumer boycotts, and policy uncertainty that will likely depress capital spending. Their baseline assumes US tariff rates will rise by 15pp total, requiring significant reduction in April 9 scheduled tariffs. GS warns that if most April 9 tariffs take effect, pushing rates up by an estimated 20pp, they would likely revise to a recession forecast. In their current non-recession scenario, GS expects three consecutive 25bp Fed cuts starting in June (previously July), bringing the funds rate to 3.5-3.75%, whereas a recession would trigger approximately 200bp in cuts over the next year. Their probability-weighted forecast now projects 130bp of rate cuts in 2024 (up from 105bp), aligning with recent market pricing.

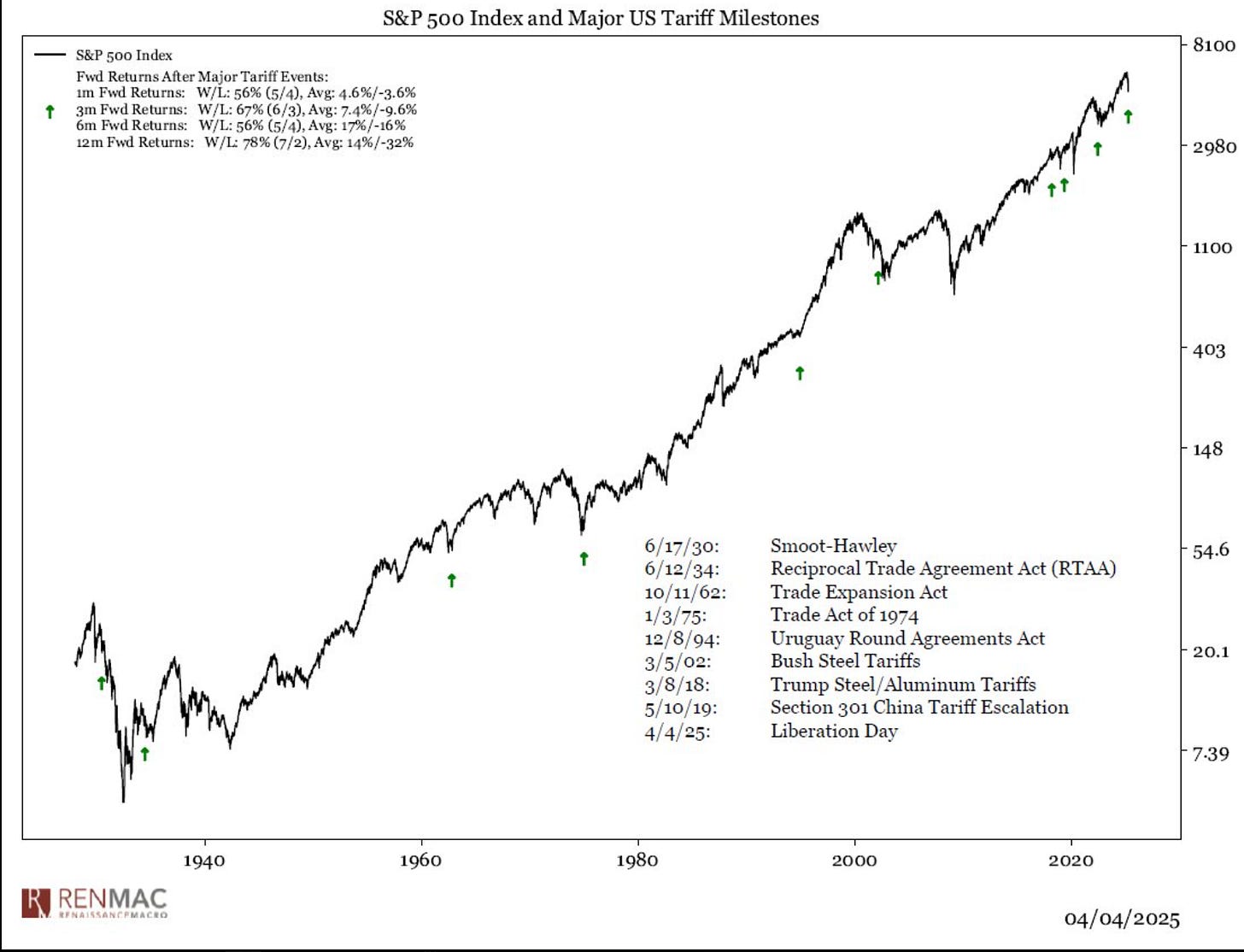

MACRO: Evercore cuts S&P 500 price target on tariff 'sledgehammer'

