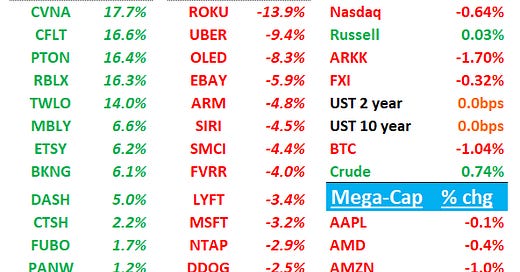

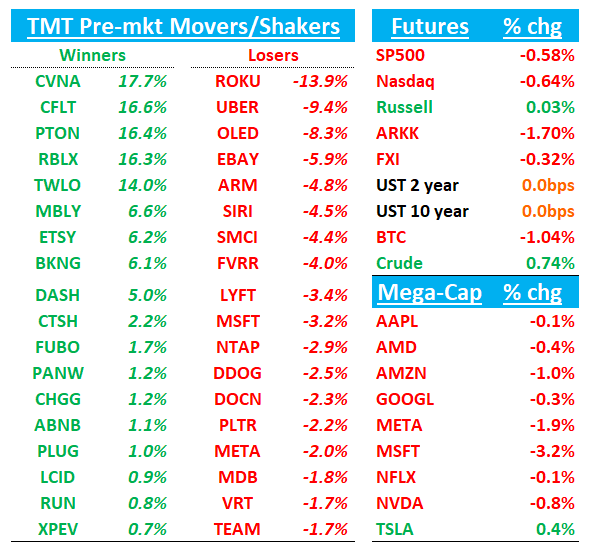

Good morning. QQQs - 80bps hit by some inline/mixed large cap earnings (META - 2%; MSFT - 3.5%; UBER -9%) although still got some good prints overnight/this morning from some smaller names (DASH +5%; RBLX +15%; CVNA +18%; CFLT +15%; PTON +15%) Yields flattish. BTC - 1%.

In terms of research/news, got an ARM dg at Bernie, news of a big PANW win at DoD, news of Samsung getting qualified at NVDA, and hearing a slight uptick in weekly AWS data ahead of AMZN’s print (details below the earnings recaps…)

Let’s get to it…(Apologies for typos, lots to get to…)

UBER -9% doesn’t look great as Q3 bookings came in light vs street and bogeys missing by 1-2% due to mobility and Q4 EBITDA missed buyside bar and even slightly below street. FCF solid.

Sentiment was mixed heading into the print given noise around AV (Waymo, robotaxi, etc.) and mixed 3p data and these numbers don’t do much to inspire confidence in short or long term investors (LYFT/DASH partnership announced yesterday doesn’t help as well). Feel like UBER is one of those stocks right now where they have to be beating to get people off the structural AV fears and this print didn’t do that. Wait for Dara to say more on the call…

UBER GUIDANCE: Q4

- Guides gross bookings $42.75B to $44.25B, EST $43.67B

- Guides ADJ EBITDA $1.78B to $1.88B, EST $1.84B

RESULTS: Q3

- Gross bookings $40.97B, +16% y/y, EST $41.24B

- Mobility bookings $21.00B, +17% y/y, EST $21.38B

- Delivery bookings $18.66B, +16% y/y, EST $18.58B

- Freight bookings $1.31B, EST $1.29B

- Revenue $11.19B, +20% y/y, EST $10.99B

- ADJ EBITDA $1.69B, +55% y/y, EST $1.65B

- EPS $1.20 vs. $0.10 y/y

- Trips 2.87B, +17% y/y, EST 2.88B

- Net income $2.61B vs. $221M y/y

- Monthly active platform consumers 161M, +13% y/y, EST 160.33M

RBLX +15% looks solid with better bookings/revs/EBITDA and better Q4 Bookings Guide

Sentiment had been mixed going into the print given 3p data and some short reports. However, bull case has been building here as advertising begins to ramp up and becomes a bigger story in 2025 and better bookings guide for Q4 will go a good way to bridging the gap until then. I expect mgmt to sound positive on recent initiatives and ad opportunity on the call…

Could this be the print that finally breaks it above $50? We’ll see…

“Comfortable anchoring 2025 bookings growth target of 20%” (street at 19.5%)”

