TMTB Morning Wrap

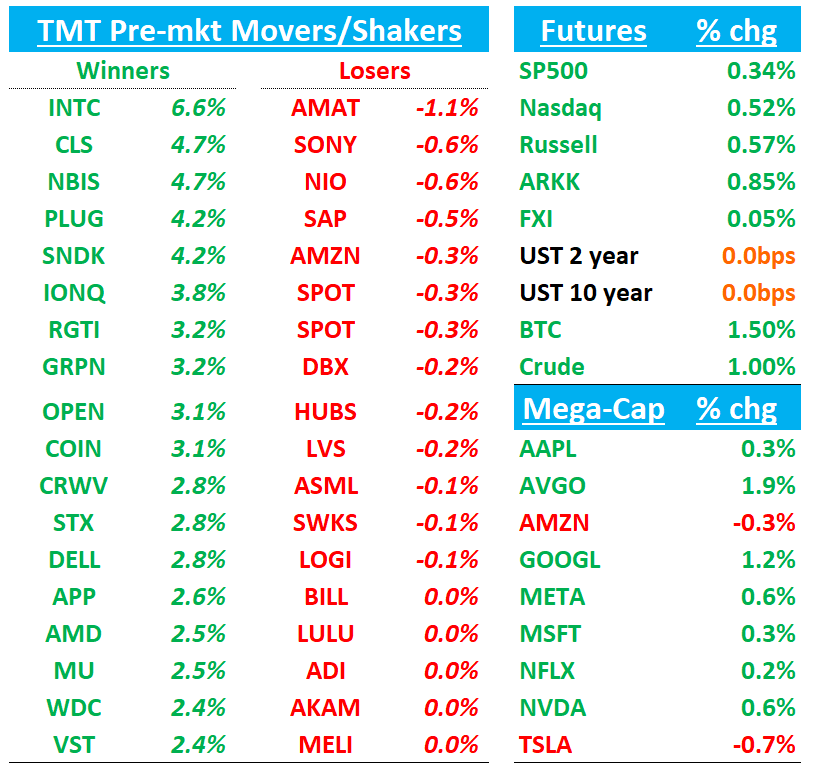

Good morning. Futures +50bps ahead of CPI in 10 minutes. Stocks in Asia generally up: TPX +0.48%, NKY +1.35%, Hang Seng +0.74%, HSCEI +0.68%, SHCOMP +0.71%, Shenzhen +1.36%, Korea KOSPI +2.5%. BTC +1.5%. Yields flattish. AI Semis up strong to start the day.

We’ll hit INTC first, then the usual…

Happy Friday. Let’s get to it…

INTC +7%: Rev, gross margin, and EPS beat for 3Q25, but guided a softer 4Q on supply constraints and Altera deconsolidation; demand tone improved, AI pull‑through is real

Numbers were fine ex-Altera and main takeaway for me here was more positive tone around server and PC demand from mgmt.

3Q25 revenue was $13.65B (+6% q/q, ~+3% y/y), non‑GAAP GM 40%, and non‑GAAP EPS $0.23, all above Street on stronger PC and server CPU demand; inventory and balance sheet metrics improved. CCG outperformed on Windows 11 refresh and AI PC adoption; PC consumption TAM ~290M in 2025, and Panther Lake is on track.

IFS posted $4.2B revenue (down 4% q/q) and ‑$2.3B op loss, with 18A milestones met, 14A progressing, and packaging (EMIB‑T) pipeline building.

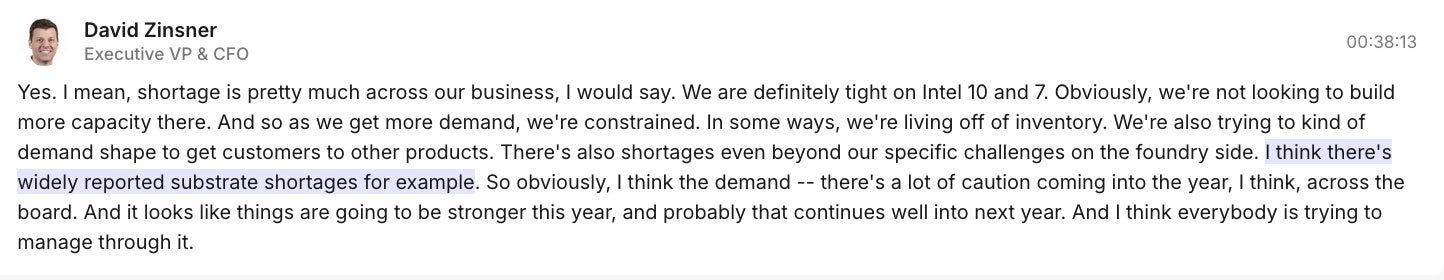

Management flagged tight supply, especially on Intel 10 and Intel 7, constraining upside and forcing demand‑shaping (pricing/mix) and server prioritization into 4Q. Constraints expected to persist into 2026, with peak constraints around 1Q26 per sell‑side checks.