Evercore ISI equity, derivatives and quantitative strategist Julian Emanuel reduced the firm's S&P 500 year-end 2025 price target to 5,600 from 6,800. Evercore says remaking 80 years of economic, geopolitical and domestic governmental order "is messy business." Doing it with the "sledgehammer" of a larger tariff than 1930's Smoot-Hawley "was bound to cause turmoil in stocks, bonds, credit and commodities," the strategist tells investors in a research note. Evercore believes the "prolonged uncertainty" has raised asset volatility, "damaged" confidence and increased the odds of an outright recession. "Investors, CEOs and consumers dislike uncertainty," the firm contends.

IPO pause: Klarna + StubHub delayed their IPOs due to market turbulence; fintech company Chime also reportedly delaying its listing

Foreign visits into the U.S. fell off a cliff in March - Axios

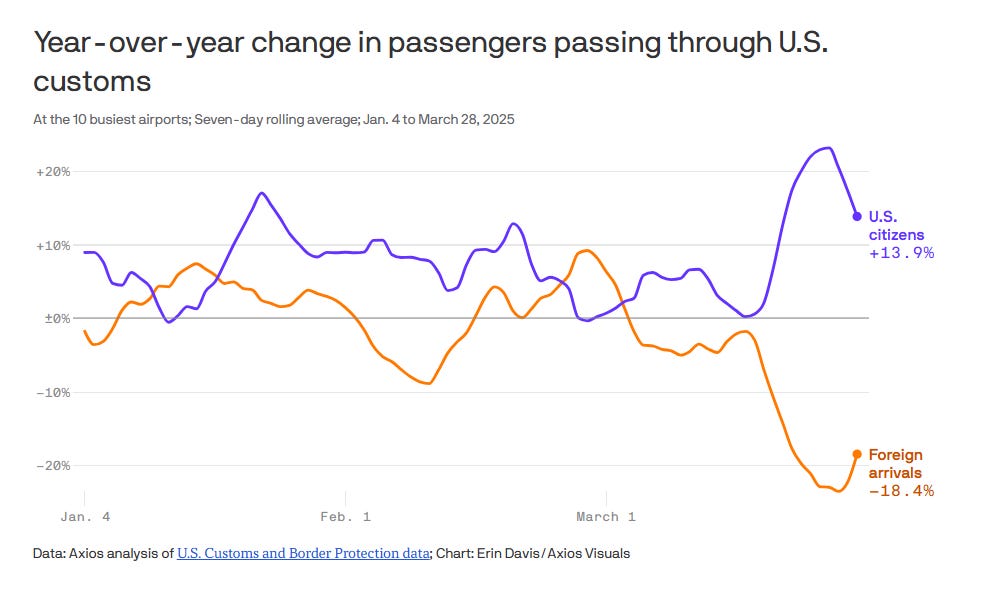

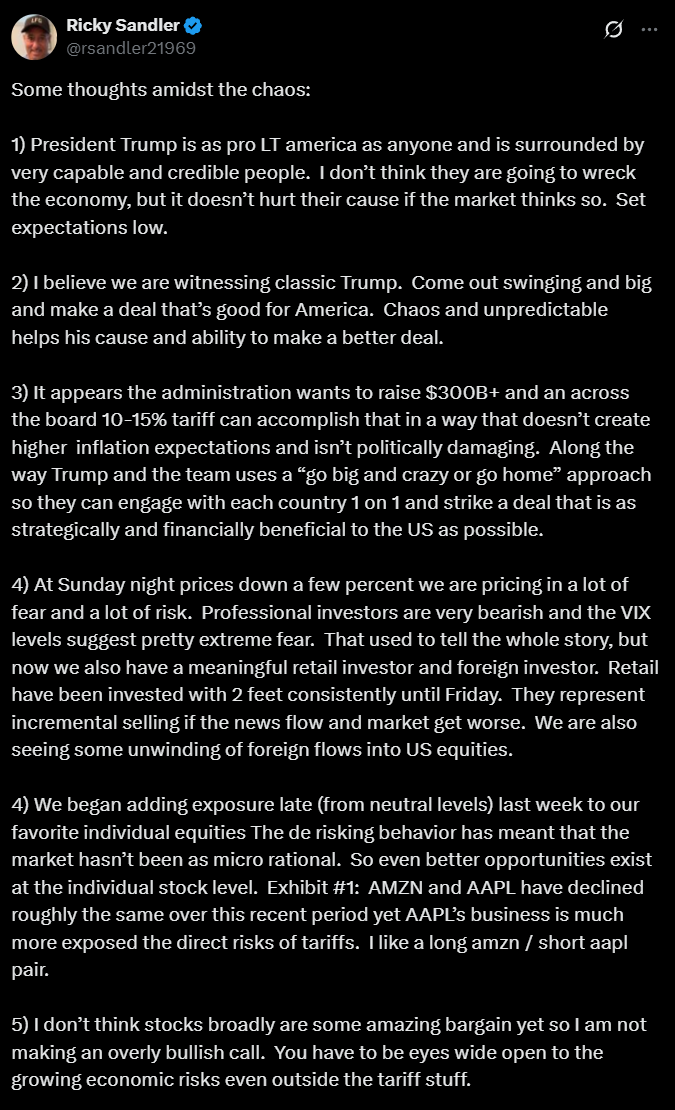

Signs of a bottom?

Not making a call, just passing along…

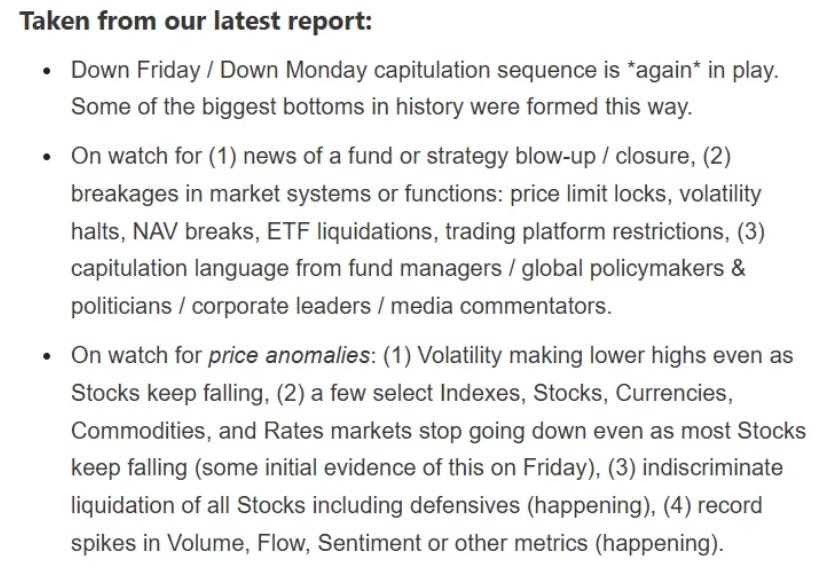

From our friends at macrocharts about what to watch for:

The Bill Ackman bottom signal:

