TMTB Morning Wrap

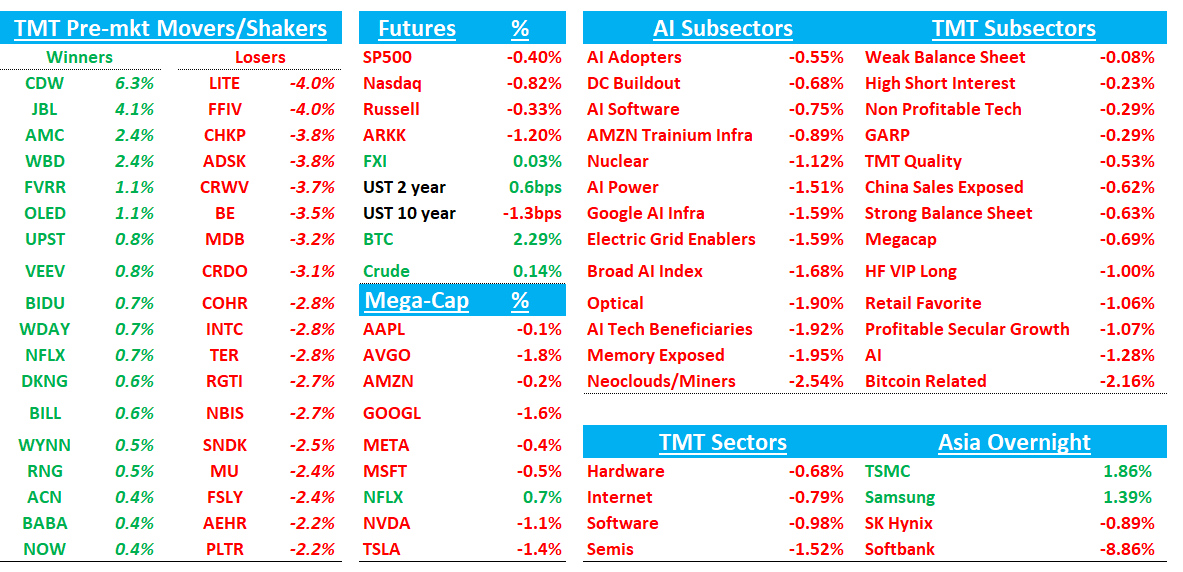

Good morning. Futures -80bps this morning. BTC -1%. Most of Asia closed overnight (China closed all week for the LNY).

We get earnings from CDNS, PANW, ADI, BKNG, DASH and FIG this week.

Let’s get to it…

WBD/NFLX: Warner Bros. Reopens Deal Talks After Paramount Raises Bid

Warner Bros Discovery Inc. has agreed to temporarily reopen sale negotiations with rival Hollywood studio Paramount Skydance Corp., setting the stage for a potential second bidding war with Netflix Inc.

Warner Bros. negotiated a waiver with the streaming giant that will allow it to engage with Paramount for seven days about the terms of its most recent offer, according to a statement Tuesday. The decision came after a Paramount banker told a Warner Bros. board member that Paramount would offer at least $31 a share if the company agreed to reopen talks. That’s $1 a share more than Paramount’s last proposal. The company also said the current bid is not its “best and final” offer.

WDAY: Rosenblatt Upgrades to Buy Ahead of Q4; Sees Limited AI Risk, $180 PT

Rosenblatt upgraded WDAY to Buy from Neutral with a $180 price target ahead of the February 24 Q4 print, citing an attractive setup following the recent selloff. The firm expects results to come in roughly in line and says management is likely to reaffirm or modestly lift its fiscal 2027 outlook. Rosenblatt notes that channel checks point to steady underlying demand and the analyst sees minimal disruption risk from generative AI. With shares down 36% since early December, the firm says the risk/reward has turned favorable.

SHOP: Truist Upgrades to Buy, Lifts PT to $150 on Growth Acceleration and AI Overhang Reset

Truist raised SHOP to Buy from Hold and increased its price target to $150 from $110, arguing the recent software selloff tied to AI concerns has created a compelling entry point. The firm says Shopify stands out as one of the few software names delivering re-accelerating growth and believes the valuation reset does not reflect the company’s long-term opportunity. Truist contends Shopify is positioned to benefit meaningfully from agentic commerce trends and expand beyond its current 14%+ share of U.S. e-commerce. The analyst views the recent dislocation as an attractive setup for patient investors

GenAI: The AI productivity take-off is finally visible

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.