TMTB Morning Wrap

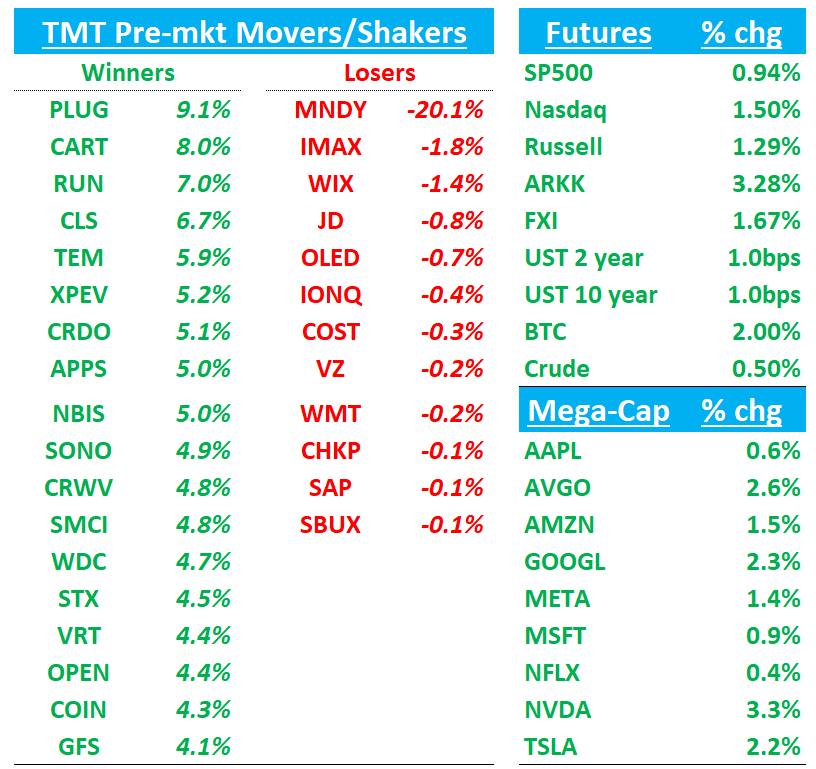

Good morning. Futures +1.5% bid to start the day as Senate reached a deal for the government to open after some democrats broke with their part leaders. Here’s Bloomberg:

The Senate voted 60-40 on a procedural measure to advance the bill Sunday evening. The House also needs to approve the measure before it goes to President Donald Trump’s desk for his signature.

House passage is not guaranteed. Democratic leaders have spoken out against any deal that doesn’t include extending expiring Obamacare subsidies, which this bill does not do Democrats secured a pledge by Republicans to vote on a bill to renew the Affordable Care Act tax credits by mid-December, according to a person familiar with the talks.

Stocks rallied in Asia on Monday: TPX +0.56%, NKY +1.26%, Hang Seng +1.55%, HSCEI +1.9%, SHCOMP +0.53%, Shenzhen +0.4%, Taiwan TAIEX +0.79%, Korea KOSPI +3.02%, BTC +5-% over the weekend to $106K. Yields up 3bps across the curve. Odds of a 12/10 bps rate cut sit at 65%.

AI Names bid to start the day: CLS +6%; MU/STX/WDC/SNDK +4-5%, NVDA/AMD +3%

Let’s get to it…

EARNINGS:

MNDY -18%: Another miss as Top line numbers a bit light vs expectations and Q4 guided below

Investors won’t like this especially after sounding good at the analyst day two weeks before the Q. Will keep stock firmly in the AI loser camp. Another reason to stay away from app sw…

3Q Results:

Revenue of $317M, up +26% y/y, modestly above the Street’s $312M (+24%) but slightly below buyside expectations around $319–320M (+27%). Growth slowed sequentially from +27% y/y in Q2.

Free cash flow margin came in at +29.1%, ahead of consensus at +28%, while non-GAAP operating margin was ~15%, also above guidance of 11–12% and flat q/q.

Net dollar retention rate (NDRR) remained steady at 111%, unchanged from Q2.

Guidance:

For Q4, MNDY guided revenue to $328–330M (+22–23% y/y), below Street’s $334M (+24.5%), implying an exit growth rate near +23% y/y. Non-GAAP operating margin guidance is ~14%, suggesting a modest sequential decline. The company reiterated its long-term outlook for ~+21% revenue CAGR through 2027.

CART +7%: Solid beat, inline guide checks boxes against low expectations.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.