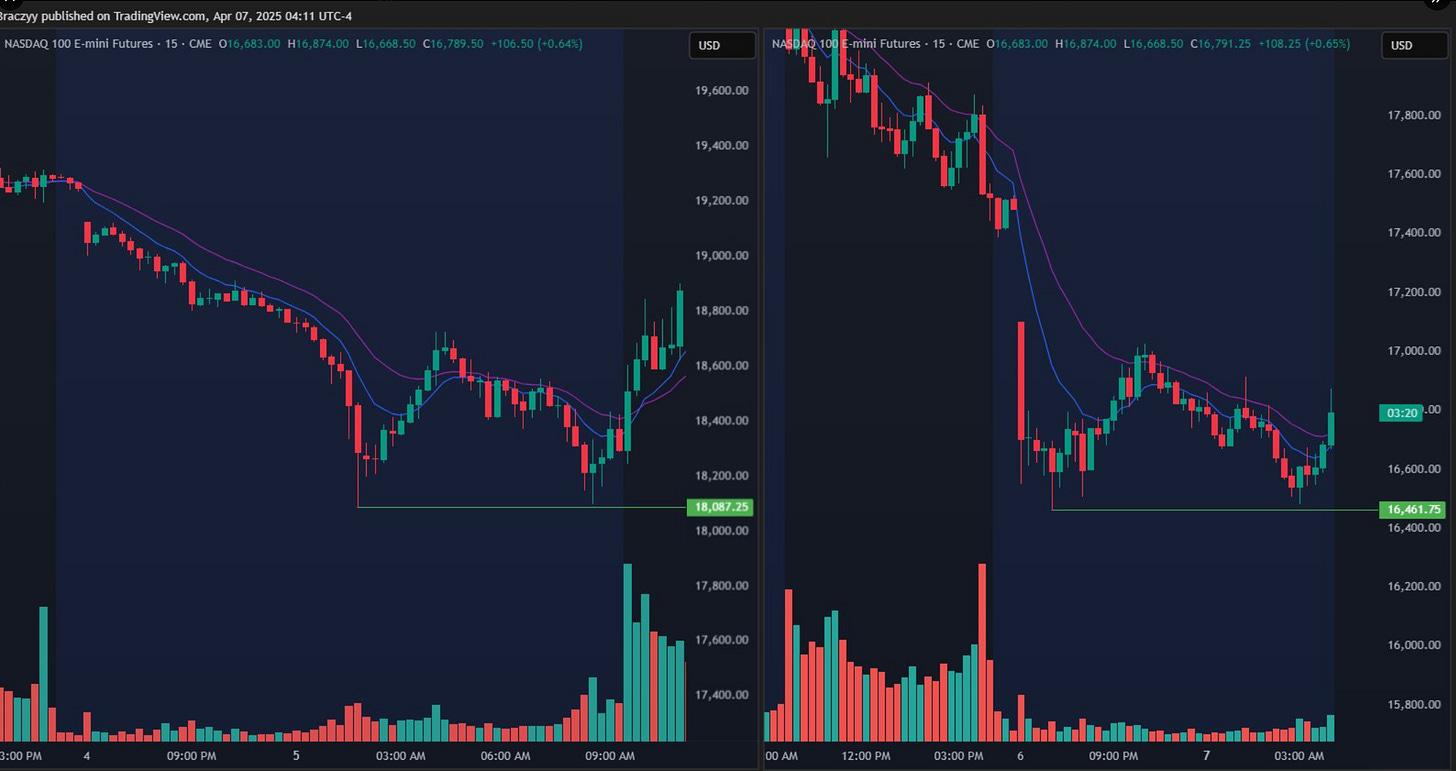

The Technical argument (overnight session looks very similar to Aug 4/5th / at 2021 support

Aug 5th lows vs Current lows (overnight futures session)

Major Tariff Milestones typically mark bottoms (except 1930 Smoot-Hawley)

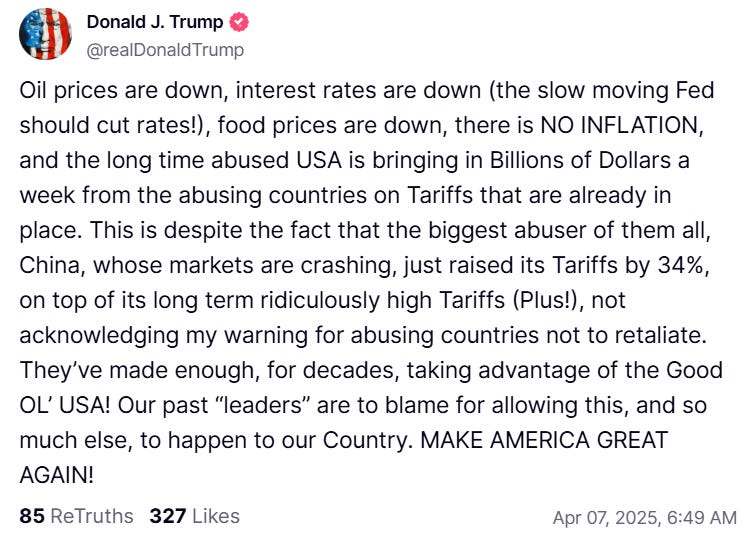

China Wanted to Negotiate With Trump. Now It’s Arming for Another Trade War.

Beijing spent the first months of President Trump’s second term trying—and failing—to figure out the new administration’s approach to China. Officials hoping to build lines of communication with Washington had no luck.

With Trump’s latest tariff action, the magnitude of his trade assault hit home and Beijing’s hope for dialogue melted into frustration and anger.

