TMTB Morning Wrap

Good morning. Futures +60bps after ORCL’s massive blow out, which seems like the most important AI print since NVDA in 2023. The whole AI semi complex rallying. We recap below…

Futures took another leg higher after a cooler PPI is helping rate cut hopes.

GS TMT Day 3 continues today.

BTC +1%; yields slightly up. Asian mkts up overnight: NKY +1%, Hang Seng +1%, TAIEX +1.3%, KOSPI +1.7%, India +0.3%. Softbank +7%. NAND names strong.

Let’s get to it…

ORCL +30%: Massive RPO steals the show

RPO came in at $332B, an astonishing addition of $316B in bookings. In the call back, IR said contract lengths could be up to 10 years in duration, implying the $30B annualized contract talked about represents a very large % of the $332B in bookings in the quarter.

ORCL also gave out OCI targets well above street for the next 5 years and said most of it is already contracted:

FY26: Consensus 17.7 vs. 18 Guide (1.5% above)

FY27: Consensus 29 vs. 32 Guide (10% above)

FY28: Consensus 50 vs. 73 Guide (46% above)

FY29: Consensus 69 vs. 114 Guide (65% above)

FY30: Consensus 84 vs. 144 Guide (72% above)

Capex guide was $35B a $10B increase in expectations laid out last q. The co emphasized that the majority of this spend is related to rev generating equipment within DCs that are leased.

Key quote from Big Bull Larry:

"Eventually, AI will change everything, but right now, AI is fundamentally transforming Oracle and the rest of the computer industry, though not everyone fully grasps the extent of the tsunami that is approaching…Several world-class AI companies have chosen Oracle to build large-scale GPU-centric datacenters to train their AI models. That's because Oracle builds gigawatt-scale datacenters that are faster and more cost-efficient at training AI models than anyone else in the world ... Training AI models is a gigantic multi-trillion-dollar market. It's hard to conceive of a technology market as large as that one. But if you look close, you can find one that's even larger, and is the market for AI inferencing, millions of customers using those AI models to run businesses and governments. In fact, the AI inferencing market will be much, much larger than the AI training market. AI inferencing will be used to run robotic factories, robotic cars, robotic greenhouses, biomolecular simulations for drug design, interpreting medical diagnostic images and laboratory results, automating laboratories, placing bets in financial markets, automating legal processes, automating financial processes, automating sales processes. AI is going to write, that is, generate the computer programs called AI agents that will automate your sales and marketing processes. Let me repeat that. AI is going to automatically write the computer programs that will then automate your sales processes, and your legal processes, and everything else in your factories and so on. Think about it. AI inferencing. It's AI inferencing that will change everything"

I’m hearing buyside going up to $15-$18 in FY29 after last night, although a lot of that is based on finger in the air assumptions for OCI margins where I’ve heard a wide range this morning (incremental IaaS GMs currently in the teens this q and most come out at 45-55% for IaaS GMs in FY29).

At 25-30x you get a $375-$500 on that $15-$18 EPS range. ORCL remains in our Tier 1 software bucket along with NET, MSFT, SNOW, and MDB (sprinkle in PLTR when the set up is right), as the key names to play AI demand in sw. Analyst day in Mid Oct is the next catalyst.

Stock move is the biggest gap up for a $150B company since early 2000s;

In terms of read-through, these are good numbers for NVDA and AMD (ORCL doesn’t do ASICs, yet). Good for CRWV as their biz most similar to ORCL’s Cloud infra biz, similar to other neoclouds. Overall, this print is just another sign AI demand continues to tick up (see CRWV quote yesterday about AI demand inflecting up again in the past 4-6 weeks) so the whole DC supply chain and Power names should benefit

SNPS -21%: F3Q25 a reset—IP shortfall drove a miss and FY25 guide-down, while EDA/Ansys held up and backlog expanded.

Revenue/EPS came in at $1.74B/$3.39 vs Street $1.77B/$3.82, as Design IP fell 8% y/y on China export restrictions, a large foundry customer’s delays, and internal roadmap choices. Mgmt expects a transitional/muted year for IP into FY26 as they pivot to higher‑value subsystems/chiplets and explore more royalty‑like constructs.

Mgmt reset Q4 to $2.23–$2.26B and $2.76–$2.80 EPS (OM ~36%) and FY25 to $7.03–$7.06B and $12.76–$12.80 EPS, cut FY25 FCF to ~$950M, and announced ~10% headcount reduction by FY26; backlog is $10.1B including Ansys.

Management cited an “unprecedented and challenging geopolitical backdrop”; China headwinds persist despite sequential improvement, and export restrictions extended well beyond their nominal six-week window as customers questioned multi‑year commitments. HPC/AI demand is strong; industrial/auto remains subdued.