4Q25 guide: revenue $12.8–$13.8B (midpoint $13.3B), GM ~36.5%, EPS $0.08, with CCG down modestly q/q and DCAI up strongly as wafer capacity is prioritized for server; tax ~12%, NCI $350–$400m. 4Q GM step‑down to ~36.5% reflects Altera roll‑off (~50 bps), early ramp costs (Lunar Lake/18A), and demand‑shaping mix.

Commentary on supply/demand:

Management emphasized AI is expanding traditional compute demand; CPUs play a critical role in head nodes, inference, orchestration and storage; 2026 CPU TAM expected to grow. They called out customer wanting Long-term agreements on server CPUs (which is a big positive surprise and good read-through for AMD)

Bull vs Bear Debate:

Bulls argue the print shows the demand engine is back: AI infrastructure build‑out is expanding the CPU TAM (head nodes, inference, orchestration, storage), x86’s installed base and software ecosystem make it a prime beneficiary, and the NVLink collaboration with NVIDIA could lock Intel into the leading AI platform for multiple generations. PC demand is healthier than feared (Windows 11 refresh + AI PC), with a ~290M unit PC TAM in 2025 and incremental content from Lunar/Arrow/Panther/Nova Lake. Balance sheet is now robust (CHIPS/SoftBank/Altera/Mobileye proceeds), giving management runway to execute; 18A is shipping with Fab 52 operational and 14A engagement ongoing; advanced packaging (EMIB‑T) is a differentiator. This is a Trump proxy, which remains tough to short and has the gov’t support.

Bears see the same report and focus on structural issues: supply is tight on older nodes (Intel 10/7) rather than the newest ones, suggesting sticky mix pressure and risk of share loss while 18A/14A mature; foundry remains heavily loss‑making with uncertain external wafer traction; 4Q GM step‑down implies the 3Q GM beat isn’t durable; PC cyclicality (Win11 EOL) fades; competitive intensity in both PC and server remains high. Some bears think the stock already embeds meaningful foundry success unlikely to materialize, and prefer Intel to exit merchant foundry.

BAH -8% pre-market: IT services co with lots of gov’t exposure cuts revs (seen as an AI loser).

Q2 FY26 rev $2.89B (-8% y/y) and adj EPS $1.49 missed Street ($2.99B / $1.53). Guide cut: FY26 rev $11.3–$11.5B & adj EPS $5.45–$5.65 (prior $12.0–$12.5B / $6.20–$6.55), both below Street ($12.06B / $6.30). Drivers: mgmt cites funding/procurement slowdown and delayed civil recovery despite nat-sec strength

TECH/RESEARCH NEWS

GOOGL: Anthropic and Google Cloud strike blockbuster AI chips deal

Good for AVGO/CLS. Wells saying an $80B deal over 6 years adds 5% ($5-7B) incremental revs (1% EPS impact) to GOOGL Cloud in ‘27 and ‘28.

Anthropic has reached a deal to secure access to 1mn Google Cloud chips to train and run its artificial intelligence models, increasing its ties to one of its largest investors. Google, which has invested more than $3bn in Anthropic, will bring more than a gigawatt of AI computing capacity online for the start-up next year using its custom chips known as Tensor Processing Units, or TPUs. Anthropic said the deal was worth tens of billions of dollars, but would not give a specific estimate.

Record $38 Billion Debt Sale Nears for Oracle-Tied Data Centers

Recall, debt raise a couple months back brought in $80B+ worth of demand/

Banks are preparing to launch a $38 billion debt offering as soon as Monday that will help fund data centers tied to Oracle Corp. in what would be the largest such deal for artificial intelligence infrastructure to come to market, according to people with knowledge of the matter.

JPMorgan Chase & Co. and Mitsubishi UFJ Financial Group are among banks leading the deal, which is split across two separate senior secured credit facilities, said the people, who asked not to be identified when discussing private matters. One $23.25 billion package will go toward financing a data center in Texas and another $14.75 billion facility will help fund a project in Wisconsin, the people said.

Trump Administration Moves to Accelerate AI Power Hookups

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.