TMTB Morning Wrap

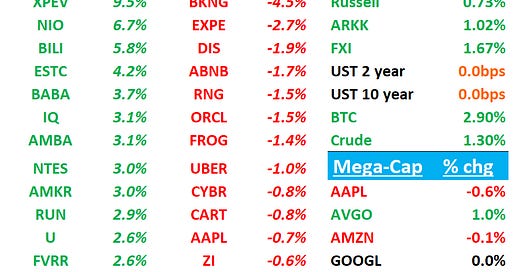

Good morning. QQQs +30bps after being down 70bps post-close at one point. BTC +2.5% popping back above $80k. China +1.6%. Yields flat.

ORCL + CIEN recap first then onto to News + Research. Let’s get to it…

ORCL -1%: Strong bookings overshadow mostly disappointing quarter…investors want to see backlog translate to revenue

RPO stole the show +62% (accel from 50% last q) to $130B up from $97B last q (street at $103B, bogeys at $110B, and most bullish bogeys at $120B). $33B increase bigger than any prior six month increase. None of this includes any RPO from Stargate: “And we do expect Stargate, our first large Stargate contract fairly soon.”

Co said that as backlog turns to revenue, revs should continue to accelerate from 6% in FY24 to 8% in FY25, to a projected 15% in FY26 and 20% in FY27 (street was at 13% / 15% before tonight)

- OPM beat at 44% vs 43.6%

However, rest of the quarter was subpar:

- Revs missed at $14.13B vs $14.39, decelerating to 6% vs 9% last q

- IaaS 51% cc y/y, down from 52% last q (bogeys 53%+)

- SaaS 11%% y/y inline 11% last q

Bulls will say that huge RPO beat is a massive accel and doesn’t include any Stargate revs and forward revenue guidance is significantly above street and the co continues to sound very bullish around demand. The co also said that component delays which have slowed cloud capacity expansion will ease in Q1 FY ‘26 as power capacity growth is expected to 2x in CY25 and 3x by FY26 and help drive better OCI revs going forward. Bulls will also say that ORCL has evolved into a strategic cloud provider with 101 cloud regions, more than any other hyperscaler and the co addresses a massive TAM of close to ~500B from infrastructure.

Bears will say co has missed top line in 7 out of the last 9 quarters and doesn’t deserve the benefit of the doubt, IaaS came in light, May Q guide was light on revs/EPS, and investors are unsure whether the revenue translated for backlog will be margin dilutive or accretive and ramping capex will weigh on gross/operating margins going fwd. Some investors worry that ORCL’s OCI is predominantly AI training and AI training rev is low margin / short-term revs; as Bernstein put it, bears will say “Oracle is offering AI training capacity that Microsoft does not want and that once global AI training capacity increases Oracle’s AI training revenue will be hurt.” (Bernstein disagrees as they think ORCL hw architecture is different/more flexible than competitors")

We think both sides have fair points and think ORCL likely remains a show-me story for now (on revs and margins). We do like the r/r here though:

We still think co can do close to $8 in EPS in CY26 and think 22-23x is the right multiple, which is at the very high end of where stock traded at before OCI took hold and would mean $175-$185. Our dnside is $135 which is 20x CY25 street EPS of $6.70. So below $150, our base case $30 up and $15 down, which is 2:1. If stock got down to $145, then r/r begins to get more juicy at $10 down (<10% downside), $40 up (30% upside). That’s also good resistance from previous breakout back in Sept.

CIEN +9%: Solid Q1 with revs, EBITDA and margins beating.

PR: “As the global leader in high-speed connectivity, we are incredibly well positioned to benefit from the global investment in networks to scale for cloud and AI. As a result, we are very confident in our ability to deliver in fiscal year 2025 and beyond.”

Guide on the call

CIEN RESULTS: Q1

- ADJ EPS $0.64 vs. $0.66 y/y, EST $0.41

- Revenue $1.07B, +3.3% y/y, EST $1.05B

- Networking platforms revenue $821.2M, +1.7% y/y, EST $800M

- Converged Packet Optical revenue $728.0M, +4.6% y/y, EST $723.1M

- Routing and switching revenue $93.2M, -16% y/y

- Platform software and services revenue $95.1M, +6% y/y, EST $97.1M

- Blue Planet Automation software and services revenue $26.0M, +86% y/y, EST $20.8M

- Global Services revenue $130.0M, +2.5% y/y, EST $135.9M

- Maintenance support and training revenue $74.6M, +0.7% y/y

- Installation and deployment revenue $47.7M, +12% y/y, EST $48.1M

- Consulting and network design revenue $7.7M, -23% y/y, EST $12.2M

- ADJ gross margin 44.7% vs. 45.7% y/y, EST 42.1%

NEWS/RESEARCH/3P

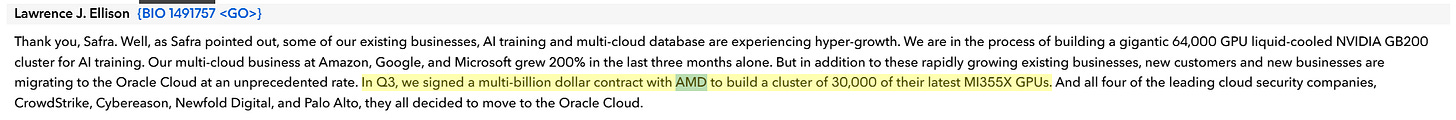

AMD: ORCL said they signed a multi-$B contract to build a 30k cluster of Mi355x GPU. Assuming $2B, that would be ~30% of buyside expects of $7B GPU revs in 2025

U: Unity upgraded to Outperform from Market Perform at Citizens JMP

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.