TMTB Morning Wrap

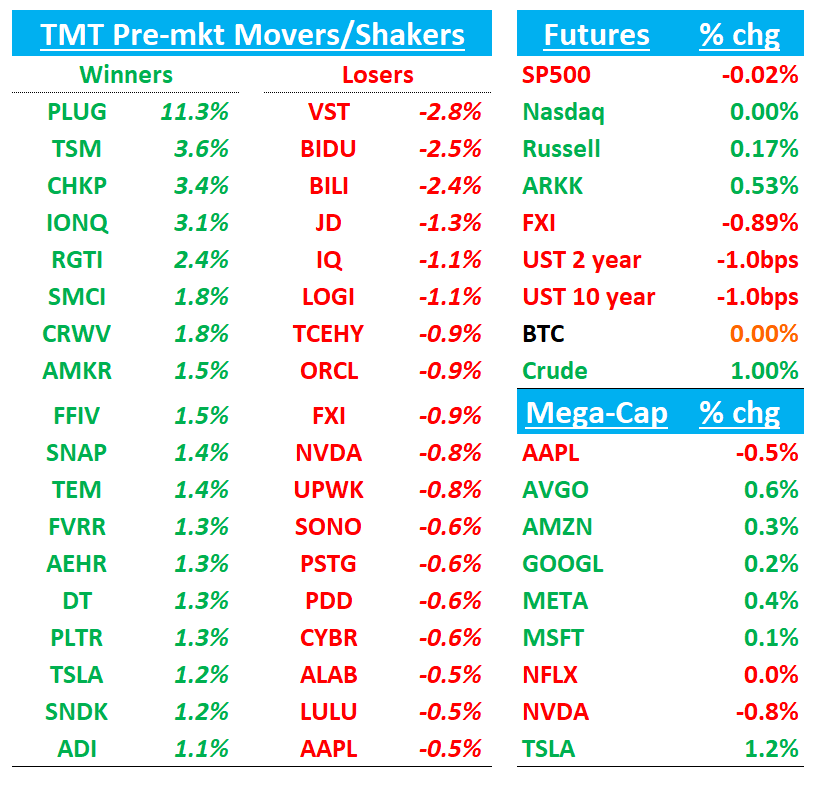

Good morning. Futures flat on a relatively quiet day (so far) relative to what we’ve seen over the past couple of weeks. We get Micron tonight and expectations there have ramped up significantly over the past several weeks.

BTC flat while China -1%. Yields slightly down.

We’ve hit up the OAI/NVDA takes first, then dive into the usual.

Let’s get to it…

NVDA/OpenAI

NVDA: UBS Highlights $400B Multi-Year Revenue Opportunity From OpenAI Deal; Notes Risks for AMD, Potential ASIC Impact for AVGO

UBS says the timing of Nvidia’s gains will largely hinge on how quickly OpenAI ramps, but the firm estimates the partnership could ultimately generate around $400B in revenue for NVDA over several years. While some overlap with Oracle’s OpenAI capacity is possible, management emphasized to UBS that most of the business looks incremental. The analyst adds this bolsters Nvidia’s long-term visibility after previously framing a $3–4T TAM by 2030 where its share has been 30–35%. UBS also stresses that it was OpenAI approaching Nvidia for support rather than NVDA offering vendor financing. On Broadcom, the firm notes this could affect the size of OpenAI-related ASIC orders, but so far sees no signs of weakness and still expects volumes to surpass Google’s AVGO relationship. UBS concludes the development looks most negative for AMD, as it reinforces Nvidia’s entrenched dominance.

NVDA: ISI Reiterates Top Pick, PT Raised to $225 on OpenAI Deal Upside

ISI says its call with Nvidia’s CFO reinforced that the company is the preferred supplier to OpenAI, which has underestimated demand and now plans a massive infrastructure build. The firm highlights the deal represents at least 10GW of AI capacity, equating to a $30–40B TAM per GW, and is incremental to what Nvidia had previously expected. ISI lifts its 2H26 revenue forecast by $5.5B, pointing to benchmarks like Colossus, Prometheus, and Project Rainier, while also raising CY26 revenue and EPS estimates by 2%. Nvidia’s $100B investment commitment is seen as aligned with OpenAI’s scale-up. With NVDA trading below long-term averages on NTM P/E, ISI raises its price target to $225 from $214 and reiterates Nvidia as its top pick in AI infrastructure.

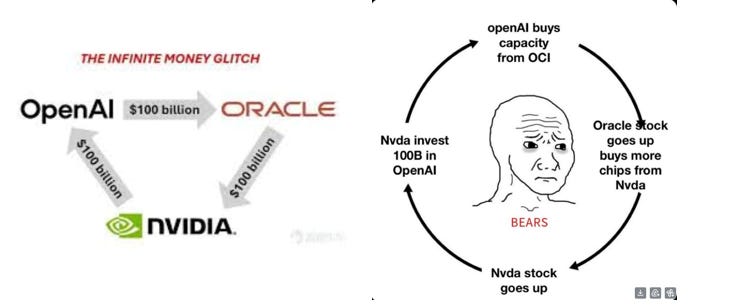

NVDA: Bernstein Says OpenAI Partnership Positive, Though Structure and Scale Still Unclear

Bernstein argues the deal reinforces Nvidia’s GPU strength over ASICs, even if some ASIC use cases emerge, given the magnitude of demand. While incremental revenue uplift (~$10B in 2H26) looks modest against Street’s long-term forecasts, the firm sees potential for upside depending on execution. Bernstein also cautions about “circular” concerns, with Nvidia possibly channeling capital into startups that ultimately buy more of its GPUs. Still, the firm believes the news should be taken positively for Nvidia, supporting growth into 2026 and beyond, and frames it as broadly bullish for quality AI names like NVDA and AVGO.

How Nvidia Is Backstopping America’s AI Boom

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.