TMTB Morning Wrap

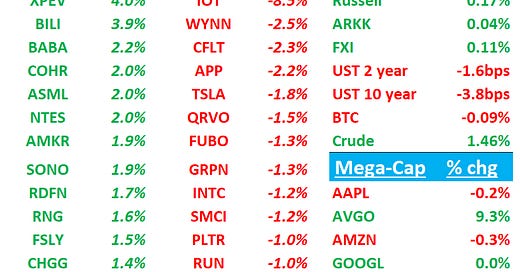

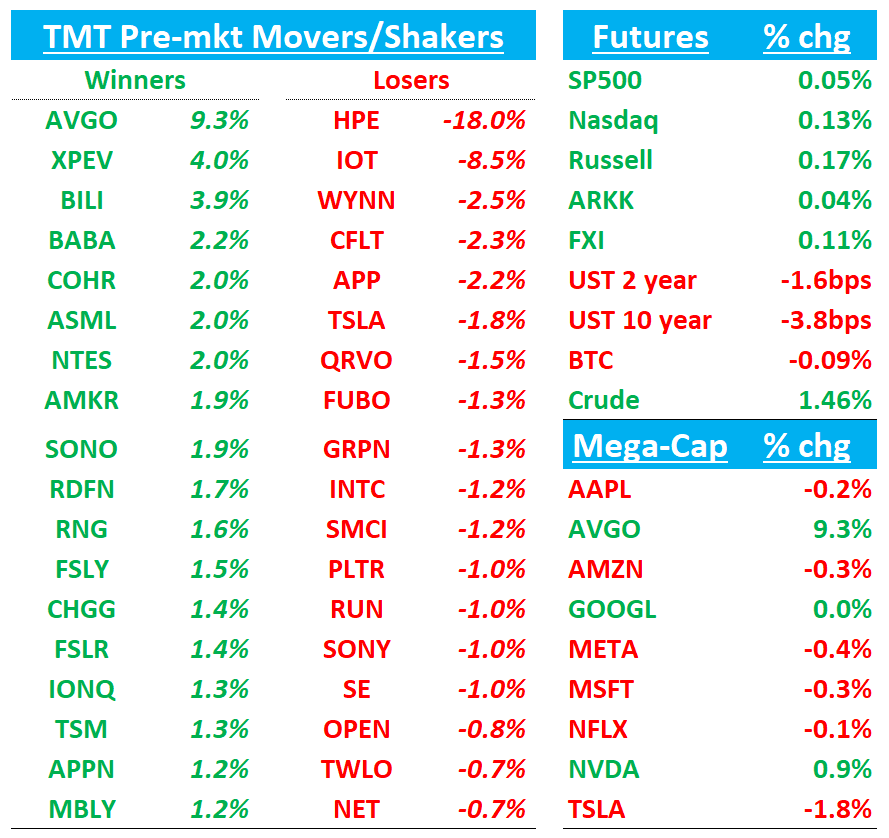

QQQs +25bps ahead of NFP (consensus = 160k) in a few minutes - QQQs are pricing in a 2% move, which is more than the election and points to how skittish investors are around growth right now. Yields are ticking down 2-4bps across the curve. Powell will speak at 12:30 PM EST (Speech takes place at the University of Chicago’s Booth School of Business). China/BTC flat.

Let’s get straight to it…

AVGO: Great print with Q4/Q1 upside while Hock Tan surprises again

FQ1 revenue/EBITDA/EPS of $14.92b/$10.1b/$1.60 vs. Street at $14.62b/$9.66b/$1.51 and bogeys of closer to $14.7B…higher AI-related networking drove the ~$300M beat

Q2 revenue/EBITDA margins of $14.9b/66% vs. Street at $14.71b/64.7% vs bogeys of $14.7B…m,,gmt talked up XPU and networking driving sequential growth into Apr.

Q2 AI revenue of $4.4b (+7% q/q) vs bogeys of $4.2B likely means AVGO’s custom AI accelerator broadening beyond the marquee TPU program with GOOGL as its two other ASIC customers ramp.

The big surprise was Hock Tan announcing 2 additional engagement partners bringing total to 4, with 3 current hyperscaler customers. SAM ($60-$90B) reaffirmed for 3 customers, the 4 additional ones not included in guide, so upside there. But their introduction into revenues will likely be later, so the SAM for them will be higher if/when they become full blown customers. Co also sounded said no NT concerns on tariffs or restrictions in dealing with non-US customers

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.