Until now its response had been restrained. On Friday, Beijing matched Trump’s 34% additional tariffs and for the first time it hit all U.S. products, no exceptions. It also restricted exports of certain rare-earth minerals, added U.S. companies to trade blacklists and aimed an antitrust probe at the China operations of U.S. chemicals and materials company DuPont.

The lack of communication between the two sides shows no signs of letting up. What lies ahead is likely to be a cycle of tit-for-tat retaliation, making it hard to even start negotiations in the near term.

China Appeals for Calm, Readies Plans to Counter Trump’s Tariffs

Under plans outlined in the People’s Daily, which is frequently used to express official policy views, China appears more committed to make bolstering domestic demand its “long-term strategy” and to turn consumption into a “major driver and ballast” for economic growth.

The government will look to boost consumer spending with “extraordinary strength,” cut rates and pump more long-term liquidity into the banking system whenever needed. It also has room to raise the fiscal deficit and sell more bonds to expand public spending, according to the article.

‘Fewer Choices and Higher Prices’: The Supply Chain of the Future

American consumers should brace for price increases and fewer options in the store, say people involved in the global networks that supply U.S. retailers.

The companies that built up Asian supply chains over decades operate on slim margins, and many say they have little choice but to pass on the cost of President Trump’s higher tariffs, assuming he sticks by his plan. They say it is impossible to make many labor-intensive products in the U.S., and shifting around production to ease the tariff burden will be time-consuming and costly.

“The supply chain of the future will look like a multiheaded dragon,” said Bruno Jaspaert, the chief executive of the Vietnamese industrial-park owner Deep C Industrial Zones. “The era of sourcing from one global manufacturing base in the world is completely over,” said Jaspaert, whose sites are home to tenants such as the tiremaker Bridgestone.

TECH RESEARCH/NEWS

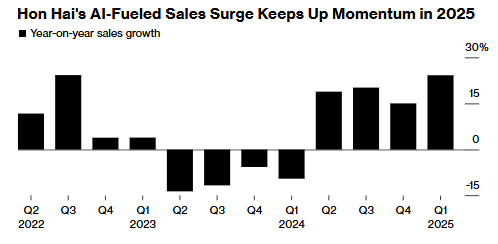

Nvidia Partner Hon Hai’s Sales Jump 24% on AI Demand

Hon Hai Precision Industry Co.’s first-quarter sales rose at their fastest clip since 2022 on resilient data center demand, a bright sign for the artificial intelligence sector amid tariff-induced fears.

The Taiwanese supplier of Nvidia Corp.’s AI servers and Apple Inc.’s iPhones is riding a wave of demand for servers to power AI computing by the likes of Alphabet Inc. and Amazon.com Inc.

Hon Hai’s revenue surged 24.2% for the first three months of 2025 to NT$1.64 trillion ($49.8 billion), in line with analyst estimates. The contract manufacturer said Saturday it expects its cloud and networking products segment to maintain growth momentum in the second quarter.

ROKU: Roku upgraded to Buy from Neutral at Redburn Atlantic

Redburn Atlantic upgraded Roku to Buy from Neutral with a $100 price target. The firm says the company has "defensive attributes" with $2.2B of cash, which should rise to $3.7B by 2027, and with 40% of costs variable. The shift of advertising dollars to connected TV will continue to progress and will likely accelerate if macro headwinds worsen, the analyst tells investors in a research note. Redburn believes Roku has reached a level of financial maturity where it can now be valued on EBITDA and free cash flow multiples, "for the first time providing a valuation floor to the stock."

PINS: Pinterest downgraded to Market Perform from Outperform at Raymond James

TheFly:

Raymond James downgraded Pinterest to Market Perform from Outperform without a price target. The firm is incrementally cautious on Pinterest expectations, despite the firm's overall favorite stance on the management team and shopping strategy, the analyst tells investors in a research note. The firm believes softer than expected consumer packaged goods trends calling out beauty, home and trade-down effects worsened throughout the quarter, which could lead to in-line results from Pinterest and translate into a sub-seasonal Q2 guidance, and notes that uncertainty from tariffs is likely to weigh on discretionary/brand spend, particularly in categories like beauty, home, and apparel where Pinterest over-indexes that carry a degree of U.S. import risk.

MSFT CEO AI Mustafa Suleyman and Nadella had some interesting quotes on Friday in CNBC interviews re: AI Capex. Key quotes (h/t JPM/Jefferies):

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.