Gets downgraded at Rosenblatt and BofA

RBRK -3%: Solid print as they beat across ARR/revenue/margins/FCF, raised FY26 outlook again

Key takeaways

Broad beat: Subscription revenue $297M (+55% y/y vs street +42%), total revenue $310M (+51% vs street +37%), GM 81.6%, non‑GAAP OM ‑1.4% vs Street ‑20.5%, and non‑GAAP EPS ‑$0.03 vs ‑$0.34. FCF $57.5M crushed Street (~$1.5M), with TTM FCF margin climbing to ~17%.

Recurring engine still healthy: Subscription ARR $1.252B (+36% y/y vs street +33%); Cloud ARR $1.064B (+57%) and now 85% of Subscription ARR. LTM DBNRR >120%, with >35% of NRR from security upsell; +124 net adds of >$100k ARR customers (2,505 total; 85% of ARR).

FY26 revenue guide moved up to $1.227–1.237B (+38–40% y/y) and Sub ARR to $1.408–1.416B (+29–30%); FY26 FCF now $145–155M. Management said material rights (non‑recurring) should add ~6 pts to FY26 revenue growth (previously “few points”) and be minimal in FY27

Cash flow setup: Q2 FCF strength benefited from early renewals and favorable duration; for 2H, CFO is modeling low‑to‑mid single‑digit duration compression and still targets roughly even FCF in Q3/Q4.

Management sees no change in the competitive landscape and claims to “win vast…majority” of deals vs legacy and next‑gen vendors, citing the pre‑emptive recovery engine as the key differentiator.

Rubrik is “evolving into the security and AI company”; Predibase acquisition underpins Agent Rewind (undoes agent errors) and broader AI ops ambitions. Early stage for PMF; near‑term margin drag (Q3) but long‑term optionality.

Demand commentary was constructive—customers adopting an “assumed breach” posture and re‑platforming for AI; no specific tariff commentary appeared in the materials.

Bull vs. Bear Debate:

Bulls argue Rubrik is becoming the default cyber‑resilience platform across data center, cloud, SaaS, and identity—supported by >120% DBNRR, an expanding security upsell mix (~35% of NRR), and growing presence in large accounts (2,505 customers >$100k ARR; 85% of ARR). Momentum in Cloud ARR (+57% y/y; now 85% of sub ARR) and strong land‑and‑expand into M365/identity/DSPM sustain high‑20s%+ ARR growth even as the base scales. The AI optionality (Predibase + Agent Rewind) can widen the platform TAM and pull forward strategic vendor consolidation. On execution, Q2 showed significant operating leverage and cash generation, with TTM FCF margin stepping up and FY26 FCF raised to $145–155M

Bears focus on quality of revenue and the risk to growth optics as the material rights tailwind (≈6 pts to FY26 revenue growth) fades to minimal in FY27. They also flag decelerating NNARR growth vs last quarter, potential duration compression and 2H OpEx ramp (Q3 subscription contribution margin guided down), as well as rich valuation (already low‑teens EV/ARR on CY26 for the group). Competitive risks persist—from both new‑gen backup vendors and hyperscalers’ native services—while AI monetization remains early and margin‑dilutive near‑term

CHWY -9%: Missed heightened expectations. Q2 top line slightly ahead but surprise margin shortfall…call ongoing

TECH/RESEARCH

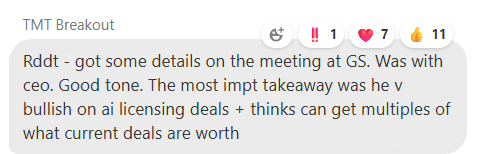

RDDT: Jefferies Raises PT, Reiterates Buy on Monetization and Data Licensing Upside

Jefferies reiterated a Buy on Reddit and lifted its price target to a Street-high, citing sustained DAU trends and meaningful long-term monetization potential. The firm argues RDDT could generate ~35% upside to 2027 revenue if its ad market share scales similarly to SNAP and PINS, supported by a large monetization gap and improving ARPU → that implies 63% growth vs 62% in ‘24. Jefferies also highlights Dynamic Product ads as a new growth lever and points to RDDT’s engagement—where ~40% of comments mention brands or products—as a strong foundation for expanding performance ad offerings. On top of this, the firm sees incremental EBITDA of ~$450M from AI licensing alone. With higher ARPU forecasts and monetization optionality, Jefferies raises its ’26 EV/EBITDA to 5–10% above peers and argues the risk/reward remains compelling.

TTD: Morgan Stanley Downgrades to Equal-Weight, PT Cut to $50 on CTV and Open Web Weakness

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.