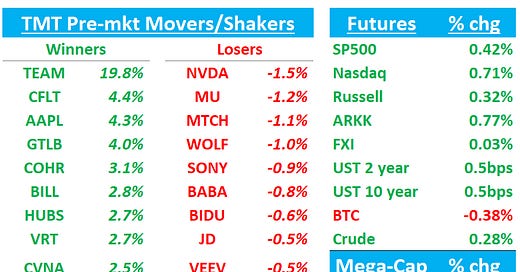

QQQs +77bps after a roughly inline PCE print. Yields flattish. BTC flat. China flat. We’ll hit up AAPL, TEAM, INTC, CHTR first then get to research/news. Let’s get to it…

AAPL: Guide better than feared. China weaker in Dec - but Cook does his best to spin for better growth in March and going fwd. Services beat and good GMs

Q2 guided to Low to mid single digits y/y, despite 2.5 ppts fx headwind and implies $94B for March Q, above buyside expects of $92B.

Services revenue Guide: +LDD y/y

GM guide: 46.5% - 47.5%

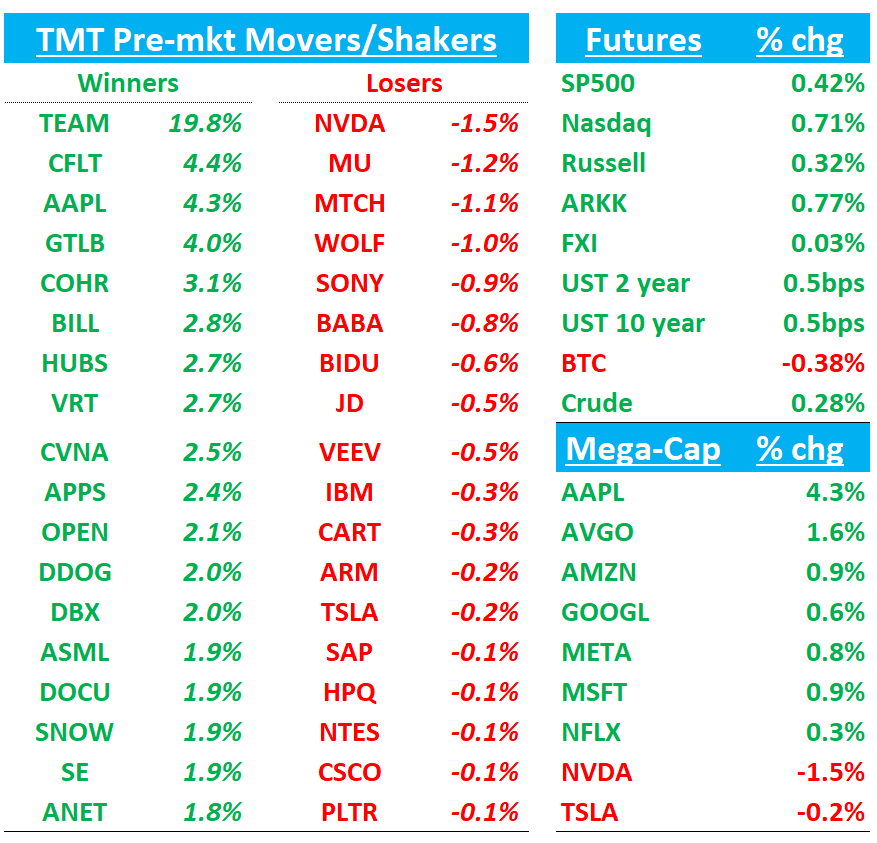

Despite weaker China #s, Cook made the case that China got better near the end of the Q and AAPL intelligence - which has improved demand in other geos, has not rolled out in China (and Q4 did not see any tailwinds from subsidies which were enacted in Jan):

Cook also did his best to say that there was still plenty of product innovation in the pipeline with the iPhone

Citi and KEYB lay out the bullish vs. bearish debate pretty well this morning:

Citi opens 90d positive catalyst watch saying they see “ release of the iPhone SE4 in March and the next Apple Intelligence software update (iOS 18.4) in April, featuring a significant Siri upgrade, as positive catalysts for the stock.” and is positive on AAPL’s intelligence rollout. Citi also thinks Deepseek’s recent breakthrough offering lower cost per compute and optimized models running locally, could help celebrate AI adoption on devices.

Keybanc who is a bear points to underwhelming results and caveats the better guide saysing: “1) It was below consensus yet again. 2) We believe it implies Hardware sales between -3.5% and +1.4% YoY in F2Q, which lacks inspiration. 3) The lack of higher gross margins (47% at midpoint, flat quarter-over-quarter) suggests iPhone sales are likely down more than average Hardware sales.” Their concerns mainly center around “1) Lack of a U.S. upgrade cycle. 2) Increased competition in China. 3) An unlikely inflection across all products and geographies” and 4) valuation with AAPL trading at 22x 2026 EV/EBITDA. “

We tend to side with the bulls although we don’t find the stock super exciting here. We are positive on AAPL’s potential to monetize AI Siri and drive further upgrade cycles as on-device AI takes hold at some point. That may come sooner than some expect, although AAPL always seems to be late to the game. From a rate of change perspective, China demand doesn’t seem to be getting worse and subsidies should help as well as AI releases. We were happy to hear Cook talk up increasing demand as AI features get rolled out and have a nice catalyst path with 18.4iOS release, SE release along with WWDC in June, and new form factor iPhone in fall. We aren’t super excited, but think path likely higher from here. We’d call it a boring long.

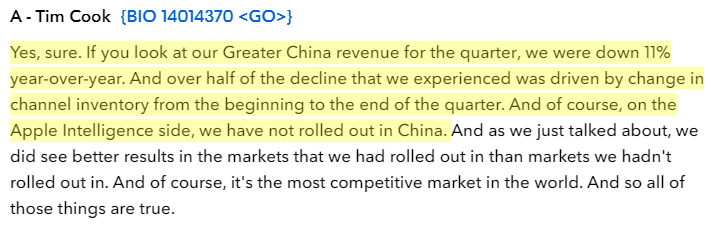

AAPL RESULTS: Q1

- Revenue $124.30B, +4% y/y, EST $124.1B

- Products revenue $97.96B, +1.6% y/y, EST $98.02B

- IPhone revenue $69.14B, -0.8% y/y, EST $71.04B

- Mac revenue $8.99B, +16% y/y, EST $7.94B

- IPad revenue $8.09B, +15% y/y, EST $7.35B

- Wearables, home and accessories $11.75B, -1.7% y/y, EST $11.95B

- Service revenue $26.34B, +14% y/y, EST $26.1B

- Greater China rev. $18.51B, -11% y/y, EST $21.57B

- EPS $2.40 vs. $2.18 y/y, EST $2.35

- Total operating expenses $15.44B, +6.6% y/y, EST $15.34B

- Gross margin 58.28B, +6.2% y/y, EST 57.98B

- Cash and cash equivalents $30.30B, -26% y/y, EST $36.45B

- Cost of sales $66.03B, +2% y/y, EST $65.98B

- Total current assets $133.24B, -7.3% y/y, EST $165.17B

- Total current liabilities $144.37B, +7.8% y/y, EST $167.07B

TEAM +20%: Very good results with big cloud beat, much better FY guide and much better Q3 Cloud guide

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.