TMTB Morning Wrap

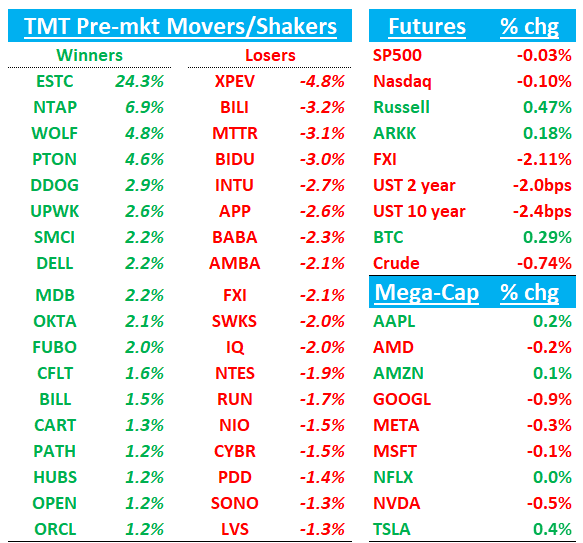

QQQs hovering around flat. Treasuries slightly bid with yields down 2-3bps. Odds of a fed cut continue to be ~55% on 12/18. BTC trying to get close to $100k. China -2%. We’ll cover ESTC NTAP INTU results first then move onto news/research…No EOD Wrap today as I’ll be on the road. Have a great weekend!

ESTC+28%: Strong Cloud driven by stronger consumption, much better billings. CFO leaving seen as a ++

Total Revs $365M vs street at $354M

Cloud revs came in +25% to $169M vs buyside in mid to high 160s (street 166M).

Billings $384M +23% y/y accelerating from +6% last q vs street at $353M

OPM 18% vs guide at 13%

Q2 guide $367-369M vs street at 366M and inline with buyside. OPM 15% vs street at 13.5%.

Another Cloud consumption beat following SNOW earlier this week although this one not as big or clean. Beat driven by accelerated consumption from major customers alongside broad-based strength across enterprise and commercial segments. Sales reorganization benefits materializing, with pipeline creation and progression returning to historical levels. Improved execution led to robust customer commitments, notably in Gen-AI where deal value nearly doubled, including three $1M+ ACV wins.

CFO Janesh is leaving; investors I’m hearing from are viewing that as a big positive as he has a history of rug-pulling and over-promising and under delivering and contributing to the big move this morning.

Bulls will say you get an AI winner with SMID/SMB exposure and takeout potential trading at 6x CY’26 sales and an overhang lifted with CFO leaving.

Bears will say FY guide was only raised slightly and still implies Q4 exit rate of only 11-12% and Q1 commitment shortfall will impact 2H cloud revs as they take months to ramp and that new customer growth remains low. They’ll say 11-12% is pretty uninspiring consider GenAI tailwinds. RPO looked a bit squishy. They’ll say stock is only up this much because of CFO leaving.

We don’t have a strong view but move seems a bit outsized relative to #s although some of it being attributed to CFO leaving, which is fair. We’re uninvolved.

Gets an upgrade at Baird saying significant operational improvements in Q2, marked by strong commitments, consumption trends, and improved win rates, alongside emerging GenAI momentum as reasons for the upgrade. Baird notes quick management response to Q1 challenges through territory stabilization and pipeline discipline has proven effective. Baird also points out GenAI commitments doubled, validating AI search leadership position, while Express Migration strengthens competitive stance against SIEM competitors, saying increased margin guidance and sustainable profitability metrics (Rule-of-30+) support the bull case.

NTAP +6%: Very solid beat and raise

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.