RBLX F/Y GUIDANCE

- Guides bookings $4.34B to $4.37B, saw $4.18B to $4.23B, EST $4.22B

- Guides revenue $3.55B to $3.57B, saw $3.49B to $3.54B, EST $3.55B

- Guides consolidated net loss $1.00B to $1.02B, saw loss $1.05B to loss $1.09B, EST loss $1.02B

- Guides ADJ EBITDA $125M to $145M, saw $92M to $132M, EST $671.3M

GUIDANCE: Q4

- Bookings $1.34-$1.36B vs street at $1.3B

- Guides revenue $935M to $960M, EST $969.4M

- Guides consolidated net loss $283M to $303M, EST loss $266.7M

- EBITDA $330-$350M, up from prev guide of $324M

RESULTS: Q3

- Bookings $1.13B, EST $1.02BSymbol,AMZN

- Revenue $919.0M, EST $878.4M

- Loss per share $0.37

- Free cash flow $218.0M

- Cash and cash equivalents $602.6M, EST $1.3 billion

META -2%: Solid print with Revs slightly below bogeys but above street and Q4 guide inline with bogeys/street at $46.5B

OPMs much better at 43% vs street at 39.6% and EPS 6.03 vs street at 5.05. The endless year of efficiency continues..

Top end of exp guide lowered by $1B. Lower end of capex guide increased by $1B for 2024 to $38-$40B.No 2025 capex or opex guide but CFO on the call talked up higher depreciation hit to opex, and said “significant” capex growth in 2025, although was non-committal on head count growth.

All in all, don’t think buyside numbers moving here one way or another. A pretty down the fairway print and given stock strength going into the print and lack of #s going up, not surprising to see stock giving some back. But doesn’t change anything in medium or LT outlook on the stock. At sub 20x P/E, we continue to like META as one of our favorite compounders and think we are likely to see an accel in revs early next year as comps begin to get easier in the June Q after getting harder for 5 straight q’s. In terms of near-term trade, we don’t think this print gives us an opening for anything interesting.

Reminder that mgmt is having investors out to Menlo Park tomorrow.

META RESULTS: Q3

- Revenue $40.59B, +19% y/y, EST $40.25B

- Advertising rev. $39.89B, +19% y/y, EST $39.71B

- Family of Apps revenue $40.32B, +19% y/y, EST $39.92B

- Reality Labs revenue $270M, +29% y/y, EST $312.8M

- Other revenue $434M, +48% y/y, EST $395.5M

- Operating income $17.35B, +26% y/y, EST $16.24B

- Family of Apps operating income $21.78B, +25% y/y, EST $20.47B

- Reality Labs operating loss $4.43B, +18% y/y, EST loss $4.66B

- Operating margin 43% vs. 40% y/y, EST 39.6%

- EPS $6.03 vs. $4.39 y/y, EST $5.25

- Ad impressions +7% vs. +31% y/y, EST +10.8%

- Average price per ad +11% vs. -6% y/y, EST +6.76%

- Average Family service users per day 3.29B, +4.8% y/y, EST 3.25B

- COMMENTARY AND CONTEXT

- "We expect fourth quarter 2024 total revenue to be in the range of $45-48B."

MSFT -4%: Q1 looked solid rev, margins and eps beat and Azure hitting +34% bogey, but Azure guide 31-32% vs buyside looking for 32-33%.

Q1 was solid but more in line after adjusting for a grater mix of in period rev recognition, specifically across M365 commercial, azure and server products.

CFO called out stable consumption trends and said AI was 12ppts impact to Azure in Q1/Q2 with decel due to rev-rec pull in for Q1 and equipment pushouts to C25 for AI, noting that 2H accel was intact (“In H2, we still expect Azure growth to accelerate from H1, as our capital investments create an increase in available AI capacity to serve more of the growing demand.”). After GCP, investors were hoping for something a little better for the guide and a 2-3ppt decel for the guide is slightly higher than the 1-2ppt decel buyside was hoping for. So more expectations for hockey stick here which investors always have trouble underwriting, and stock likely stays as a funding short at pods until we get closer to C25 as Azure is key KPI.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.